Tight end Travis Kelce, #87 of the Kansas City Chiefs, celebrates with Taylor Swift after the AFC championship football game against the Buffalo Bills, at GEHA Field at Arrowhead Stadium in Kansas City, Missouri, on Jan. 26, 2025.

Brooke Sutton | Getty Images Sport | Getty Images

Taylor Swift‘s engagement announcement on Tuesday sparked the latest example of the celebrity’s influence in America’s corporate and economic world.

The “Love Story” singer’s joint social media post sharing the update with her now fiancé, NFL player Travis Kelce, sent fans buzzing — and even some stocks and prediction markets moving.

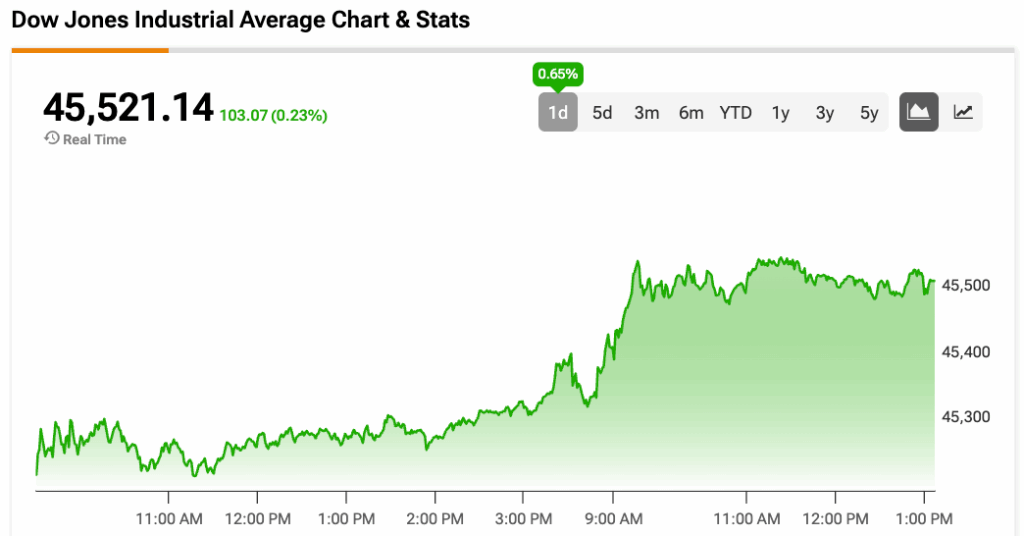

Signet Jewelers, one of few publicly traded jewelry companies on major exchanges, jumped more than 3% on Wednesday. That builds on gain of around 3% in Tuesday’s session, which included a pop directly following Swift and Kelce’s afternoon post.

That jump comes after fans raced the decipher what type of ring Swift opted for from the photos. Multiple industry professionals confirmed the diamond was a cushion cut.

Signet, 1-day

Ralph Lauren, whose clothes both halves of the couple seemed to sport in the pictures, rose 0.4% on Wednesday after gaining 2% a day earlier. Jefferies analyst Ashley Helgans said Swift’s apparent preference for the brand is a positive for the stock.

“For a company that states it is not only in the clothing business but in the dreams business, we view this outcome as mission success,” Helgans wrote in a Wednesday note to clients.

American Eagle shares jumped more than 4% on Wednesday after the retailer announced a collaboration with Kelce’s sportswear brand Tru Kolors. Kelce is headlining a campaign tied to the collection.

American Eagle, 1 day

Other brands rushed to cash in the cultural cache of the Swift-Kelce engagement. Domino’s Pizza and GrubHub pushed alerts to app users, with each referencing Swift’s songs and including a ring emoji. Soda producer Poppi shared an Instagram photo themed to the duo’s social media caption.

Prediction markets also lit up on the latest cultural moment. A Kalshi bet on the likelihood that the two would be married by the end of 2025 shot up directly following Tuesday’s announcement.

Swift has been considered an economic engine coming out of the pandemic. The boost to consumer spending tied to her worldwide “Eras” tour caught the attention of both Wall Street and the Federal Reserve.