Tuesday, June 3, 2025

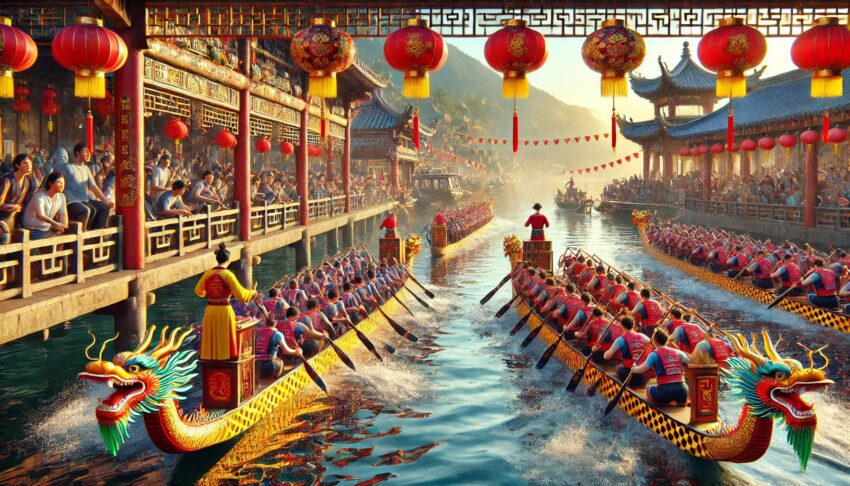

In the evolving landscape of holiday travel, Fliggy, a leading online travel services platform and a wholly-owned subsidiary of Alibaba Group, has revealed insightful trends shaping the 2025 Dragon Boat Festival travel season. The platform’s latest data underscores a remarkable shift towards high-quality, customized travel experiences among Chinese consumers, signaling growing sophistication and diversity in holiday planning.

A Surge in Customized Travel and Higher Spending

Data from Fliggy indicates that bookings for domestic customized tours surged by over 50% year-on-year (YoY), reflecting travelers’ growing preference for tailored and unique itineraries that go beyond traditional package tours. These bespoke travel plans often include personalized services such as curated local experiences, exclusive access to attractions, and flexible itineraries, catering to the increasingly discerning tastes of holidaymakers.

Alongside this, domestic hotel packages combining accommodation with entertainment and dining options grew by 20%, suggesting a rising demand for all-in-one experiences that maximize convenience and cultural immersion. This is further supported by an 8.8% increase in average spending on holiday activities including tickets to theme parks, camping adventures, and chartered tours compared to the previous year.

Staycations and Cultural Experiences Dominate

The 2025 Dragon Boat Festival travel season saw a strong preference for staycations and cultural experiences. With the southern region of China entering its rainy season, many travelers opted for hotel-based retreats where traditional festival activities such as making zongzi (glutinous rice dumplings), handcrafting five-color bracelets, and creating aromatic sachets were offered to guests. This blend of leisure and cultural participation attracted many seeking meaningful and authentic experiences during their holidays.

Theme parks and resorts were also highly favored, with ticket sales for major attractions on the festival’s first day jumping by 25% YoY. Comprehensive packages that included dining and entertainment saw an even more dramatic 140% increase in bookings, highlighting a surge in demand for integrated leisure options where families and friends can celebrate together.

Luxury resorts and boutique homestays stood out among accommodation choices, with these segments registering particularly strong booking growth. Travelers appear to be valuing exclusive, personalized stays that provide comfort, privacy, and a connection to local culture.

Short-Distance Travel Leads Holiday Plans

The three-day Dragon Boat Festival holiday showcased a clear preference for short-distance travel and nearby getaways. Data from Fliggy reveals that domestic car rental bookings increased by approximately 30% YoY, driven by flexible pickup and return options that empower travelers to design their own road trips. Popular self-drive destinations included Urumqi, Chengdu, Sanya, Haikou, and Beijing, reflecting a diverse set of locales that range from urban centers to coastal and scenic retreats.

