Bybit, the world’s second-largest cryptocurrency exchange by trading volume, has announced the launch of Bybit TradFi, marking what the company calls another milestone in the crypto-native platform’s evolution toward becoming a comprehensive financial destination that serves all customer needs.

Bybit TradFi launch

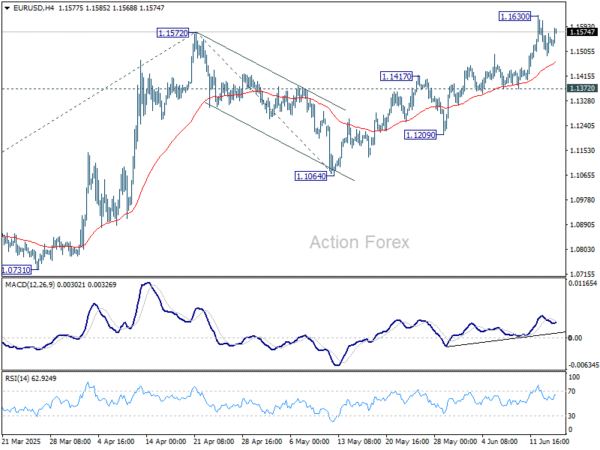

Through Bybit TradFi the major crypto exchange will be offering trading access to the world’s five largest markets: Gold, Indices, Commodities, Forex, and Stocks CFDs — all these are now directly tradeable on the Bybit app, eliminating the need for additional MT5 software installation.

Licensing

Bybit’s initial foray into CFDs brokerage will be via offshore Infra Capital, domiciled in Mauritius.

Other crypto platforms which have launched plans to add trading in “traditional” instruments for their clients include Crypto.com, and Kraken, both key competitors of Bybit. However those firms seems to be focusing on operating onshore licensed businesses, mainly in the UK and EU.

Crypto brokers adding traditional instruments

Bybit’s move signals emerging financial service providers’ foray into traditional finance, bringing competitive product suites and digital asset capabilities into conventional markets with some of the world’s deepest liquidity. Bybit TradFi empowers the new generation of traders to diversify their assets with the minimum number of intermediaries:

- Unified Trading Experience: Traders can access both traditional and crypto markets from a single account and crypto wallet, allowing them to capitalize on potential opportunities regardless of market conditions.

- Global Market Access: Beyond gold and forex, Bybit TradFi connects traders directly to major asset classes worldwide without the usual barriers or complex processes, enabling users to trade 78 leading stock CFDs via Bybit, including FAANG stocks such as $AAPL, $AMZN, $TSLA, and $GOOG, to name a few.

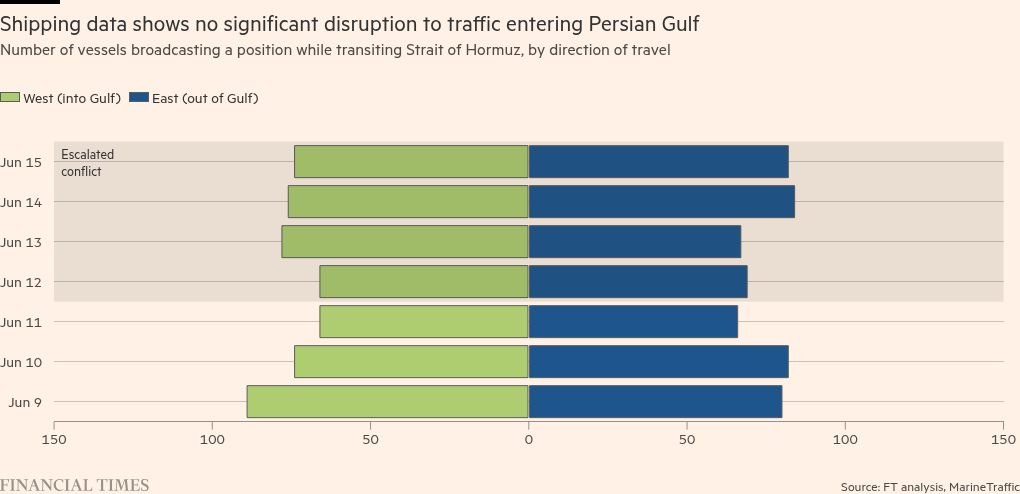

- Cross-Market Positioning: While crypto captures headlines, traditional markets are equally dynamic. Traders may now position strategically across multiple asset classes to maximize their trading potential and recalibrate risk exposure.

