TLDR

-

Bybit now supports stocks, crypto, and forex trading.

-

Trade 78 stock CFDs like Apple and Tesla in one app.

-

No MT5 needed — use one account for all markets.

-

Get 50% off stock CFD fees until June 23, 2025.

-

Bybit aims to become a global financial platform.

Bybit has launched a new feature that enables direct access to stocks, crypto, and forex trading on one platform. The feature, called Bybit TradFi, integrates traditional markets with digital assets to create a unified trading environment. Users can now trade five major market types without switching platforms or using external software like MT5.

Free $500 positions !

Just gave FX trading on Bybit a shot — and honestly?

It Mad! 🔥

I’ve used a couple of brokers over the years, but Bybit’s MT5 experience was on another level. Fast, seamless, and rewarding. Let me break down what I did and why I think it’s worth it! pic.twitter.com/CMzGbnakTC— Kelvin king (@Kelvinking_) June 16, 2025

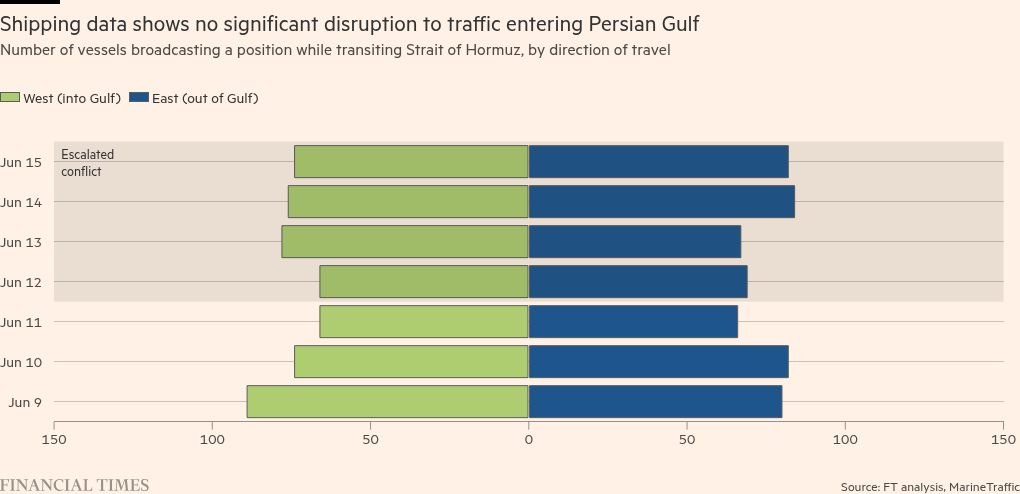

This integration removes the need for separate accounts and streamlines portfolio management across asset classes. Bybit users can trade commodities, gold, indices, forex, and 78 stock CFDs directly from the app. With this rollout, Bybit aims to serve both retail and institutional investors with a more efficient system.

The launch expands Bybit’s reach beyond crypto by offering diversified investment opportunities in traditional markets. This also reflects increasing demand from traders looking to manage volatility across multiple sectors. Bybit has aligned this development with its broader goal of becoming a global financial hub.

Stock CFDs Available Alongside Crypto

Users can access stock CFDs, including Apple, Tesla, Google, and Amazon, directly through the Bybit app interface. The platform supports 78 stock CFDs and integrates them with existing crypto trading tools for smoother execution. Traders can use one crypto wallet for all trades, making it easier to move between markets.

The stock offering enables traders to adjust their strategies based on economic events across both equities and digital assets. This two-way flexibility appeals to users interested in hedging, arbitrage, or risk balancing. The platform also offers professional-grade features suitable for active and institutional traders.

Bybit is offering a 50% fee discount on stock CFD trading until June 23, 2025. The platform has made account setup simple, targeting new users seeking exposure to equity markets. Regional restrictions apply, but the service is already live for eligible users.