Emerging Domestic Destinations Gain Popularity

While major cities like Shanghai, Beijing, Hangzhou, Chengdu, Guangzhou, Shenzhen, Nanjing, Chongqing, Xi’an, and Wuhan remained dominant holiday destinations, several lesser-known locations experienced rapid growth in bookings. Emerging destinations such as Beitun (Xinjiang), Jincheng (Shanxi), Qiongzhong (Hainan), Qingyuan (Guangdong), Wuwei (Gansu), Nujiang (Yunnan), Dezhou (Shandong), Fangchenggang (Guangxi), and Kaifeng (Henan) attracted travelers seeking quieter, less crowded environments rich in cultural heritage and natural beauty.

This trend indicates a growing appetite among travelers for off-the-beaten-path experiences that highlight China’s vast regional diversity and offer alternatives to conventional tourist hubs.

Outbound Travel Trends Highlight Popular and Emerging Destinations

On the international front, outbound travelers from China showed strong interest in countries within easy reach via short-haul flights (under four hours). The most sought-after destinations included Japan, South Korea, Hong Kong SAR, Thailand, Malaysia, Vietnam, Singapore, France, Indonesia, and the United States. These markets continue to appeal to Chinese tourists due to their combination of cultural attractions, shopping opportunities, and culinary experiences.

More interestingly, several emerging destinations have seen significant growth in bookings, including Poland, Iceland, Finland, Bhutan, Uzbekistan, Laos, Azerbaijan, Kazakhstan, Tanzania, and Georgia. These locations are gaining popularity thanks to their pleasant climates, rich cultural offerings, and the allure of unique natural landscapes, appealing to travelers eager to explore new horizons beyond traditional tourist circuits.

Summary: Key Trends in the 2025 Dragon Boat Festival Travel Season

- Customized domestic tours surged by over 50% YoY, reflecting a clear preference for personalized holiday experiences.

- Domestic hotel packages including dining and entertainment increased by 20%, highlighting demand for all-in-one leisure solutions.

- Average spending on holiday activities rose by 8.8%, signaling increased traveler willingness to invest in quality experiences.

- Staycations and cultural immersion activities gained traction, with many travelers enjoying festival-themed hotel retreats.

- Short-distance self-drive trips surged, supported by a 30% rise in domestic car rentals and flexible travel options.

- Emerging domestic destinations with cultural and natural appeal experienced rapid growth in bookings.

- Outbound travel favored short-haul destinations, with notable growth in bookings to emerging countries offering unique experiences.

These insights from Fliggy reveal a tourism market that is maturing rapidly, with consumers seeking richer, more meaningful, and personalized travel experiences during key holiday periods like the Dragon Boat Festival.

Looking Ahead: What This Means for Tourism Stakeholders

Tourism operators, hoteliers, and destination marketers should note the increasing importance of customization, cultural authenticity, and convenience. Developing flexible packages that integrate accommodation, dining, and local experiences can capitalize on this growing demand. Similarly, promoting lesser-known destinations and tailoring marketing strategies to highlight unique local traditions will attract adventurous and experience-driven travelers.

Additionally, the popularity of short-distance and self-drive travel suggests opportunities for regional tourism boards to enhance infrastructure and services catering to domestic road trippers. Partnerships with car rental services, local guides, and entertainment venues can further enrich the visitor experience.

On the outbound front, travel agencies and airlines can expand offerings to include emerging destinations alongside established hotspots, tapping into travelers’ growing appetite for novel and culturally diverse experiences.

Tags: Africa, Asia, Azerbaijan, Bhutan, china, Dragon Boat Festival 2025, Europe, finland, Fliggy, france, Georgia, Hong Kong, Iceland, indonesia, japan, kazakhstan, Laos, malaysia, north america, poland, Singapore, south korea, Tanzania, Thailand, United States, Uzbekistan, Vietnam