We’re pitting Palantir’s momentum against SoundHound’s potential.

It’s hard to describe an investing opportunity as lucrative and surefire as artificial intelligence (AI) right now. Companies are working to install AI-powered products to assist with customer service, smart devices, manufacturing, inventory management, diagnostics, and more.

Grand View Research estimates that the global market size for artificial intelligence was $279.2 billion in 2024. That’s a huge figure all by itself, larger than the market caps for all but 40 publicly traded companies around the world.

But then consider that Grand View projects the AI market to grow to $1.81 trillion by 2030, and grow at a compound annual growth rate (CAGR) of 35.9%. It’s no wonder that AI stocks are so popular — and profitable — these days.

Image source: Getty Images.

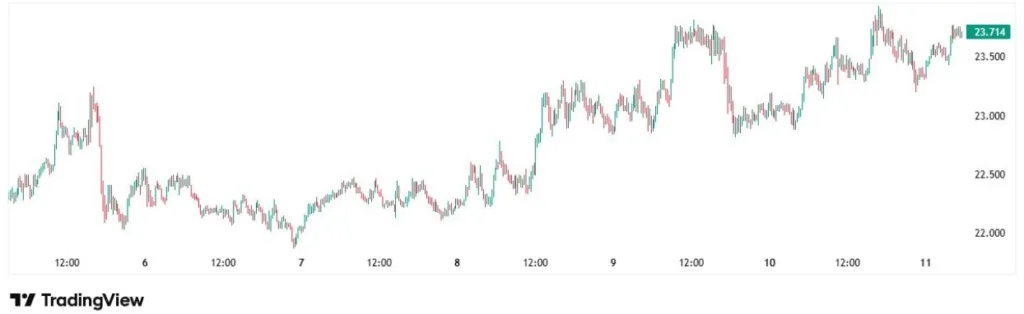

Palantir Technologies (PLTR 1.87%) and SoundHound AI (SOUN 6.87%) are two of the more interesting AI stocks on the planet right now. But which is the better investment?

Palantir’s in a lull

The biggest winner on Wall Street for the last 18 months is facing some adversity. Palantir shares are down 18% from all-time highs set a month ago. Shares struggled to maintain their level after Citron Research published a report month that called the company “detached from fundamentals and analysis.”

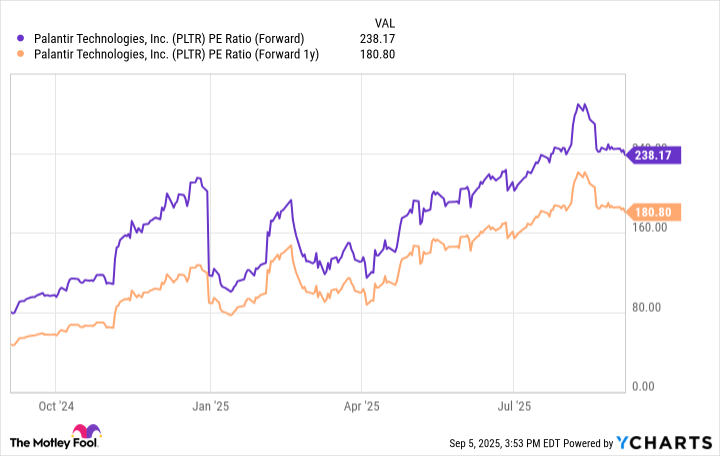

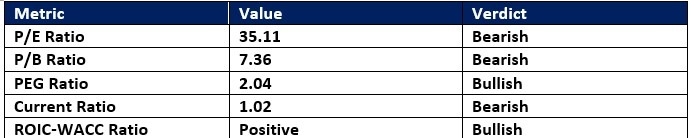

And Citron is probably right. I’m as big of a Palantir bull that you’ll meet, but the company’s valuation is eye-popping. Palantir currently has a trailing price-to-earnings ratio of 510 and a forward P/E of 238. Its projected forward P/E in a year is still a ghastly 180.

PLTR PE Ratio (Forward) data by YCharts

But here’s where I break with Citron — Palantir is a momentum play right now, not an investment based on fundamentals. Citron thinks that’s a deal-breaker, but I still think there’s an extraordinary opportunity behind Palantir. The company uses artificial intelligence to crunch data pulled in from hundreds of sources to help both its commercial and government clients make real-time decisions.

For companies, that means using Palantir’s vaunted Artificial Intelligence Platform to make recommendations about workflows, inventory, supply chains and resources. Palantir is working with healthcare companies to manage clinical trials; with retailers to give insights about store operations, marketing, sales, and strategy; and with the aviation industry to help airlines navigate the skies. And that’s just touching the surface.

