On its way out of the door, the Biden administration has thrown what one official has characterized as a “grenade over your shoulder as you exit the room.” The long-awaited export controls it released on December 2 are a major escalation in the ongoing U.S.-China technology competition, and in the U.S. government’s attempt to slow down China’s efforts to develop an indigenous capability to manufacture advanced semiconductor nodes.

The new controls, at least on paper, establish a multi-tiered system aimed at closing gaps in the first two sets of export controls the administration released in October 2022 and October 2023. The thrust of the new rules is about two major issues:

1) Targeting the ability of China’s domestic foundry leader Semiconductor Manufacturing International Corp. (SMIC) and technology giant Huawei — what I call the Huawei-SMIC Complex (HSC), based primarily in Shanghai and Shenzhen-Guangzhou — from together driving the development of an end-to-end supply chain for advanced node semiconductor production, for both smartphone application specific integrated circuits (ASICs) and advanced graphics processing units (GPUs).

2) Extending U.S. export controls extraterritorially in an effort to choke off former suppliers from providing support for the SMIC-Huawei effort, and preventing American and other foreign firms from using offshore locations to do the same.

In addition, the U.S. government has added 140 companies to its Entity List, including most of China’s equipment makers, electronic design automation tool companies, and upstream process gas and materials companies that are all key to developing an indigenous supply chain to support the Huawei-SMIC Complex.

As with the first Department of Commerce’s rule package released in October 2022, the new rules focus almost exclusively on control of “advanced-node integrated circuits (ICs)”, meaning semiconductors, which get a slightly new definition. In effect, the department two years on is now using its definition of what it views as an advanced node IC to include those that use a “production” technology node of 16/14 nanometers (nm) or less for logic — think CPUs or GPUs (the lower the level of nanometers, the more advanced a chip is considered to be). It has also tightened its definition of advanced nodes for DRAM integrated circuits, used for memory, to capture advanced memory that is now routinely packaged with GPUs for artificial intelligence applications.

…White House and Commerce officials continue to draw new lines around technology exports, while stressing concepts like the by now completely discredited “small yard, high fence” idea, and the notion that only the most advanced semiconductors are being targeted.

For the semiconductor industry this represents yet another changing of the administration’s goalposts. Even in October 2022, industry voices were clear that the semiconductor sector does not consider 16 or 14 nanometer (nm) semiconductors to represent “advanced” node production, nor did it consider 128 layer NAND or at the time 19 nm DRAM to be “advanced.” In addition, and interestingly, none of the 140 companies added to the Entity List are doing work on what the industry considers to be “advanced node ICs.”

Jake Sullivan discusses the “small yard, high fence” approach during a speech delivered at Brookings, April 27, 2023. Credit: Brookings

Clearly the Commerce Department and the industry continue to speak different languages when it comes to semiconductor technology. Yet White House and Commerce officials continue to draw new lines around technology exports, while stressing concepts like the by now completely discredited “small yard, high fence” idea, and the notion that only the most advanced semiconductors are being targeted.

While a number of assessments of the new rules have focused on their likely effectiveness, there has been much less questioning of the underlying rationale behind them — that is, choking off China’s ability to produce the most advanced semiconductors, specifically those used for training advanced or frontier AI models, to slow China’s military modernization.

Secretary of Commerce Gina Raimondo reiterated this rationale during the announcement of the December 2 controls, noting that “no administration has been tougher in strategically addressing China’s military modernization through export controls than the Biden-Harris administration.”

The Commerce Dept. formulation contains a number of inherent contradictions that are seldom if ever addressed by U.S. officials:

1) Most military applications typically do not require the most advanced semiconductors, as Russian efforts to cannibalize washing machines for semiconductors to use in drones illustrate.

2) Advanced node semiconductors — those under say 7 nm — are overwhelmingly used for consumer devices such as smartphones. Advanced GPUs are also overwhelmingly used globally and in China by civilian companies developing consumer and business applications.

Biden administration officials, perhaps realizing the obvious disconnect here, have shifted from talking about concerns around Huawei’s latest advanced chips for its smartphones and other consumer devices, to just talking about “advanced semiconductors for military applications,” without actually naming any of those applications; this is because

3) Although AI is being used for military applications, for example Israel’s Lavender system for targeting insurgents in Gaza, these are driven by more traditional AI algorithms that are quite different from frontier generative AI models. These applications do not require the most advanced GPUs, nor do most current military applications of AI for logistics, training, and other mostly administrative applications.

