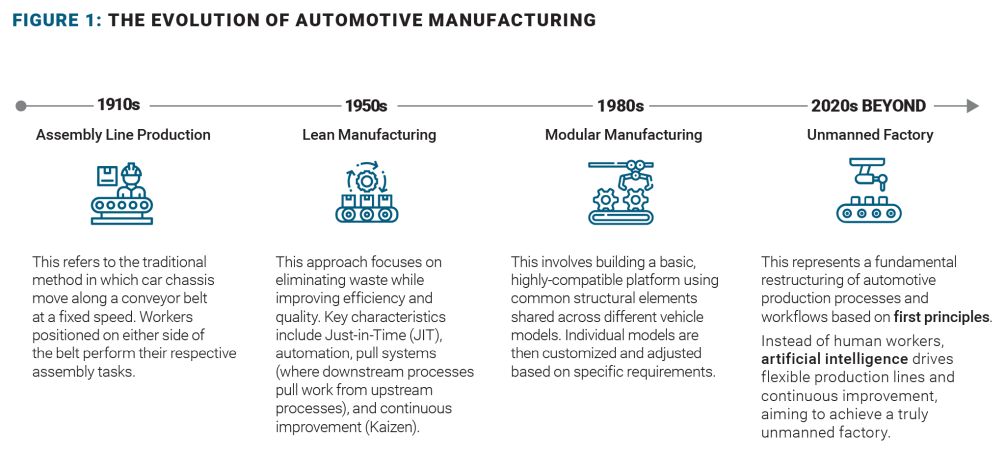

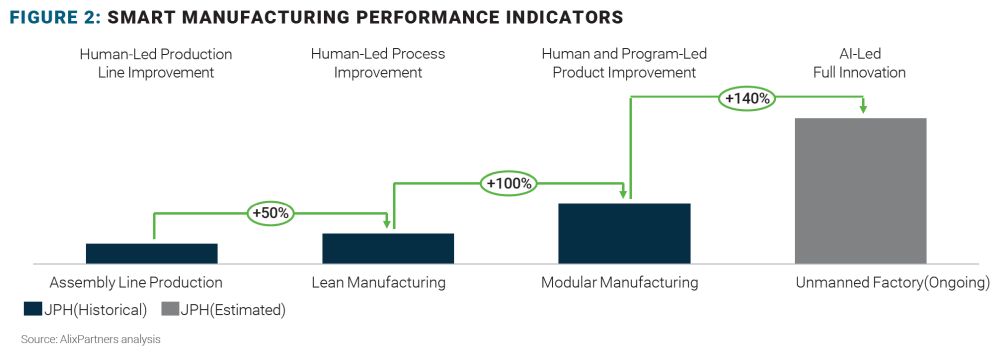

Over the past century, the automotive industry has undergone a

major manufacturing revolution roughly every 40 years. From

Ford’s introduction of the assembly line to the rise of lean

manufacturing, and later the advancement of platformization and

modularization, each wave of innovation has profoundly reshaped the

industry’s landscape (figure 1).

More than 40 years have passed since the last revolution of

platformization and modularization. And today, with the rapid

advancement of artificial intelligence (AI) and growing demands

from manufacturers for both greater efficiency and product variety,

the automotive industry has reached a pivotal moment, both

technologically and in the market—a new revolution.

The changing face of automotive manufacturing

The fourth revolution will increasingly be led by AI rather than

humans, ultimately paving the way for the realization of the truly

unmanned factory.

