The China Frontier Technology Group (HKG:1661) share price has softened a substantial 32% over the previous 30 days, handing back much of the gains the stock has made lately. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 36% in that time.

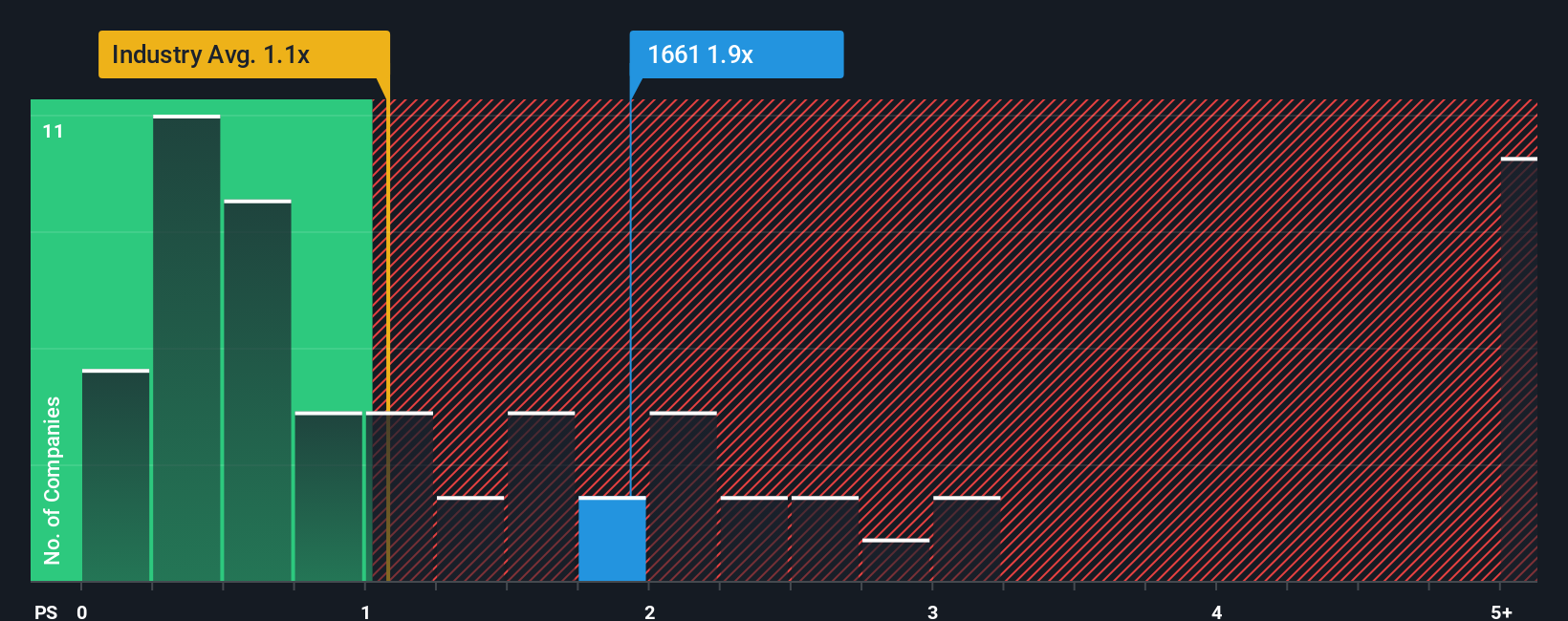

In spite of the heavy fall in price, you could still be forgiven for thinking China Frontier Technology Group is a stock not worth researching with a price-to-sales ratios (or “P/S”) of 1.9x, considering almost half the companies in Hong Kong’s Media industry have P/S ratios below 1.1x. Although, it’s not wise to just take the P/S at face value as there may be an explanation why it’s as high as it is.

See our latest analysis for China Frontier Technology Group

How China Frontier Technology Group Has Been Performing

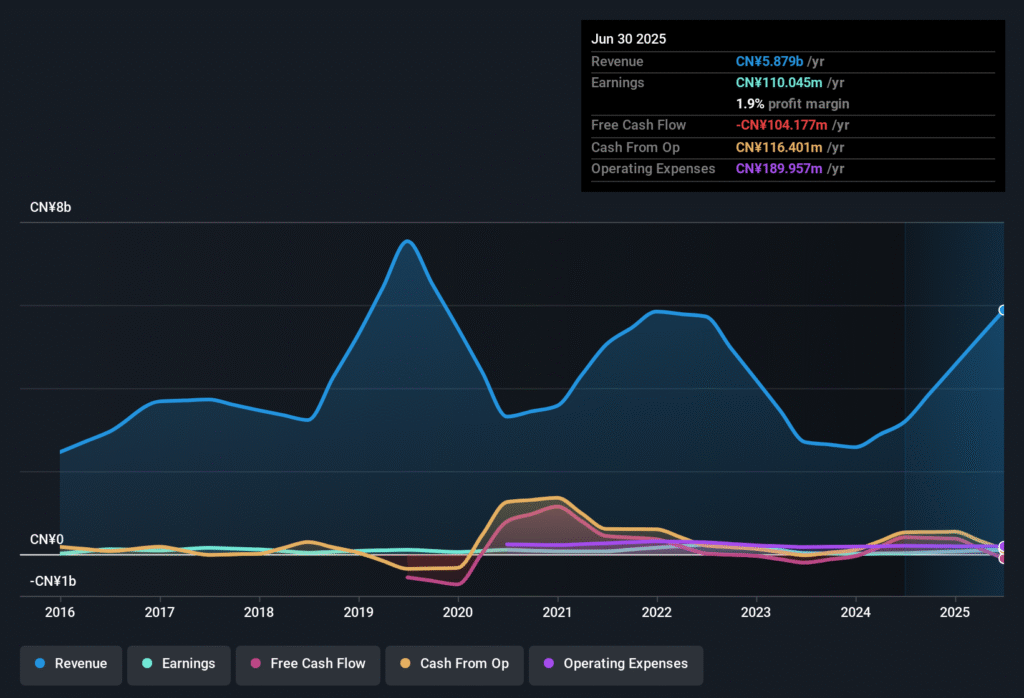

With revenue growth that’s exceedingly strong of late, China Frontier Technology Group has been doing very well. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on China Frontier Technology Group will help you shine a light on its historical performance.

How Is China Frontier Technology Group’s Revenue Growth Trending?

In order to justify its P/S ratio, China Frontier Technology Group would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered an exceptional 42% gain to the company’s top line. This great performance means it was also able to deliver immense revenue growth over the last three years. Therefore, it’s fair to say the revenue growth recently has been superb for the company.

This is in contrast to the rest of the industry, which is expected to grow by 17% over the next year, materially lower than the company’s recent medium-term annualised growth rates.

With this in consideration, it’s not hard to understand why China Frontier Technology Group’s P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Bottom Line On China Frontier Technology Group’s P/S

There’s still some elevation in China Frontier Technology Group’s P/S, even if the same can’t be said for its share price recently. Using the price-to-sales ratio alone to determine if you should sell your stock isn’t sensible, however it can be a practical guide to the company’s future prospects.

We’ve established that China Frontier Technology Group maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Don’t forget that there may be other risks. For instance, we’ve identified 2 warning signs for China Frontier Technology Group that you should be aware of.

It’s important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.