A new era of technology supply chain tit-for-tat

The other critical aspect of the U.S. continuing effort to ratchet up controls is the collateral damage that it will continue to inflict on U.S.-China bilateral relations, and on global semiconductor and critical mineral supply chains. The comprehensive nature of the new December 2 controls now sets up a complex dynamic, as Beijing explores its retaliation options, albeit as it balances a number of competing priorities. The retaliation function is being pushed in part to:

1) Put pressure on U.S. allies to forego full alignment with the provisions of the December 2 and previous packages;

2) Send a message to the incoming Trump administration that further controls will complicate the bilateral relationship and disrupt U.S .and allied supply chains for critical inputs;

3) Avoid damaging domestic economic priorities and further poisoning the investment climate for foreign business, and

4) Appease domestic nationalist critics that think Beijing should take more drastic measures against U.S. and allied company interests in China, and cut off a much broader set of critical minerals, process technology, and IP to the U.S. in particular.

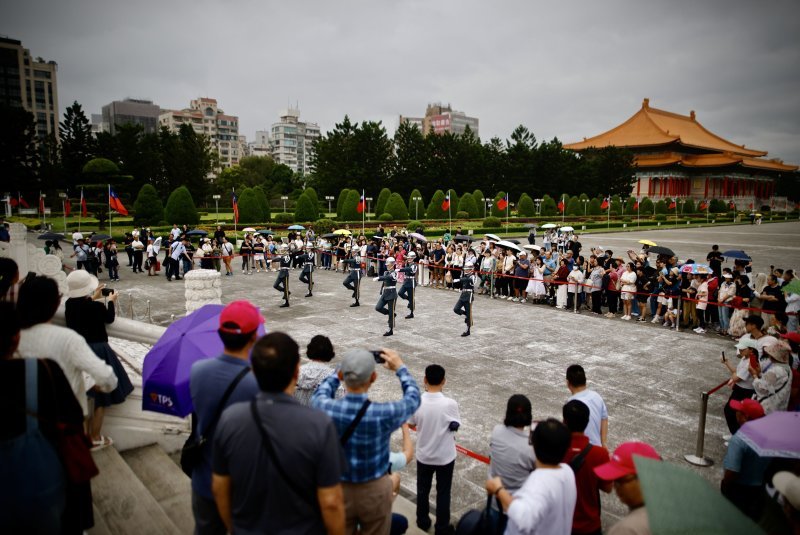

Beijing’s response will play out in the coming months against the backdrop of a new U.S. administration finding its feet on a range of complex foreign policy challenges. It is likely that Xi and Beijing would like to leave some room for a potential trade deal early on with the new Trump team. But should the new administration begin to push back on some of Xi’s newly packaged set of four policy “red lines”, topped by Taiwan, the chances of any such deal will drop precipitously. Beijing will then feel more emboldened to take stronger measures in response to U.S. technology controls.

The unchartered waters we are already in with respect to the impact of wide ranging export controls on the Chinese semiconductor industry, and on major U.S. and foreign technology companies most impacted by the measures, would in turn become even more turbulent and dangerous.

The focus of the new Trump administration’s technology controls on China will shift to some degree from semiconductor manufacturing to AI models being trained and deployed via cloud-based services. The new Export Control Framework for Artificial Intelligence Diffusion, set to bereleased in early January, but which could slip and be reviewed and released by the new Trump team, is part of what will be a longer term effort, that the Trump administration will pick up, to close global loopholes that could allow Chinese companies and researchers access to restricted hardware via AI data centers offering cloud-based services. The complexity of the proposed rule has generated considerable pushback from industry, given that the administration has planned to release the rule as nearly final, without the normal comment period where industry can weigh in — the rule appears to be primarily based on input from government experts who may be less aware of the latest industry developments across the AI stack or industry preferences.

The new rule on AI diffusion is ambitious and will attempt to divide the world into a group of close U.S. allies subject to one licensing regime around advanced GPU servers for AI datacenters; and another, separate regime for potential partners in non-allied countries that seek collaboration with U.S. companies on AI datacenter development, but also are likely to want to maintain close relations with Chinese companies.

