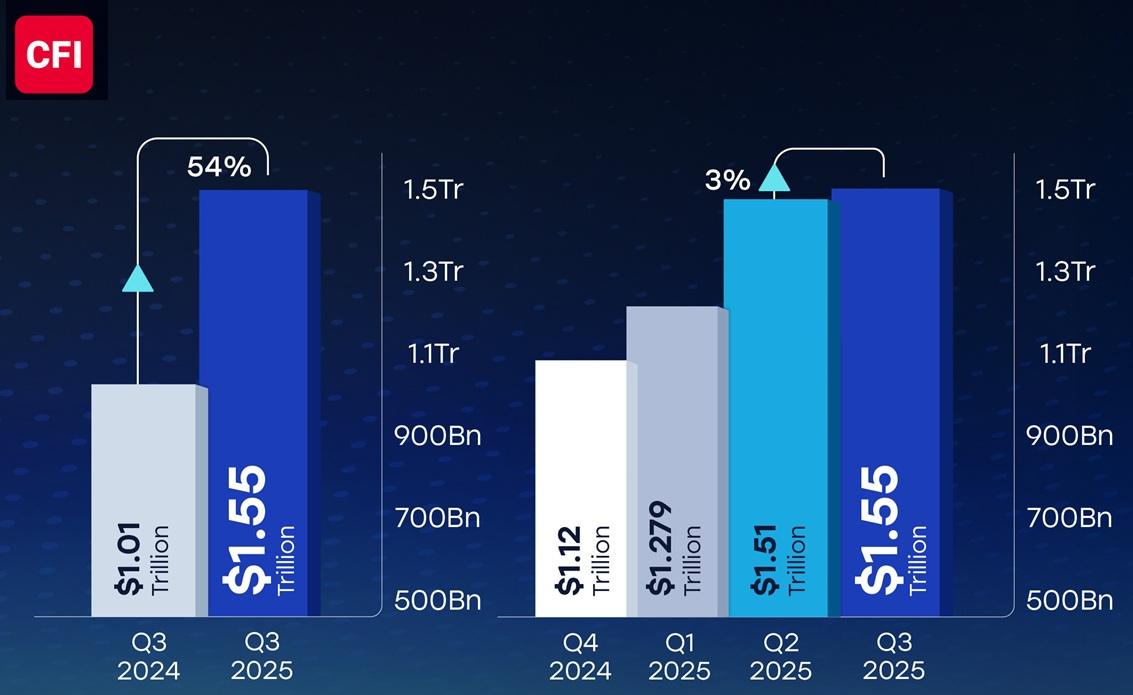

Leading MENA region based online trading provider CFI Financial Group has continued its upward trajectory, announcing that it closed Q3 2025 with USD $1.55 trillion in trading volume (or $517 billion in monthly average client volumes), marking a 3% increase from Q2 2025 and a remarkable 54% surge compared to Q3 2024.

Fueling this growth was a record-breaking September, with the Group reaching its highest-ever monthly volume of USD $625 billion, a milestone reflecting the Group’s unwavering commitment to performance, technology, and client-centric innovation.

Consistent Client Growth and Engagement

CFI said that its Q3 2025 results reflect not only sustained trading growth but also a significant increase in platform activity and user confidence:

- Active clients rose by 28% year-on-year.

- Funded accounts for the year to date grew by 27% versus YTD 2024, highlighting continued acquisition momentum and onboarding effectiveness.

Leadership & Global Growth Highlights

Q3 also marked pivotal developments in CFI’s global growth and executive leadership:

- The appointment of Omar Khaled as Chief Marketing Officer, bringing over 15 years of experience in fintech and digital transformation, to lead global brand and growth strategy.

- Regulatory approval received earlier to establish a representative office in Colombia, marking a foundation step into Latin America market and reinforcing CFI’s commitment to international expansion.

- Operational launch in Bahrain, following prior regulatory approval, expanding CFI’s footprint in the GCC and emphasizing its dedication to regional accessibility and service excellence.

Continued Brand Excellence

Building on earlier achievements in 2025, CFI said it continued to amplify its global brand visibility through world-class ambassadors and strategic partnerships:

- Lewis Hamilton and Maria Sharapova continued to serve as CFI’s Global Brand Ambassadors, reflecting shared values of precision, performance, and global impact.

- CFI’s strategic partnership with the Egyptian Basketball Federation earlier this year, reflects its deep-rooted commitment to regional communities and grassroots development.

- CFI also received two major accolades in Q3:

- Trading Platform of the Year – Finance ME 2025

- Great Place to Work – Asia Region 2025, celebrating CFI’s culture of empowerment and excellence.

Ziad Melhem, Group CEO of CFI, commented,

“This quarter demonstrated that CFI is not only growing, but accelerating through stronger engagement, smarter expansion, and a sharper execution edge. As we enter the final stretch of 2025, our eyes remain on delivering client empowered trading experiences at scale, across every market we serve. ”

As 2025 progresses, CFI said it remains focused on scaling innovation, expanding market presence, and delivering world-class trading experiences for a growing global client base.

About CFI

CFI Financial Group, established in 1998, is MENA’s leading online trading broker with over 25 years of experience. Operating from key locations like London, Abu Dhabi, Dubai, Cape Town, Baku, Beirut, Amman, Cairo, Kuwait, and Bahrain CFI provides seamless access to both global and local markets. Offering diverse trading options across equities, currencies, commodities, and more, CFI delivers superior conditions, including zero-pip spreads, no commission fees, and ultra-fast execution.

The group is a leader in AI-driven tools, offering intuitive and advanced solutions for traders of all experience levels. CFI fosters financial literacy through multilingual educational content and inspires excellence through partnerships with global icons like AC Milan, FIBA WASL, and MI Cape Town cricket team, as well as the Department of Culture and Tourism – Abu Dhabi. With Seven-Time Formula One™ World Champion Sir Lewis Hamilton and Tennis Legend Maria Sharapova as Global Brand Ambassadors, CFI reflects a shared commitment to innovation, performance, and success while supporting cultural and community initiatives worldwide.