- Bitcoin fell during the trading session on Friday as the July 4th session will have taken a certain amount of liquidity out of the market.

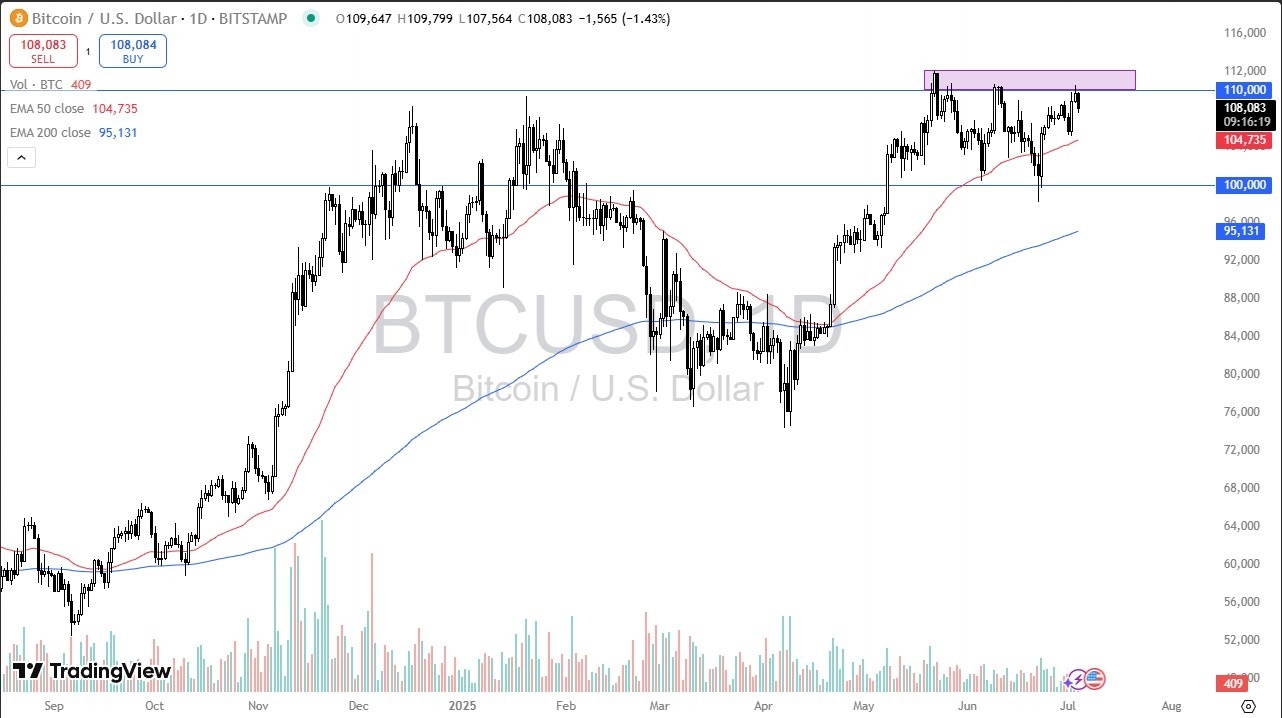

- All things being equal, when I look at this chart, I can see that we are clearly consolidating.

- If you look at the gold market, it’s somewhat similar. We had shot straight up in the air and now we are spending certain amount of time here to work off some of the froth.

The market has been trading between the $100,000 level at the bottom and the $110,000 level at the top. So, it’s not a huge surprise that we have pulled back from here. At one point, we had even broken above the $110,000 level to reach the $112,000 level. So, I think it’s a zone of resistance as I have marked on the chart. Nonetheless, I do think it’s probably only a matter of time before Bitcoin does take off to the upside, but it is going to need some type of value. That value, of course, is found in the pullback and it looks like we’re at least starting to get that.

Weekend and Monday

We’ll see how Bitcoin trades over the weekend. I imagine it’ll be fairly thin, but Monday you will have Wall Street coming back into the picture and the ETF could be influential as well. Regardless, there’s nothing on this chart that suggests you should be shorting Bitcoin and therefore I won’t be doing it either. As long as we can stay above the $100,000 level, really not much will have changed. It’s also worth noting that the 50 day EMA at the $104,729 level could offer a little bit of support on the way down also.

My plan with Bitcoin is going to be the same plan that I’ve had all along. When it falls, especially close to the $100,000 level, I wait for a bounce and buy that bounce. At least that way, you have a frame of reference of winning the trade won’t work out as you are buying the momentum that goes with the longer term trend.

Ready to trade Bitcoin forex forecast? Here’s a list of some of the best crypto brokers to check out.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.