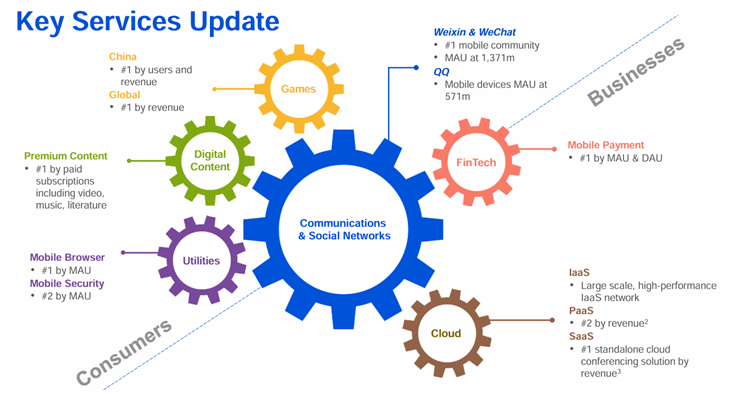

A key example of the type of country and firm involved here is the UAE technology conglomerate G42. Last summer, G42 became the test case for the new U.S. regime on GPUs, with National Security Advisor Jake Sullivan and Commerce Secretary Gina Raimondo personally meeting with UAE national security advisor and G42 Chairman Sheikh Tahnoon bin Zayed to pressure the firm to cut ties with Chinese firms, before it could gain approval for large shipments of AI servers to the UAE.

The new rule also conditions the supply of GPUs on the recipient’s willingness to implement restrictions on the access of Chinese persons and organizations to their restricted hardware on a worldwide basis. It remains unclear how the Commerce Department will implement and enforce this unprecedented package of extraterritorial rules, and how allies and non-allies will view the GPU country caps based on the Commerce Department metric “total processing performance” (TPP), rolled out for the first time in October 2023 as a new way to measure the computing power of advanced GPUs. The new rule targets computing power for the most advanced AI models, such as the next OpenAI platform GPT-5.

Further disrupting supply chains and business models without fully understanding what the Biden administration has attempted in this space… would work against U.S. technology leadership.

And this, finally, is one of the major issues surrounding the entire Biden administration effort to control China’s access to hardware for training AI models. All the rules have been released on a fully unilateral basis, and their implementation has then relied on U.S. government arm-twisting of allies — despite efforts to portray the controls as “trilateral”, for example, with Japan and the Netherlands.

While U.S. industry leaders and former Commerce officials have frequently spoken of the need for export controls to be multilateral to be effective, the Biden approach has been to issue controls first, then try to drag allies along after the fact. Despite some efforts to align with U.S. controls, both Japan and the Netherlands do not necessarily fully share the national security concerns around AI models of the Biden administration, and tend to listen to major domestic firms whose business models are heavily impacted by the U.S.’s extraterritorial controls.

The result of this has been to:

1) Put U.S. firms at a disadvantage, because U.S. allies do not maintain or are not willing to implement similar controls

2) Anger allies who feel that they have not been consulted on the shaping of the rules, and

3) Force companies to design out U.S. technology from their supply chains to free themselves from the extraterritorial provisions of the rules. Even senior Commerce officials acknowledge this trend.

All this is happening in ways that are significantly disrupting supply chains and undercutting the business models of firms across the global semiconductor industry, in both current and unknown future ways.

The full long-term impact on U.S. technology leadership in a critical sector remains unknown: but all signs point to a growing negative impact on key firms. Well-run companies are able to compensate for lost revenue in the short-term, but the true impact on U.S. toolmakers will be on their future R&D spending power and revenue, not their current sales and gross margins.

Already there are significant examples to point to. Export controls on Intel’s sales to China have contributed to the firm’s financial troubles, and toolmaker KLA in December noted it expected China sales to drop considerably, specifically citing losses in service revenue, a key generator of income that is plowed back into R&D.

The new Trump administration and Commerce Department will have to reassess all of these issues once it takes office and as its new leadership, including Secretary-elect Howard Lutnick, gains a better understanding of the results of the Biden administration’s approach to controls.

For the incoming team, the challenges will be considerable, particularly determining how to integrate technology controls into broader China policy approaches, particularly with respect to Taiwan; and how to avoid what could be a very damaging downward spiral in relations that sees Beijing clamp down hard on exports of critical industrial inputs such as rare earths and associated products like magnets. Further disrupting supply chains and business models without fully understanding what the Biden administration has attempted in this space, without proper cost-benefit analysis, would work against U.S. technology leadership.

The new Trump team will have to unpack and reconsider all of these issues right out of the gate.

Paul Triolo is Senior Vice President for China and Technology Policy Lead at Albright Stonebridge Group. DGA Albright Stonebridge Group works with a variety of companies in many sectors, including healthcare, fashion, agriculture, and technology. The firm advises companies across the technology stack, including working with semiconductor firms, consumer electronics companies, social media companies, firms part of the Al supply chain, and firms in key verticals deploying Al cross their business operations. Mr. Triolo has been writing regularly on technology policy related issues, including export controls, since 2016.