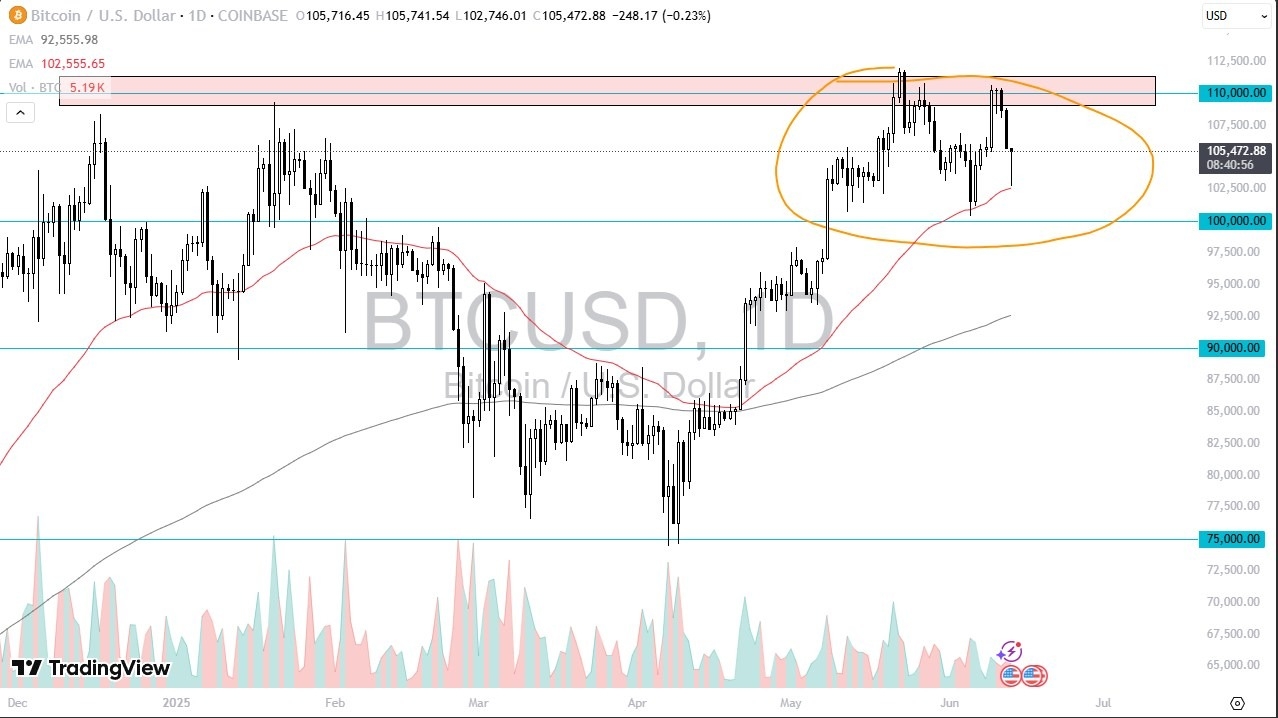

Potential signal:

- At this point, I am willing to buy Bitcoin, but I also recognize that you will have to pay close attention to the 50 Day EMA.

- That could be your stop loss. I would be aiming for the $110,000 level to take profit, and then I would move my stop loss to break even.

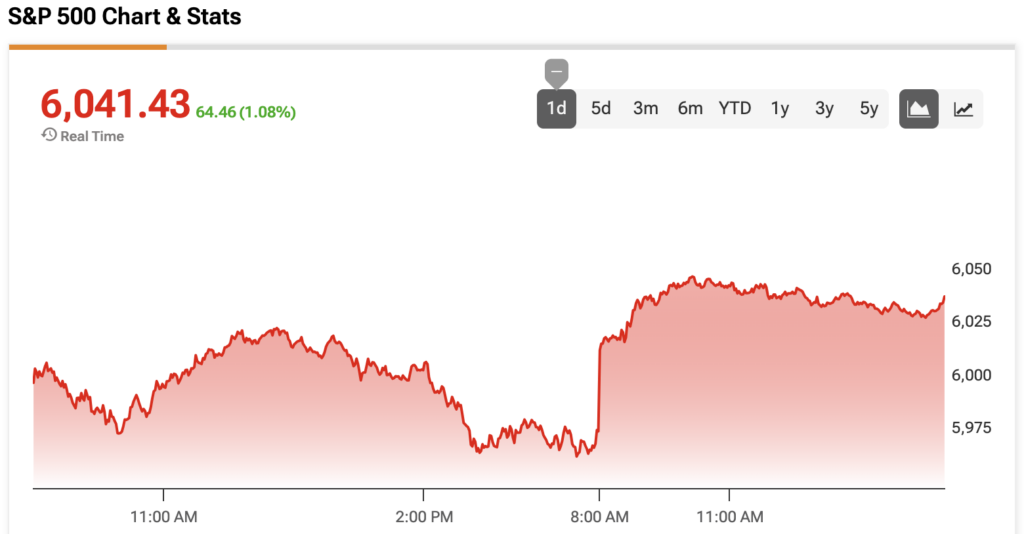

The Bitcoin market initially fell during the trading session on Friday, which makes a certain amount of sense considering we were decidedly “risk off”.

We saw a lot of different markets get hammered, and of course Bitcoin is pretty far out on the risk appetite spectrum, so with that being the case, I think you’ve got a situation where traders will continue to look at this through the prism of a market that is trying to get back to the all-time highs, but we also have to work off some of the excess froth that we had seen previously.

Technical Analysis

The technical analysis for Bitcoin is obviously relatively bullish, as the $110,000 level looks to be a major barrier to overcome, and it is worth noting that every time we pull back, buyers seem to be willing to jump in and take advantage of “cheap Bitcoin.” Because of this, you will have to pay close attention to the fact that there are people willing to take advantage of these set ups, so with this being said and the fact that we have bounce from the crucial 50 Day EMA, it looks a lot like a market that is going to do everything it can to build up enough pressure to break out.

If we do break out above the $112,000 level, then it’s likely that we go looking to the $120,000 level in fact, if you look at the recent consolidation between the $100,000 level and the $110,000 level, then you get the measured move to that $120,000 target. Quite frankly, I think we go higher than that, but in the short term that might be what we actually aim for. If we were to break down from here, perhaps below the $100,000 level, then I would have to look at the possibility of a move down to the 200 Day EMA, near the $93,000 level.

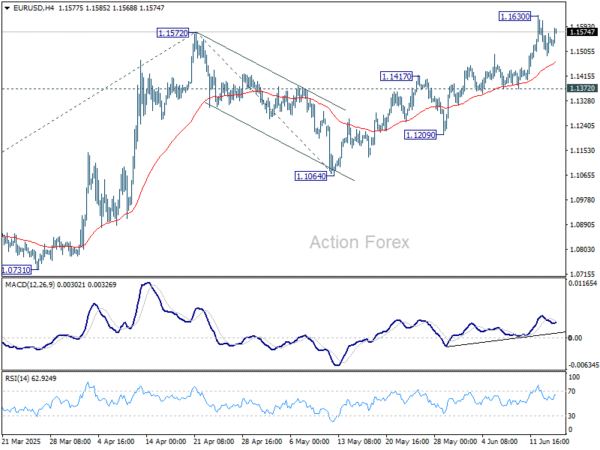

Ready to trade our free trading signals? We’ve made a list of the best Forex crypto brokers worth trading with.