President Donald Trump said Friday that he had terminated trade discussions with Canada, citing an incoming Canadian tax on tech companies including those based in the U.S.

In a post on Truth Social, Trump referred to Canada as “a very difficult country to trade with” and said that its levy on tech firms — the first payment for which is due Monday — “is a direct and blatant attack on our Country.”

“Based on this egregious Tax, we are hereby terminating ALL discussions on Trade with Canada, effective immediately,” he said. “We will let Canada know the Tariff that they will be paying to do business with the United States of America within the next seven day period.”

Last week Canada’s finance minister said that he would not delay implementation of the digital services tax — which applies to any tech company making more than $15 million from Canadian internet users — even as U.S. trade talks continue.

A lobbying group for some tech giants said the tax, which is retroactive to 2022, would cost U.S. companies as much as $3 billion. Those payments are due beginning June 30.

The office of Canadian Prime Minister Mark Carney didn’t immediately respond to a request for comment. But late Friday, Canada retaliated against the U.S. by imposing a quota on some steel imports and a 50% surcharge for imports that exceed the quota. Canada’s finance minister said the government was acting to protect its industry from “unjust U.S. tariffs.”

Canada’s government said it “remains prepared to take additional steps as needed.”

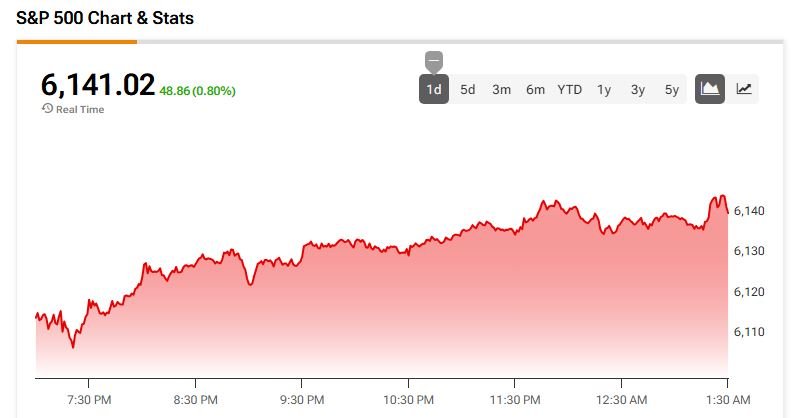

Trump’s post cuts short what had been a relatively calm period of trade-related announcements — a stretch that had helped markets recover to the all-time highs seen in February. Shortly after Trump’s post went live, the S&P 500 and Nasdaq indexes briefly turned negative but rallied later in the afternoon to close at all-time highs.

Friday had begun with encouraging comments from Treasury Secretary Scott Bessent, who indicated the president was open to moving the previously announced deadline for trade deals from July 9 to Labor Day — and that country-by-country duties themselves were negotiable.

A few hours later, Trump said that initial July 9 deadline was not set in stone, saying the U.S. could either extend or shorten it.

Canada is the second-largest U.S. trading partner. Currently, the U.S. has a tariff rate of 25% applied to Canadian imports that don’t comply with the U.S.-Mexico-Canada Agreement, the trade deal Trump inked during his first term before he upended it with a flurry of tariff announcements in his second.

The 25% tariff on non-compliant Canadian goods excludes energy products, which are subject to a 10% rate. Canada is also heavily impacted by Trump’s 50% tax on steel and aluminum imports — the country is the largest foreign supplier of those materials to the U.S. And it has also been impacted by the 25% duties Trump has imposed on foreign-made vehicles and auto parts.