subscribers. Become an Insider

and start reading now.

Have an account? .

- Bank of America predicts that large-cap stock dominance of the stock market could soon end.

- If the US economy enters a recovery phase alongside rate cuts, beaten-down stocks could surge.

- BofA recently shared top stock picks with low valuations that could be primed for a rebound.

Bank of America says large-cap dominance inoof the stock market may soon be over.

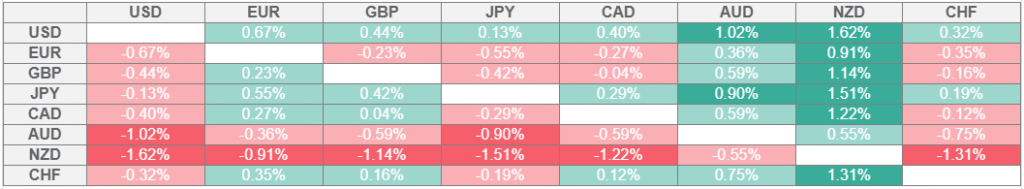

The bank’s economic regime indicator shows the US economy hovering between downturn and recovery phases. If it starts to enter the latter alongside Fed rate cuts and improving earnings, smaller and cheaper stocks in the S&P 500 should start to outperform the largest companies, the bank said in a recent client note.

“Recoveries saw 2x PE expansion for the Not-So-Nifty 450 as the Nifty 50, and the Smallest 50 enjoyed 12ppt ann. alpha,” said Savita Subramanian, the bank’s head of US equity and quantitative strategy, said in the note. “History would suggest there is more to go in cap-weighted dominance. But if the Fed’s next move is a rate cut, and if the Regime indicator is shifting to a Recovery, we think the run may be closer to done.”

As a way to invest in the potential trend, Subramanian and her team highlighted stocks with 12-month forward price-to-earnings ratios below the S&P 500’s median; those with high beta, or volatility relative to the index; and those with market caps below the S&P 500’s median. All of the stocks have a “Buy” rating from BofA.

We’ve taken the 10 cheapest stocks from the list and compiled them in descending order according to their forward P/E ratios.

Eastman Chemical Company

BI

Halliburton Company

BI

First Solar

BI

Healthpeak Properties

BI

Aptiv

BI

Synchrony Financial

BI

Delta Air Lines

BI

Host Hotels & Resorts

BI

United Airlines

BI