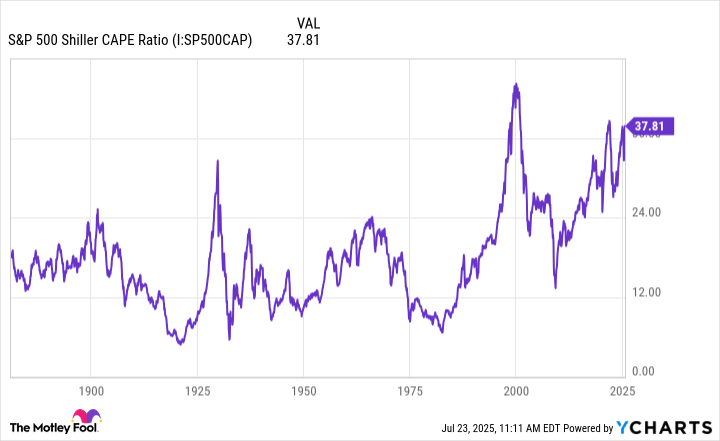

The U.S. stock market has reached unprecedented valuations, with the Buffett Indicator—a gauge of stock market capitalization relative to GDP—surpassing 212% of GDP in July 2025, marking a record high. This metric, calculated using the Wilshire 5000 Total Market Index, now reflects a market cap more than double the nation’s GDP. Warren Buffett himself has long regarded the indicator as a critical valuation measure, warning in a 2001 Fortune Magazine interview that ratios approaching 200% signal dangerous overvaluation. The current level, exceeding even the peaks of the Dot-Com Bubble and the 2008 Financial Crisis, raises questions about the sustainability of asset prices amid a backdrop of speculative fervor and macroeconomic uncertainty [1].

Berkshire Hathaway, the investment firm led by Buffett, has increasingly divested from U.S. equities since 2020, a move interpreted as alignment with the CEO’s own cautionary advice. In Q1 2025 alone, the conglomerate sold nearly $3.5 billion in financial sector holdings, including its full stake in Citigroup and significant portions of Bank of America and Capital One. Beyond finance, Berkshire also liquidated positions in Charter Communications, DaVita, T-Mobile, and Liberty Media’s Formula One Group, reflecting a broader strategy to reduce exposure to equities amid rising valuations [1].

Mainstream indices, however, continue to climb. The S&P 500 closed at 6,388 on July 25, 2025, up 0.9% from its previous session, while the Nasdaq Composite hit a third record close of the week, surpassing 21,000. The Dow Jones Industrial Average gained 0.5%, nearing its December 2024 record. Over 82% of S&P 500 companies that had reported earnings exceeded expectations, underscoring robust corporate performance [1]. Analysts attribute this resilience to stable inflation, range-bound interest rates, and rising earnings. Terry Sandven of U.S. Bank Wealth Management noted the “favorable fundamentals” underpinning the bull market, while UBS warned of potential short-term volatility ahead of the Federal Reserve’s July policy meeting [1].

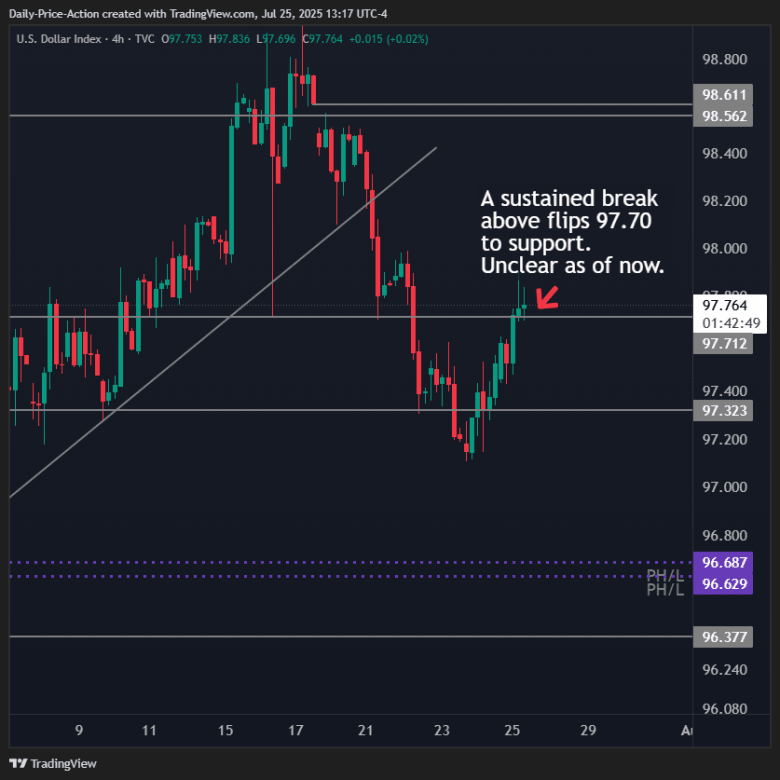

The surge in valuations has been amplified by speculative trading, particularly in high-growth sectors. Goldman Sachs’ Speculative Trading Indicator, tracking activity in unprofitable stocks and high EV/sales multiples, has reached record levels since 2020-2021. Though below the peaks of the dot-com bubble and 2020 pandemic rally, the metric highlights growing risk-taking in markets dominated by tech giants and digital asset firms [1]. Meanwhile, the Federal Reserve faces a delicate balancing act. While a rate cut in September is now priced at 60%, inflationary pressures from Trump-era tariffs complicate monetary policy. UBS highlighted a 3.6% price increase for consumer appliances due to these tariffs, potentially delaying rate cuts beyond December [1].

Political developments further add to uncertainty. A proposed corporate tax cut in Donald Trump’s legislative agenda aims to boost capital expenditures, with Piper Sandler forecasting a 3% real GDP growth for 2026 under this scenario. However, such measures introduce new economic variables, as growth from capital spending typically differs in magnitude and timing from housing-driven expansions [1]. Advisorpedia emphasized that while the Buffett Indicator signals elevated risks, market outcomes depend on broader factors, including earnings trends and macroeconomic stability. Tesla’s 8.2% drop following weak earnings underscored the fragility of current conditions [2].

The Buffett Indicator’s record high underscores a widening gap between asset prices and economic fundamentals. While central bank liquidity and speculative flows sustain valuations, the interplay of policy decisions, corporate performance, and political developments will determine whether this overvaluation persists or corrects. For now, investors remain divided, navigating a landscape where optimism and caution coexist.

Sources:

[1] [The stock market just blew through Warren Buffett’s favorite …](https://fortune.com/2025/07/25/stock-market-warren-buffett-indicator/)

[2] [Buffett Indicator Says Markets Are Going To Crash?](https://www.advisorpedia.com/markets/buffett-indicator-says-markets-are-going-to-crash/)