Bearish view

- Sell the BTC/USD pair and set a take-profit at 110,000.

- Add a stop-loss at 118,000.

- Timeline: 1-2 days.

Bullish view

- Buy the BTC/USD pair and set a take-profit at 118,000.

- Add a stop-loss at 110,000.

The BTC/USD exchange rate crashed to a key support level as institutional demand stalled and economic uncertainty remained. Bitcoin price was trading at $113,000, much lower than the all-time high of $124,200.

The BTC/USD pair fell as American investors remained on the sidelines and others sold their tokens. Data shows that spot Bitcoin ETFs have shed over $700 million in assets this week, a big reversal after they added $547 million in assets last week. The same trend happened with Ethereum, whose funds have shed assets this week.

ETF inflows and outflows data has been ideal for showing whether American institutional investors are accumulating or dumping it.

Still, Bitcoin demand remains strong this year, with spot ETF inflows surging to over $54 billion while the number of Bitcoin Treasury companies has surged.

Bitcoin price also plunged as investors moved away from risky assets, including technology stocks like Palantir and NVIDIA, which have plunged by almost 10% this year. The closely watched Nasdaq 100 Index has fallen in the last three consecutive days.

The next important catalyst that will move Bitcoin price will be the upcoming speech by Jerome Powell, in which he will possibly provide a road map for the next interest rate cuts as the US moves into a stagflation with inflation and the unemployment rate rising.

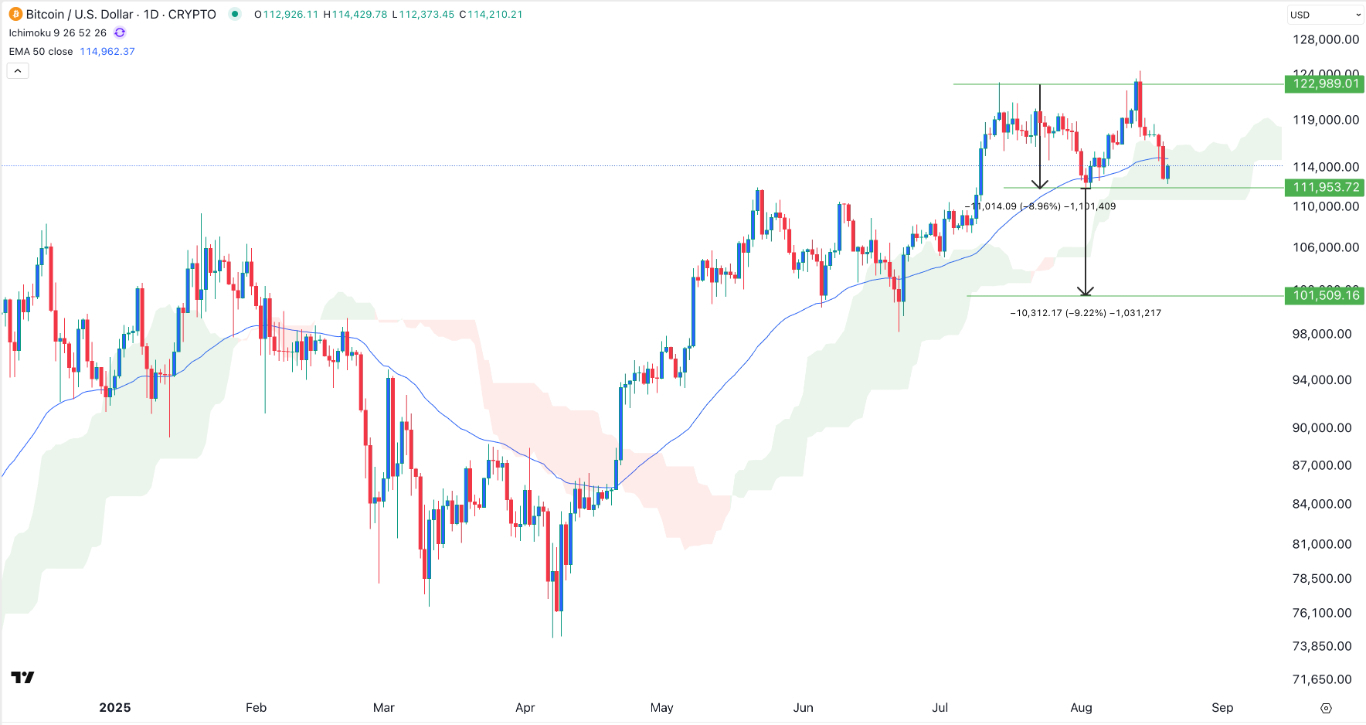

BTC/USD Technical Analysis

The daily timeframe chart shows that the BTC price has come under pressure in the past few days as the recent demand waned. It dropped to a low of $113,000 this week, a few points above the key support at 112,000, its lowest level this month. This price was also the neckline of the double-top pattern at 123,000.

The BTC/USD pair has crashed below the 50-day moving average and moved inside the Ichimoku cloud. Therefore, because of the double-top pattern, the pair will likely have a strong bearish breakout as sellers target the psychological point at 110,000. A rebound above the resistance level at 115,000 will invalidate the bearish outlook.

Ready to trade our daily Forex signals? Here’s a list of some of the best crypto brokers to check out.

Crispus Nyaga is a financial analyst, coach, and trader with more than 8 years in the industry. He has worked for leading companies like ATFX, easyMarkets, and OctaFx. Further, he has published widely in platforms like SeekingAlpha, Investing Cube, Capital.com, and Invezz. In his free time, he likes watching golf and spending time with his wife and child.