File: Meta President Global Affairs Nick Clegg speaks during a press conference at the Meta showroom in Brussels on December 07, 2022.

Kenzo Tribouillard | Afp | Getty Images

The chance of a market correction in the artificial intelligence sector is “pretty high,” former Meta executive and British politician Nick Clegg warned on Wednesday, as he pushed back on the concept of artificial superintelligence.

Clegg, the former deputy prime minister of the U.K. who went on to guide policy decisions at U.S. tech giant Meta, said the AI boom has resulted in “unbelievable, crazy valuations.”

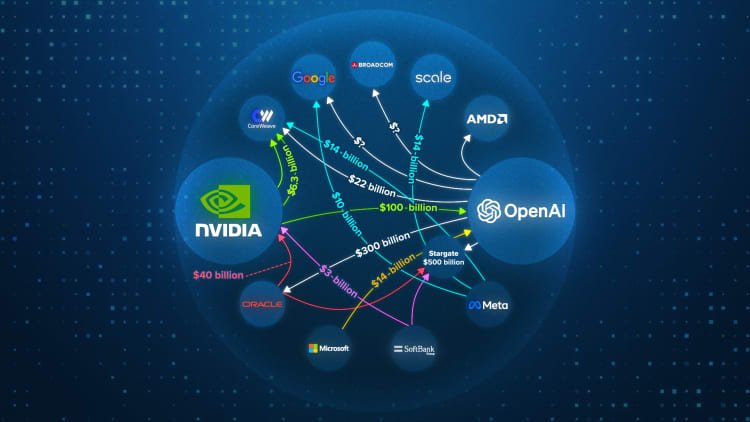

“There’s just absolute spasm of almost daily, hourly, deal making,” he told CNBC’s Arjun Kharpal for “Squawk Box Europe.”

“You’ve got to think, wow, this could be headed for a correction,” he said, adding that the likelihood of such an event is “pretty high.”

Bubbles are typically defined by inflated valuations across the private or public market, where the price of a company doesn’t match its fundamentals.

A correction comes down to whether large hyperscalers — “who are pouring hundreds of billions of dollars into the ground and building these data centers” — can recoup their infrastructure investments and prove their business models are sustainable, Clegg said.

“That’s obviously going to raise some issues,” he added, as is “the fundamental paradigm on which this whole industry is built, the so-called large language model AI paradigm.”

Superintelligence versus utility

That “paradigm” is the goal of artificial superintelligence, typically defined as when AI surpasses human intelligence — which is often perceived as the “holy grail,” Clegg said — opposed to artificial general intelligence, where AI systems have human-level capabilities.

Many high-profile tech chiefs and investors have backed the idea of artificial superintelligence, including SoftBank founder Masayoshi Son and Meta CEO Mark Zuckerberg, the latter of which created an AI lab to pursue the technology earlier this year.

“I think there are certain limits to that probabilistic AI technology, which means that it won’t perhaps be quite as all singing and all dancing as people suggest,” Clegg added. “But it doesn’t mean that technology itself is not going to persist, it’s not going to flourish and is not going to have a huge effect.”

Indeed, Clegg’s former employer Meta emerged from the dot-com era bubble and is today one of the world’s largest companies. Amazon and Google charted a similar course, showing that a bubble bursting does not always mean the end of a company.

It’s a common adage in venture capital that the best companies are built in a downturn or tough funding environment, often due to investors watching their bottom line more closely and putting greater emphasis on sound business metrics when making investment decisions. This forces business leaders to operate more efficiently, with those who can do more with less funding likely outliving competitors.

Clegg’s stance mirrors that of other investors and tech leaders, who believe a bubble is emerging, but it doesn’t mean that AI isn’t here to stay.

The pile-in has created an “industrial bubble” but “AI is real, and it is going to change every industry,” Jeff Bezos told a crowd at Italian Tech Week earlier this month.

There is low-hanging fruit where AI can be applied quickly, but society at large will adopt the technology more slowly, according to Clegg.

“There’s a lot of hype. People in Silicon Valley assume that if you invent a technology on Tuesday, everybody’s going to use it on Thursday. It’s not actually how it works at all,” he said.

“It took 20 years for all of us to get onto desktop computing after desktop computing was technologically feasible. So, I think it’s the pace that is the thing to look out for. That will vary sector from sector to sector, country by country, but I think it might be just a little bit slower than some of the technologists themselves are predicting at the moment,” he added.