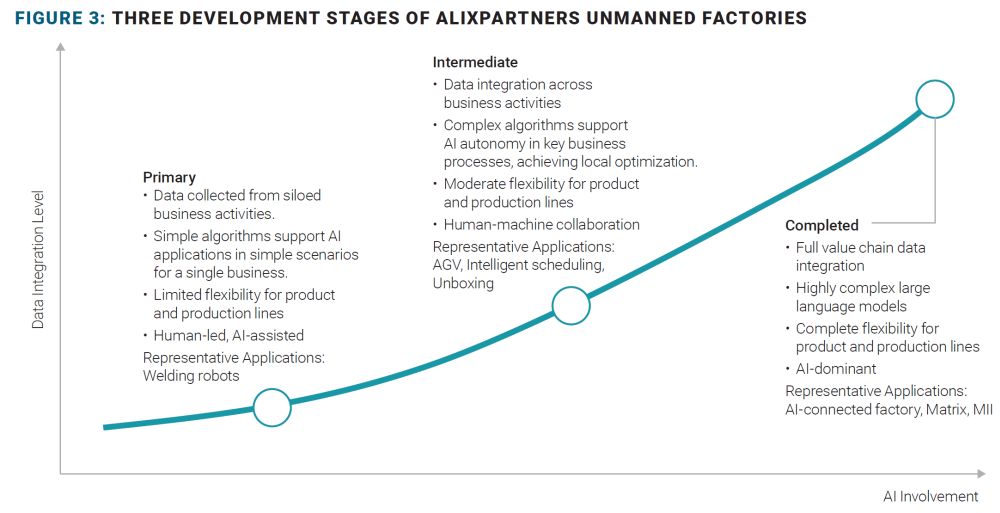

The unmanned factory will not emerge overnight. Based on the

level of AI involvement and data integration, we classify unmanned

factories into three stages (figure 3). Currently, some leading

automakers have reached the intermediate stage and are steadily

advancing toward completion, while others remain in the early

stages of implementation.

“Made in China 2.0” and new opportunities

China’s automotive industry has steadily built a

comprehensive manufacturing and supply chain system through the

strategic approach of exchanging market access for technology. With

the rise of new energy vehicles (NEVs), China has capitalized on

new opportunities and achieved significant breakthroughs. Looking

ahead, we believe China’s automotive industry will continue to

enhance its manufacturing capabilities and seize the new

opportunities presented by AI, delivering even greater value to an

increasingly diverse and expanding global market.

Development path of “Made in China

2.0”

From an investment perspective, market players in China are

increasingly focusing on AIoT (Artificial Intelligence of Things)

and process optimization to drive efficient and flexible

production. Their efforts are concentrated in three key areas:

- Reconstructing products and production lines

- Deploying highly intelligent software applications

- Integrating data and building end-to-end large language

models

Investment trend of “Made in China

2.0”

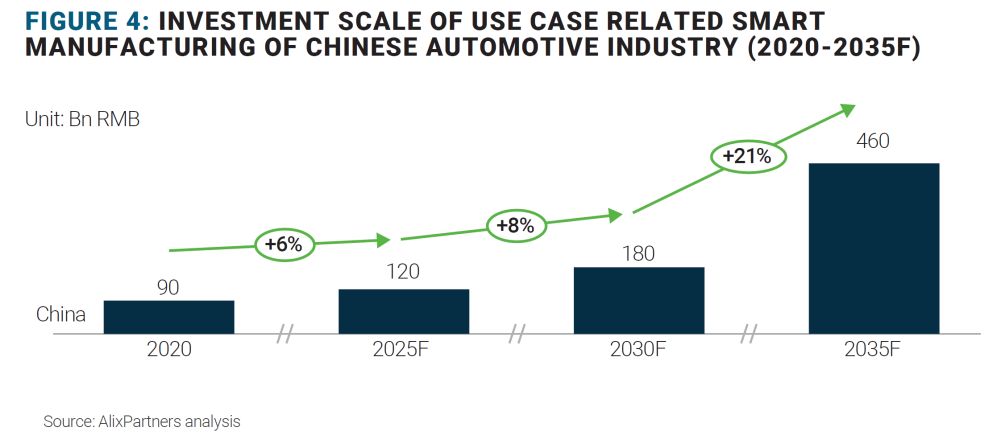

In terms of investment scale, intelligent manufacturing in

China’s automotive industry is still in its early

“pilot” stage. However, both application and investment

are expected to accelerate significantly in the coming years.

