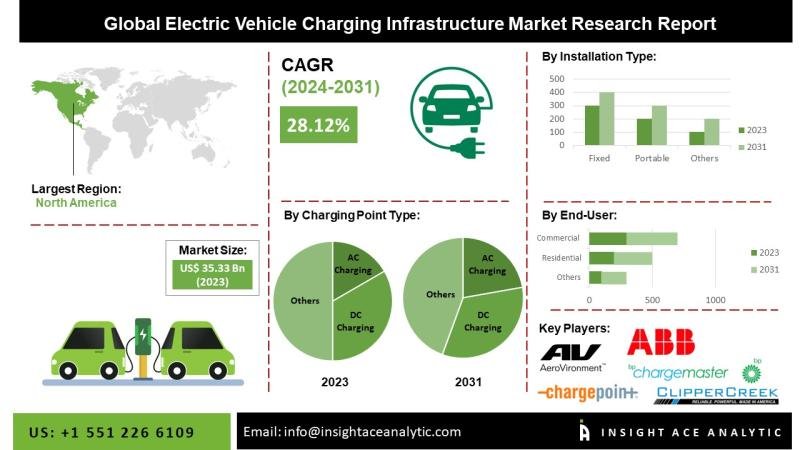

The electric vehicle (EV) market is entering a hyper-competitive phase, with legacy automakers and startups alike vying for dominance. Among these players, Lucid Motors stands out not for sheer volume but for its focus on premium differentiation. As the sector matures, investors must assess whether Lucid’s strategic bets in charging infrastructure, range leadership, and software innovation can translate into sustainable competitive advantages.

Charging Infrastructure: Bridging Gaps with NACS and Tesla Superchargers

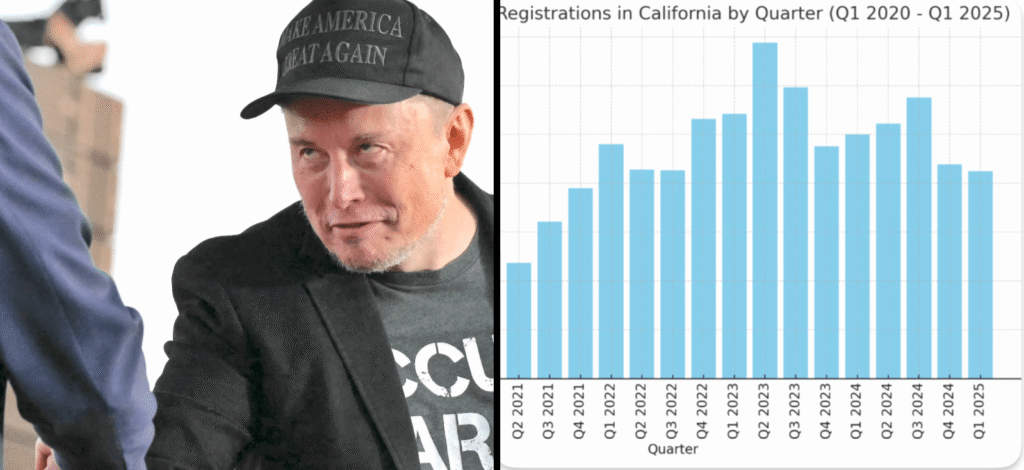

Lucid’s most transformative move in 2025 has been its adoption of the North American Charging Standard (NACS). By enabling access to Tesla’s Supercharger network via an adapter, Lucid has effectively expanded its customers’ charging options to over 23,500 stations across North America. This is a critical win in a market where charging anxiety remains a barrier to adoption.

The $220 NACS-to-CCS1 adapter, while an additional cost, is a temporary fix. By 2026, all Lucid vehicles will natively support NACS, eliminating the need for hardware workarounds. This shift aligns with industry trends and ensures Lucid’s long-term compatibility with the fastest-growing public charging network. Meanwhile, the company’s partnership with Electrify America provides complimentary three-year charging access, further reducing friction for early adopters.

