11 September 2025

Italy’s new-car market lurched to a new low in August with industry bodies and experts calling for new battery-electric vehicle (BEV) incentives. Could these measures be enough to turn things around? Autovista24 web editor James Roberts finds out.

The Italian new-car market reached a fresh low point in August. The month saw 67,322 new vehicles registered in the country, according to the latest data from ANFIA. This marked a year-on-year deficit of 1,838 units and a 2.7% drop.

Spanning the first eight months of 2025, new-car registrations in Italy trail year-on-year totals by 3.7%. Between January and August, 1,041,120 vehicles took to the country’s roads, a shortfall of 39,595 compared to 2024 totals.

Amid a continued decline in petrol and diesel registrations, electrified vehicles enjoyed growth, with plug-in hybrids (PHEVs) leading gains. However, this proved a hollow victory, as August’s market-wide volumes were significantly reduced. As a result, concerns are being voiced by industry bodies, even within the context of a traditionally slow holiday month.

ANFIA labelled the overall market as being in ‘stalemate.’ It focused on a stagnant plug-in market share, placing hope in the introduction of BEV incentives, initially slated for September.

‘If this decline continues until the end of the year, approximately 1.5 million vehicles will be registered in Italy,’ confirmed Marco Pasquetti, Autovista Group’s cluster head of forecasting for Spain and Italy.

‘Not only would this be significantly lower than the volumes seen in 2019, when registrations exceeded 1.9 million, but it would also mark the lowest figure in the past three years, a sign that the Italian market is currently not reaching its full potential,’ he added.

PHEV and BEV gains not enough

On the surface, PHEVs enjoyed an excellent August. The powertrain hit a new growth high for 2025 with a 94.7% year-on-year gain. However, after eight months of new-car sales, the total of 4,669 capped the powertrain’s lowest monthly volume of 2025.

Across the first eight months of the year, however, PHEVs were in relatively good shape. The total of 58,201 deliveries ensured a market share high of 5.6%, a 2.3 percentage point (pp) increase over last year.

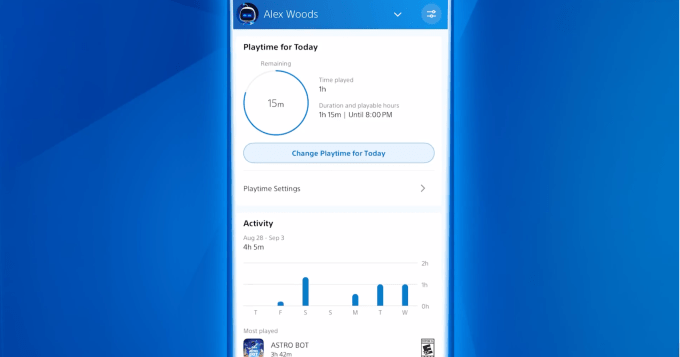

BEVs saw a 27.3% year-on-year increase in August. However, mirroring PHEV fortunes, the reality is far from positive. Aside from June’s anomalous 40.4% BEV registration dive, August saw the technology’s smallest annual gain of just 708 units. June aside, BEVs also suffered their lowest total number of deliveries so far this year, reaching 3,298 units in August. The month matched July’s market share of 4.9%, with one fewer working day.

After eight months, BEV registrations in Italy sat at 53,887 units, a 28.9% year-on-year improvement. Crucially, the BEV market share remained at 5.2% for three consecutive months. Since January’s 5% baseline, this has only increased by 0.2pp, underlining fears of an electrified market stasis. Italian industry body UNRAE cited any BEV sales gains as ‘insufficient.’

Italy’s electric inertia continues

The painful reality for the Italian market can be seen by combining BEV and PHEV registrations.

In August, all plug-in vehicle sales amounted to 7,967 units. This marked the first time the total has dipped below five figures in monthly reporting between January and August. Nevertheless, this relatively low return did ensure a market share of 11.8%, a 4.6pp year-on-year increase.

Covering the first eight months of 2025, plug-in totals reached 112,088 units. This equated to a flattering 44.5% year-on-year surge, with 34,499 more BEVs and PHEVs leaving dealerships. Coupled with this, the plug-in vehicle market share increased by 3.6pp.