The company is better known for its government work, where Palantir taps into satellites and other sensitive resources to help intelligence agencies and military commanders make decisions while soldiers and operatives are in motion. And its expanding its work with the U.S. government to include the State Department, Homeland Security, Health & Human Services, and more.

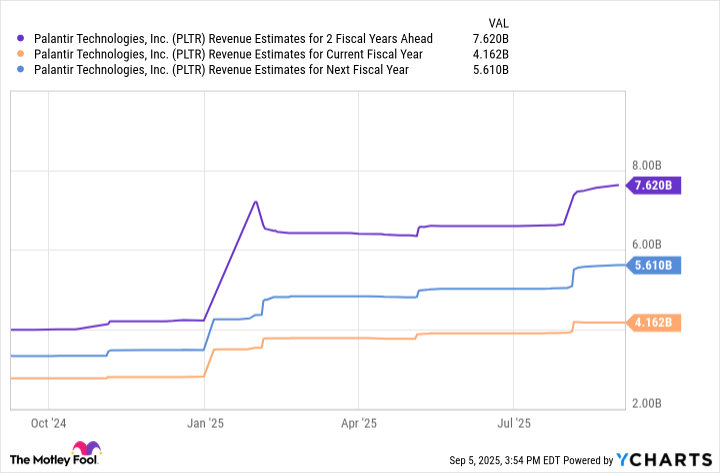

Palantir’s revenue is expected to jump from $4.16 billion this year to $7.62 billion by 2027. And I think that’s just the beginning.

PLTR Revenue Estimates for 2 Fiscal Years Ahead data by YCharts

SoundHound is smaller, but has potential

While Palantir is growing by leaps and bounds, SoundHound AI is still comparatively near the beginning of its growth story. SoundHound works to create AI-assisted voice solutions, so people can use natural language to talk to platforms and have a conversation.

The company has an array of customers, including Hyundai, Honda Motor, and Stellantis in the automotive industry. It works with Block-owned Square to improve point-of-sale systems, and with Oracle to develop software to allow restaurants to accept voice orders through AI. Companies such as Pandora, Snap, and Motorola Solutions also use SoundHound to power their voice assistants.

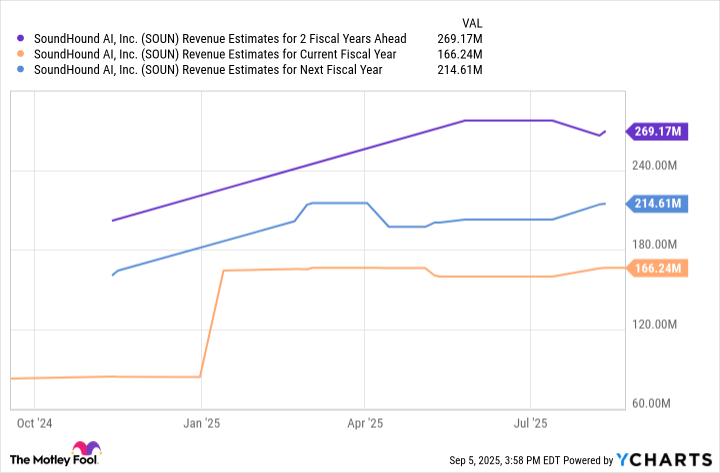

SoundHound is expecting to see its revenue ramp up as well, but not as aggressively as Palantir. SoundHound’s revenues this year are expected to be $166.2 million, rising 29% next year to $214.6 million and 25% in 2027 to $269.17 million.

SOUN Revenue Estimates for 2 Fiscal Years Ahead data by YCharts

But while Palantir has a moat — nobody can perform the services that Palantir currently offers — SoundHound faces serious competition from some of the biggest AI players on the planet, including Amazon’s Alexa, Alphabet‘s Google Assistant, and Microsoft Copilot.

Which is the better investment?

This is a case of Palantir’s potential and awful valuation versus a really good company in SoundHound that has a huge market opportunity. SoundHound had a blowout second quarter in which it brought in $42.7 million in revenue, up 217% from a year ago. Palantir’s second quarter was also impressive, as the company recorded $1 billion in quarterly revenue for the first time and saw its revenue increase 48% from a year ago.

I know that for some investors Palantir is a no-go. And that’s fine. But I’m still rolling the dice with the data mining company because there are too many tailwinds — rapid commercial adaption, increased government usage, unchallenged moat — to ignore. I’ll go with the already-established Palantir over the speculative play of SoundHound AI.

Patrick Sanders has positions in Palantir Technologies. The Motley Fool has positions in and recommends Alphabet, Amazon, Block, Microsoft, Oracle, and Palantir Technologies. The Motley Fool recommends Stellantis and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.