Focusing solely on use case related investment, the total amount

is projected to reach approximately RMB 180 billion by 2030 and

around RMB 460 billion by 2035.

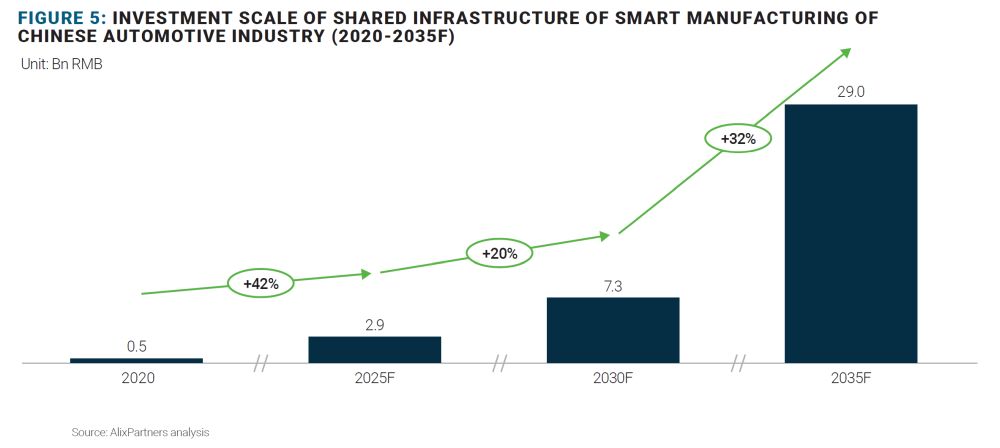

If the shared infrastructure investment is considered, like

cloud, network, computing power, the related investment will be

significantly higher. Accordingly, the infrastructure investment is

projected to reach RMB 7.3 billion in 2030 and RMB 29 billion in

2035.

We have found that Chinese automotive companies face the

following challenges when confronted with the new round of

manufacturing revolution:

- Investment uncertainty: Many companies have an

unclear understanding of their own organization’s AI progress.

Additionally, companies frequently pursue AI solutions without

clearly identifying specific business pain points or

scenarios. - Returns uncertainty: AI delivers benefits

across multiple dimensions—cost reduction, quality

improvement, efficiency gains, and greater flexibility—but it

is difficult to consolidate these into a single

return-on-investment (ROI) metric. It’s also difficult for

companies of different sizes and maturity levels to benchmark or

learn from one another’s experiences. - Infrastructure supply risks (e.g. computing

power): Geopolitical tensions—particularly U.S.

restrictions on advanced chip exports and AI software platforms

pose significant risks to infrastructure supply. China’s

domestic chip ecosystems are still maturing, contributing to a

widening gap in high-end computing capabilities. Additionally,

extended software adaptation cycles and a shortage of

inference-optimized chips further complicate deployment. The

evolving nature of AI technology also causes structural shifts in

computing demands, adding to the complexity. - AI model and data adaptability:

General-purpose AI models often fail to meet the nuanced needs of

specific business functions and may contain algorithmic biases that

lead to unfair or inaccurate outcomes. Effective algorithm training

is heavily dependent on data volume and quality—areas where

many companies fall short. - Talent mismatch: Intelligent manufacturing

requires a workforce skilled in multiple disciplines. However,

traditional manufacturing engineers frequently lack the digital and

analytical skills necessary to support AI-driven

transformation.

Our recommendations

We conclude that, to address the challenges the intelligent

manufacturing revolution presents, companies must take a top-down

approach to defining their strategies and communicating with

internal stakeholders transparently. During implementation,

companies should apply an agile approach to iterate use cases, with

continuous improvement of models and results, rather than using

traditional IT approaches.

To ensure the success of this revolution, a solid basis of lean

manufacturing, together with a robust data environment, is a

must-have. In the meantime, a combination of AI and process

engineers, under a suitable organization setup and governance

model, will be necessary to support sustainable development.

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.