However, by the end of August, this share stood at just 10.8%, with BEV incentives tantalisingly on the horizon as a potential catalyst for growth.

EV incentives: Italy’s saving grace?

In early August, the Italian Ministry of Environment and Energy Security (MASE) confirmed new subsidies worth almost €600 million for BEV purchases. These are slated to be introduced from September, however, a lag in implementation is concerning the industry, as well as consumers.

‘These incentives were announced for September but have not yet been made available,’ stated Pasquetti. ‘We hope implementation can be accelerated, as there is a risk that customers may choose to wait before purchasing a vehicle, which could slow down the electrification process. EVs are showing promising growth compared to last year, but they still account for a very small market share when compared to other European countries.’

Recent incentives have positively influenced the Italian new-car market. In April, BEV sales recorded triple-digit year-on-year growth, likely driven by the Ecobonus scheme.

Yet there are examples of delays. BEV incentives were launched in December 2023 to help boost the market, but only took effect in June 2024. There are concerns similar delays could stunt any beneficial impact from the latest incentives.

‘Unfortunately, the announcement of incentives by MASE, still without concrete follow-up, has frozen the market,’ stated Roberto Pietrantonio, president of UNRAE. ‘Many customers, and not only those interested in BEVs, are postponing purchases while waiting for the bonus. This uncertainty is paralysing sales. We strongly urge that the promised incentives become fully operational without further bureaucratic hurdles so that all drivers can take part in the transition fairly.’

Hybrids power on

In August, hybrids, made up of full and mild technologies, continued to prevail as Italy’s most popular powertrain.

Despite recording its lowest total volume across the first eight months of the year, the 30,415 hybrid registrations ensured an 8.9% year-on-year upswing. This helped the powertrain take a 45.2% market share in August, a 4.8pp lift.

Taking into account the first eight months of 2025, hybrids held a 44.2% market share, with 460,582 units sold. This reached its peak in the first quarter, topping out at 44.7%. Despite the negative impact of August’s lower sales volumes compared to other months, hybrids remain top of the pile in Italy.

Combining EV and hybrid totals, the electrified market accounted for 38,382 units in August. This ensured a 16.6% year-on-year improvement to the tune of 5,462 sales. Despite delivering a 9.4pp share surge, total volumes fell far behind the year’s previous lowest total of 67,149, lodged in July.

After eight months, the electrified market share in Italy sat at 55%. Volumes grew 14.9%, equating to the delivery of 572,670 units.

Petrol and diesel down but not out

As new petrol and diesel sales continue to decline across Europe, Italy followed suit. In August, the internal-combustion engine (ICE) market share reached 33.4%, up by 0.2pp on July’s figure, but still down from last year’s 41.9%. Combined registrations reached 7,967 units.

In total, 16,820 new petrol cars were handed over to Italian customers, a year-on-year decline of 13.9%. August continued a fourth consecutive month of double-digit drops for petrol. As a result, its market share descended by 3.2pp, to 25%.

A total of 5,637 diesel vehicles were registered in the month, underpinning the fuel type’s lowest uptake in 2025. Compared with a similarly lacklustre August 2024, this still marked a significant decline of 40.1%. The diesel market share for the month sat at 8.4%, the lowest of the year, and a significant 5.2pp year-on-year slide.

Overall, ICE registrations totalled 372,642 units between January and August. This marked a 22.2% year-on-year fall of 106,561 vehicles. While this may appear significant, the ICE market share has remained resilient at 35.8% across the year. This resilience is another factor hampering any market share gains from BEV and PHEV powertrains.

LPG deflates but remains popular

Liquid-petroleum gas (LPG) registrations continued to decline in August. The month saw 6,483 LPG vehicles join Italian roads, down 11.1% year-on-year. In the month, LPG registrations amounted to a 9.6% market share, a drop of 0.9pp.

Across the first eight months of the year, LPG uptake fell from 101,680 units to 95,807 year on year. This reflected a market share step downwards to 9.2%. This suggests that the fuel type, despite being a marginal consumer choice, remains a popular one in Italy. As of August, it holds the country’s fourth biggest market share per powertrain.