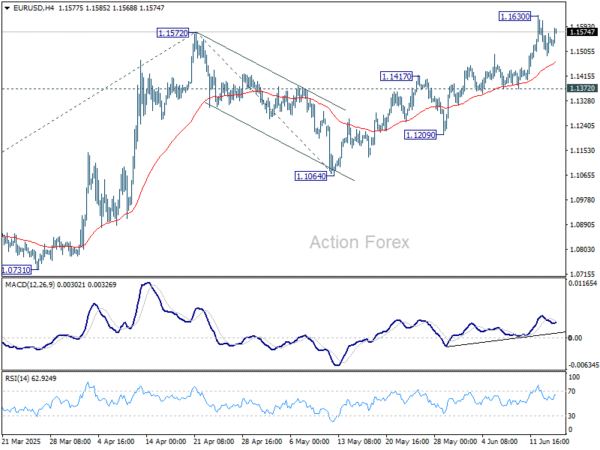

Forex and Commodities Integration Enhances Market Strategy

Bybit TradFi enables users to access major forex pairs and key global commodities under one trading account. This simplifies diversification by allowing users to enter positions in oil, gold, and FX without leaving the app. The setup also enables real-time cross-market trading, improving responsiveness to market shifts.

The forex feature helps traders monitor currency trends while maintaining positions in crypto and equities. With rising macroeconomic uncertainty, this integration supports better capital allocation and strategic planning. Bybit also offers analytical tools that help users understand inter-market correlations.

Commodities trading further expands asset coverage for users looking to diversify into inflation-sensitive markets. The feature supports advanced order types and transparent pricing. All trades are executed under Bybit’s secure infrastructure, ensuring performance and reliability.

Bybit Strengthens Its Position in Global Finance

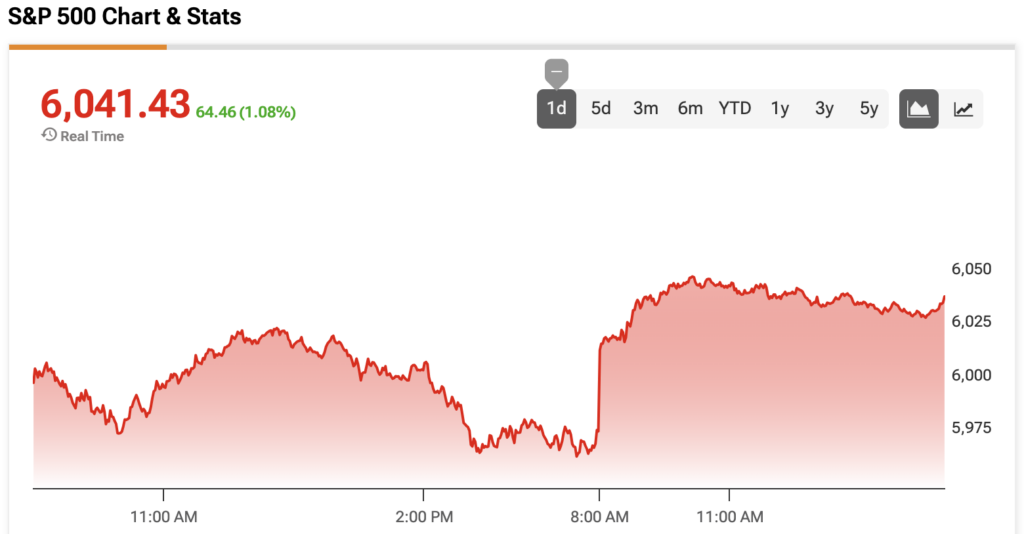

Bybit continues to expand beyond its original crypto-first model by offering more tools for traditional financial market access. On April 17, 2025, the company recorded $24 billion in trading volume for its earlier Gold & FX service. This new move builds on that momentum and addresses the need for broader investment flexibility.

The platform is powered by Infra Capital, a licensed provider under the Mauritius FSC. This structure enables Bybit to provide global access while ensuring regulatory alignment. Although unavailable in the EEA, the platform serves a global user base of over 70 million.

Bybit is also actively working with regulators and has obtained a MiCA license in Austria. This enables compliant operations within the European market, strengthening user trust. The launch of Bybit TradFi marks another step in its mission to become a comprehensive financial ecosystem.