Bearish view

- Sell the BTC/USD pair and set a take-profit at 112,000.

- Add a stop-loss at 123,500.

- Timeline: 1-2 days.

Bullish view

- Buy the BTC/USD pair and set a take-profit at 123,500.

- Add a stop-loss at 112,000.

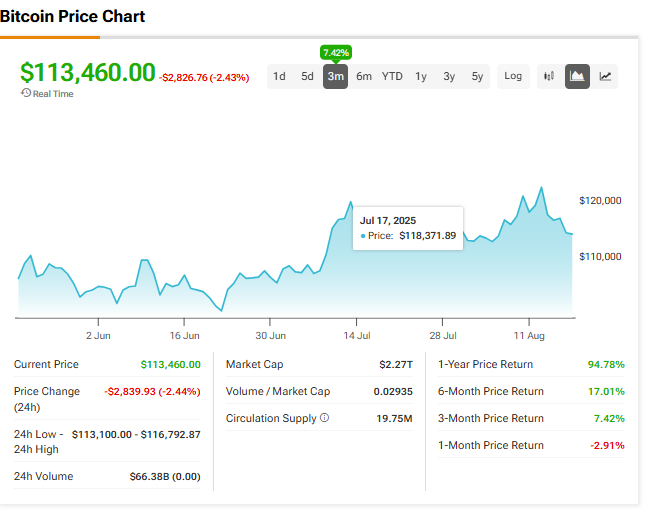

Bitcoin price moved sideways on Monday morning as the recent bullish momentum faded. The BTC/USD pair was trading at 118,230, lower than the year-to-date high of 124,200.

Bitcoin’s strong rally stalled after the strong US consumer and producer inflation data released last week which pushed investors to pare back their Federal Reserve interest rate cut odds.

The headline CPI figure remained unchanged at 2.7%, while the core consumer price index jumped to 3.1%, the highest level in months.

Meanwhile, the headline producer price index (PPI) rose to 3.6% in July as the cost of doing business in the US escalated. These numbers pushed Wall Street analysts to scale back their interest rate cuts hopes. The odds that the bank will cut rates in September fell to 70% from nearly 100% earlier during the week.

Bitcoin price will likely react to the upcoming Jackson Hole Symposium in Wyoming, which will provide more hints on when the bank will cut interest rates.

The BTC/USD pair also reacted to the ongoing focus on Ethereum among Wall Street investors. Data shows that spot Bitcoin ETFs added a net $547 million last week, much lower than Ethereum’s $2.85 billion.

Bitcoin price will also react to the ongoing BTC treasury strategy in which companies are adding BTC tokens into their balance sheet as they mimic Strategy (MSTR), which has become the biggest companies with a valuation of over $100 billion.

BTC/USD Technical Analysis

The daily chart shows that the BTC/USD pair pulled back from the year-to-date high of 124,420 to the current 118,300. It remains much higher than the 50-day and 100-day Exponential Moving Averages (EMA), which is a positive sign.

However, the pair’s oscillators have moved sideways. The MACD indicator has remained above the zero line, while the RSI has dropped to 50.

The BTC/USD pair has formed a double-top pattern at 123,283 and the neckline at 112,000. This is one of the most common bearish chart patterns.

Therefore, the pair will likely pull back as bears target the neckline at 112,00. A move above the resistance at 123,280 will invalidate the bearish outlook

Ready to trade our free Forex signals? Here are the best MT4 crypto brokers to choose from.

Crispus Nyaga is a financial analyst, coach, and trader with more than 8 years in the industry. He has worked for leading companies like ATFX, easyMarkets, and OctaFx. Further, he has published widely in platforms like SeekingAlpha, Investing Cube, Capital.com, and Invezz. In his free time, he likes watching golf and spending time with his wife and child.