Critics argue that third-party adapters and lower charging speeds (capped at 50 kW via Tesla Superchargers) limit Lucid’s appeal compared to native NACS vehicles. However, Lucid’s focus on convenience—streamlined charging via the Lucid App and integration with Uber-Nuro’s autonomous taxi fleet—offsets these drawbacks. The company’s recent collaboration with Uber and Nuro, which aims to deploy 20,000 Lucid Gravity SUVs equipped with Level 4 autonomous tech by 2026, underscores its vision of charging as a cornerstone of mobility-as-a-service.

Range Leadership: A Niche Advantage in a Crowded Market

Lucid’s flagship Air Grand Touring model still holds the industry’s longest EPA-estimated range at 512 miles, a figure that remains unmatched in 2025. The 2026 update, with a 431-mile range for the Touring variant, reinforces Lucid’s positioning as a long-range specialist. While Tesla and Rivian have made strides in performance and utility, they lack Lucid’s battery efficiency, which is critical for luxury buyers prioritizing cross-country travel.

However, range alone is not enough. Rivian’s Adventure Network (RAN) and Tesla’s Supercharger network have proven more reliable in recent Consumer Reports surveys, with only 4-5% of users reporting issues. Lucid’s reliance on third-party adapters and limited Supercharger access could deter buyers who prioritize convenience over range. That said, the company’s upcoming Gravity SUV, with its 800V architecture and bi-directional charging capabilities, may address these concerns.

Software Innovation: The Road to Autonomous Mobility

Lucid’s software strategy is perhaps its most ambitious. The 2025 update to DreamDrive Pro, featuring Hands-Free Drive Assist and Lane Change Assist, positions the company as a serious player in advanced driver-assistance systems (ADAS). These features, coupled with the Uber-Nuro partnership, suggest a long-term play in autonomous mobility. By 2026, Lucid’s Gravity SUVs will serve as the backbone of a global robotaxi service, leveraging Nuro’s Level 4 tech and Uber’s ride-hailing network.

This ecosystem approach mirrors Tesla’s Full Self-Driving (FSD) ambitions but with a key difference: Lucid’s focus on luxury and safety. The company’s partnership with Saudi Arabia’s Public Investment Fund (PIF) also provides a financial tailwind, with the AMP-2 plant in King Abdullah Economic City set to ramp to 155,000 annual units by 2026. This localization strategy not only reduces costs but also taps into the Gulf’s growing EV market, where Lucid’s vehicles are already being used in diplomatic missions.

Financials and Market Realities: A Work in Progress

Lucid’s Q1 2025 results reflect progress but also highlight structural challenges. Revenue of $235 million, driven by 3,109 deliveries, marks a 58% year-over-year increase. Yet, the company still reported a GAAP net loss of $0.24 per share and faces operational costs that dwarf its revenue. With $5.76 billion in liquidity, Lucid has the runway to scale, but profitability remains elusive.

Analysts project 2025 revenue of $1.08 billion, a 39% increase from 2024, but this growth is expected to come at the expense of short-term profitability. The stock’s 12-month consensus price target of $2.53 (as of May 2025) implies an 8.6% upside from its current price, though the wide range of targets—from $1.00 to $5.00—reflects uncertainty.

Investment Implications: Balancing Potential and Risk

Lucid’s strategic bets are high-risk, high-reward. The company’s integration with Tesla’s Supercharger network and NACS adoption are critical steps in overcoming infrastructure limitations, but execution risks remain. The Gravity SUV’s success will depend on its ability to scale production to 20,000 units in 2025, a target that may strain resources.

For investors, Lucid offers exposure to a niche but growing segment of the EV market—luxury buyers willing to pay a premium for range, design, and innovation. However, the company’s reliance on PIF funding and its lagging production efficiency compared to Tesla and Rivian present significant headwinds.

Recommendation: Lucid is best suited for risk-tolerant investors who believe in its long-term vision. While the stock may remain volatile in the short term, the company’s progress in charging infrastructure, software, and autonomous mobility positions it as a potential outperformer in the premium EV segment. Investors should monitor production ramp-ups, profitability milestones, and the success of the Gravity SUV as key indicators of its viability.