TechnipFMC (NYSE:FTI) ranks among the top robotics to buy according to analysts. Bernstein analyst Guillaume Delaby maintained his Market Perform rating on TechnipFMC (NYSE:FTI) and increased his price target from $32 to $37 on July 29. The price target rise comes after TechnipFMC’s impressive second-quarter 2025 results, which showed $2,535 million in revenue and $509 million in EBITDA.

Bernstein increased TechnipFMC’s 2025–2028 EBITDA projections by 3%, 6%, 6%, and 15%, respectively, citing the company’s optimism about landing an extra $10 billion in subsea orders in 2026.

In addition to highlighting TechnipFMC’s “increasing uniqueness” in the market and its multi-year visibility in the subsea segment, the analyst pointed out that the legacy company traded at a peak multiple of roughly 12x EV/EBITDA during the 2011–2013 upcycle.

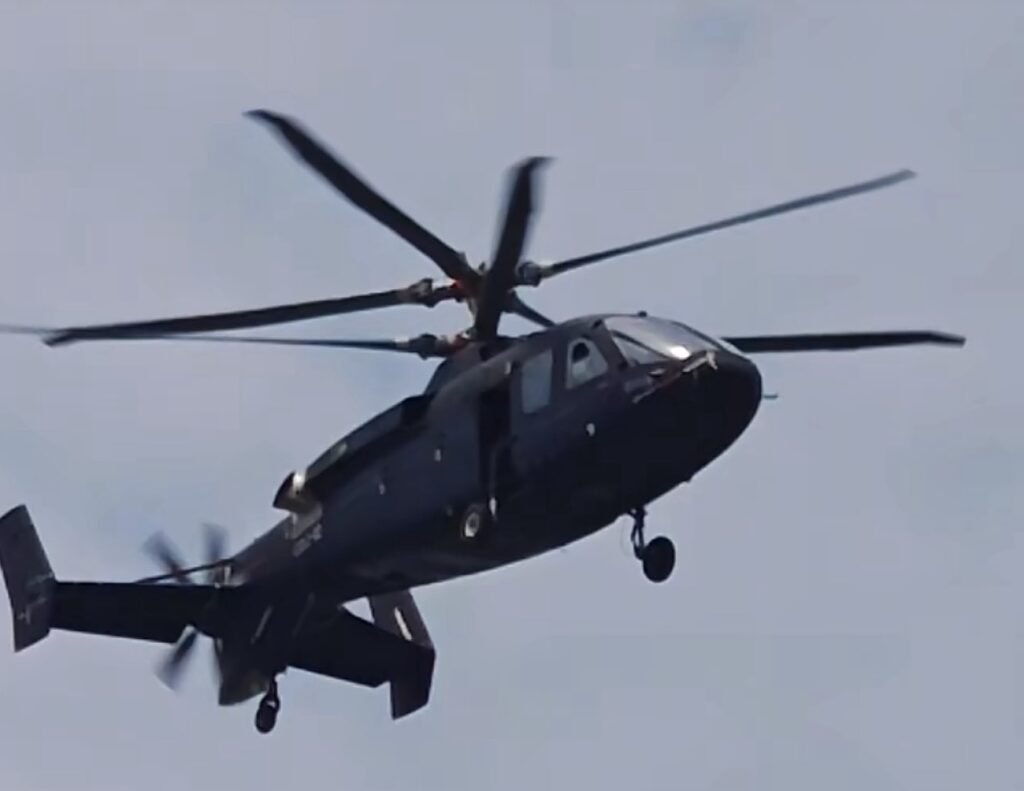

TechnipFMC (NYSE:FTI) focuses on energy projects, technologies, systems, and services businesses. The company operates through two segments: Subsea and Surface Technologies. Through its Schilling Robotics business, TechnipFMC is making progress toward more autonomous underwater operations. The company’s ROVs are used in deepwater research, the oil and gas industry, the renewable energy sector, and military applications across the world.

While we acknowledge the potential of FTI to grow, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and have limited downside risk. If you are looking for an AI stock that is more promising than FTI and that has 100x upside potential, check out our report about this cheapest AI stock.

READ NEXT: 10 Best Magic Formula Stocks for 2025 and 10 Best Retirement Stocks to Buy According to Hedge Funds.

Disclosure: None. This article is originally published at Insider Monkey.