Beyond Meat is showing what happens when a low nominal share price, retail enthusiasm, heavy options activity, and relatively elevated short interest collide: this is what a meme stock rally looks like.

Shares of the plant-based meat company are on a tear again on Tuesday morning, pushing toward the $2 level after sinking as low as $0.50 last Thursday. As of 7:39 a.m. ET, more than $115 million has changed hands trading Beyond Meat, the fourth-most of any stock listed on US exchanges.

The rally didn’t need any fundamental news, but it got some anyways: management announced plans to expand its product availability at over 2,000 Walmart locations nationwide, further adding to the stock’s early gains.

This continues Beyond Meat’s high-volume surge that saw the stock more than double on Monday, in what was by far its biggest one-day gain on record. By the time the dust settled on the opening session of the week, Beyond Meat had volumes in excess of 1.2 billion, effectively turning over its (newly boosted) shares outstanding three times over during the course of the day. That’s a higher level of turnover than Opendoor Technologies enjoyed during its most insane session of this year back on July 21.

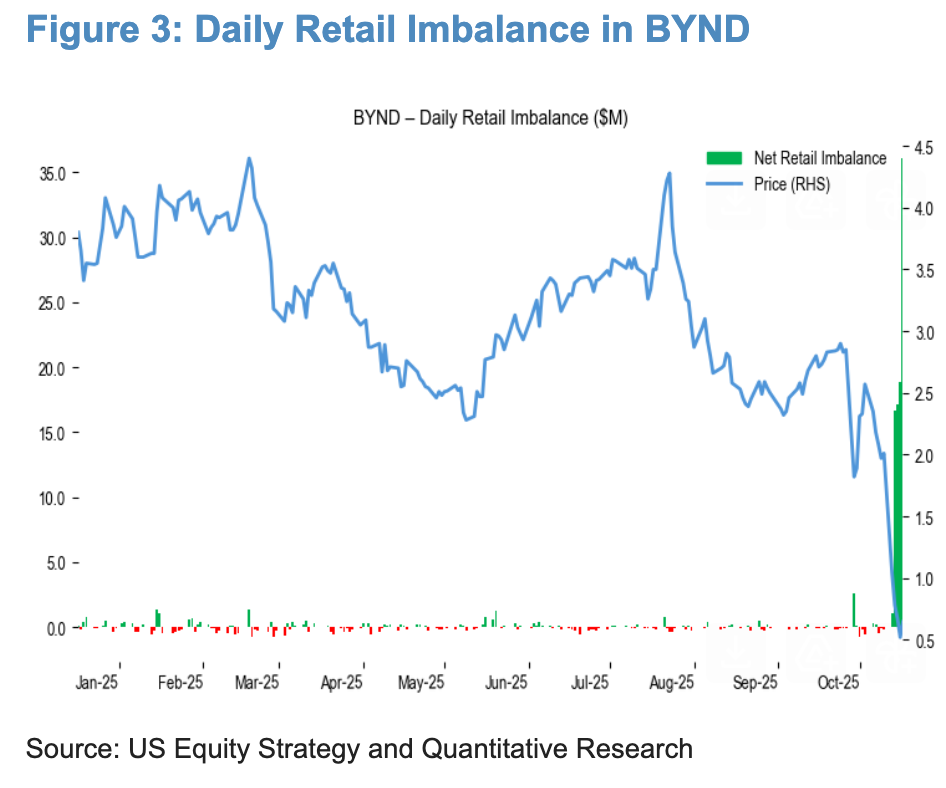

JPMorgan strategist Arun Jain observed that this retail interest came out of nowhere as the stock was trading for coins rather than dollars, as this chart on BYND’s daily net retail imbalance through Friday shows:

Source: JPMorgan

This sudden flood of positive retail sentiment appears to be in no small part thanks to a (since banned) Reddit user with the handle capybaraSTOCKS, who has since transitioned to YouTube and X to share his thesis on the company. Business Insider identified this person as Dimitri Semenikhin, a Dubai-based real estate developer.

The move on Monday included a massive spike in call volumes up to more than triple their previous daily record:

When you’re a meme stock, your equity is what becomes your top product. And while, yes, most companies do tend to see higher trading volumes on any given day than the sales they’re making, this discrepancy is particularly stark with Beyond Meat. Through its history as a publicly traded company, it’s recorded plant-based meat sales of 487.5 million pounds. In other words: more than twice as many shares traded on Monday compared to pounds sold from Q1 2018 through Q2 2025!