- Two-Way Diversification: Crypto-focused traders can now seamlessly integrate traditional assets into their portfolios, using institutional-grade tools designed for today’s interconnected markets. The new feature also gives traders of equities and other traditional asset classes a reason to venture into crypto assets all in one app.

Since its transition from an ultra-fast trading platform for professional traders in 2018, Bybit has built its presence across the crypto landscape with a wide range of innovative products and services. Bybit TradFi evolved from Bybit’s Gold & FX service, which recorded its highest daily trading volume of over $24 billion on 17 April, 2025, shortly after its initial launch. The latest addition stands to unlock broader market access for over 70 million retail and institutional customers.

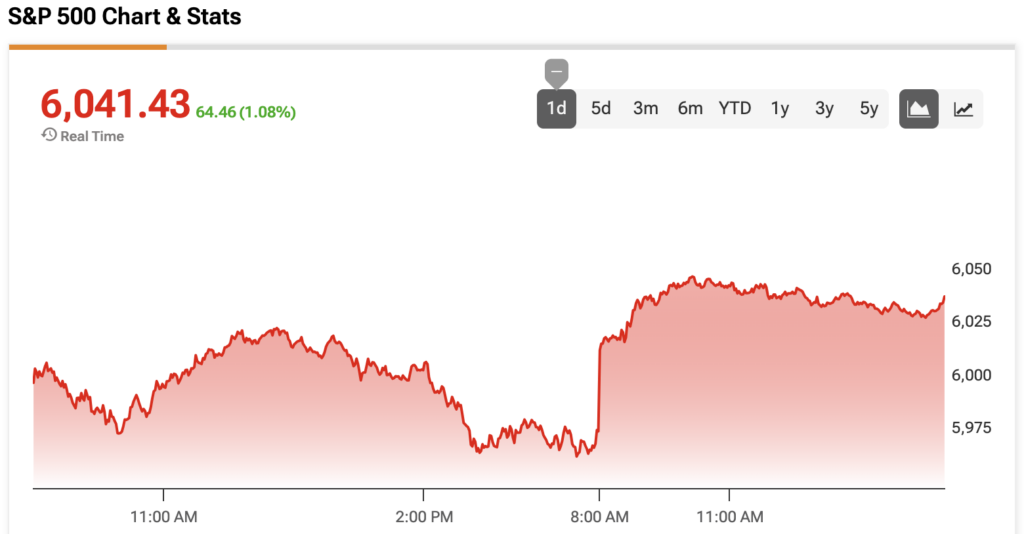

Bybit TradFi addresses the growing demand from crypto traders seeking portfolio diversification across global markets. With traditional financial markets experiencing increased volatility alongside crypto, it provides traders with the tools to leverage opportunities across all asset classes from a single, familiar interface.

“Investors are looking for opportunities, and some legacy barriers between emerging and traditional financial markets are only artificial. Bybit TradFi represents our commitment to breaking down these walls,” said Ben Zhou, CEO and Co-founder of Bybit. “We’re giving our users essential tools they need to diversify and navigate macro factors across major asset classes, all within the Bybit platform they already know and trust.”

The service is now available to eligible users through the Bybit app. Bybit TradFi is not available to residents of the European Economic Area, among other restrictions.

About Bybit

Bybit is the world’s second-largest cryptocurrency exchange by trading volume, serving a global community of over 70 million users. Founded in 2018, Bybit is redefining openness in the decentralized world by creating a simpler, open and equal ecosystem for everyone. With a strong focus on Web3, Bybit partners strategically with leading blockchain protocols to provide robust infrastructure and drive on chain innovation. Renowned for its secure custody, diverse marketplaces, intuitive user experience, and advanced blockchain tools, Bybit bridges the gap between TradFi and DeFi, empowering builders, creators, and enthusiasts to unlock the full potential of Web3.