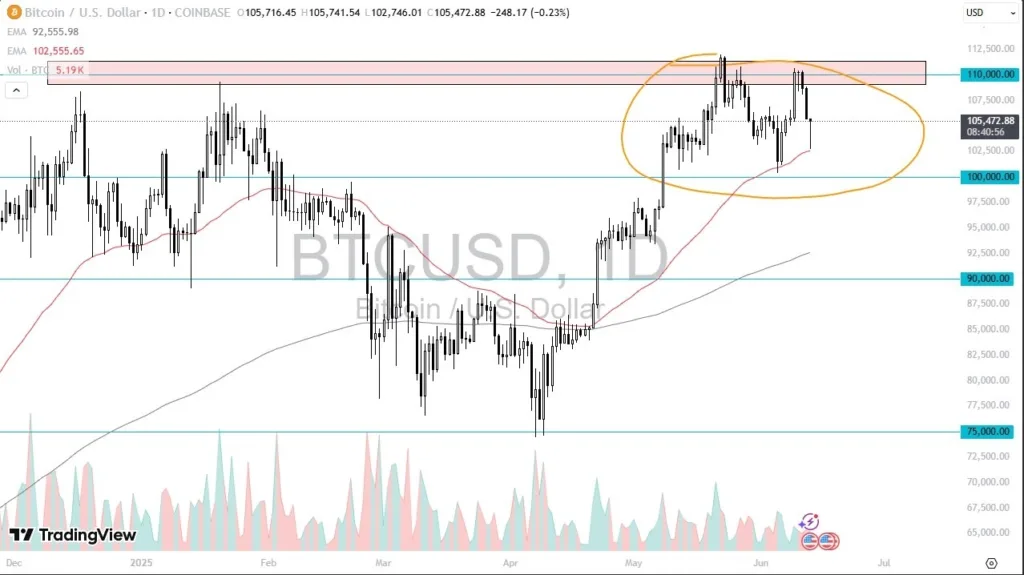

My previous BTC/USD signal on 9th June was not triggered, as there was no bearish price action at any of the identified resistance levels.

Today’s BTC/USD Signals

Risk 0.50% per trade.

Trades must be entered prior to 5pm Tokyo time Tuesday.

Long Trade Ideas

- Go long after a bullish price action reversal on the H1 timeframe following the next touch of $106,851, $104,502, or $103,091.

- Put the stop loss $100 below the local swing low.

- Move the stop loss to break even once the trade is $100 in profit by price.

- Take off 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to run.

Short Trade Ideas

- Go short after a bearish price action reversal on the H1 timeframe following the next entry into the zone between of $108,423, $109,029, or $110,463.

- Put the stop loss $100 above the local swing high.

- Move the stop loss to break even once the trade is $100 in profit by price.

- Take off 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

I wrote in my previous BTC/USD forecast on 9th June that I thought that the bulls had a minor edge, so the best trade setup would be a long trade entry from a bullish bounce off $104,165.

This was a good call although the price never traded as low as that support level, but it soared higher. I was wrong, however, in not wanting to enter a long trade in Bitcoin until a new all-time high was made, but that is my tried and tested long-term trading method which has a proven track record of profitability.

The technical picture is a little different now, but the technical outlook still seems to be bullish, with the price rising firmly over recent hours. Notably, the former key resistance level at $106,851 has been breached, and this may now act as support.

I cannot feel strongly bullish for two reasons:

The price action suggests overcoming the recent top near $110,000 is unlikely to happen any time soon, and

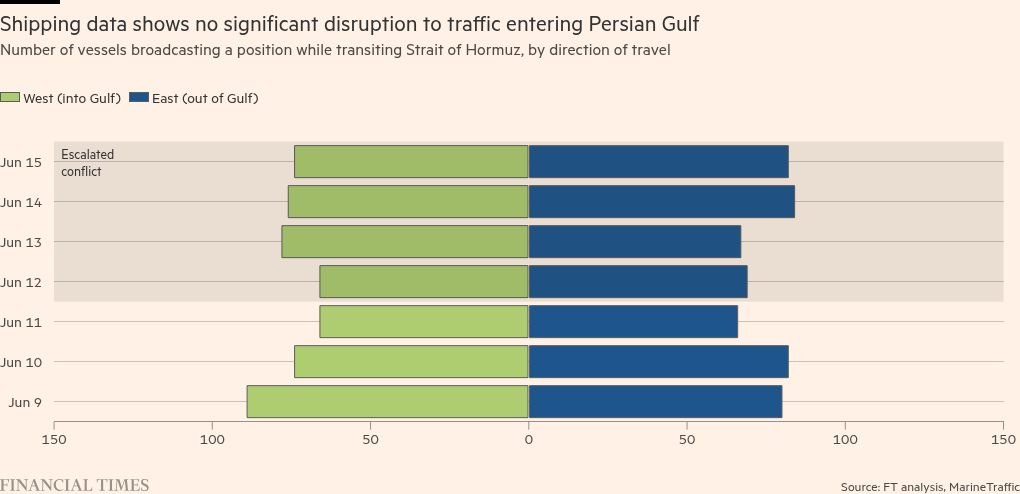

A regional escalation in the Middle East is quite possible and could sent risk sentiment tumbling, which will tend to hurt Bitcoin.

So, I think a short trade from a rejection of the resistance level at $108,423 (if it is reached today), will be the best opportunity which might set up today.

There is nothing of high importance due today regarding either Bitcoin or the US Dollar.

Ready to trade our daily Forex signals on Bitcoin? Here’s our list of the best MT4 crypto brokers worth checking out.