Most Read: Gold Price Forecast: Bearish Correction May Extend Further Before Turnaround

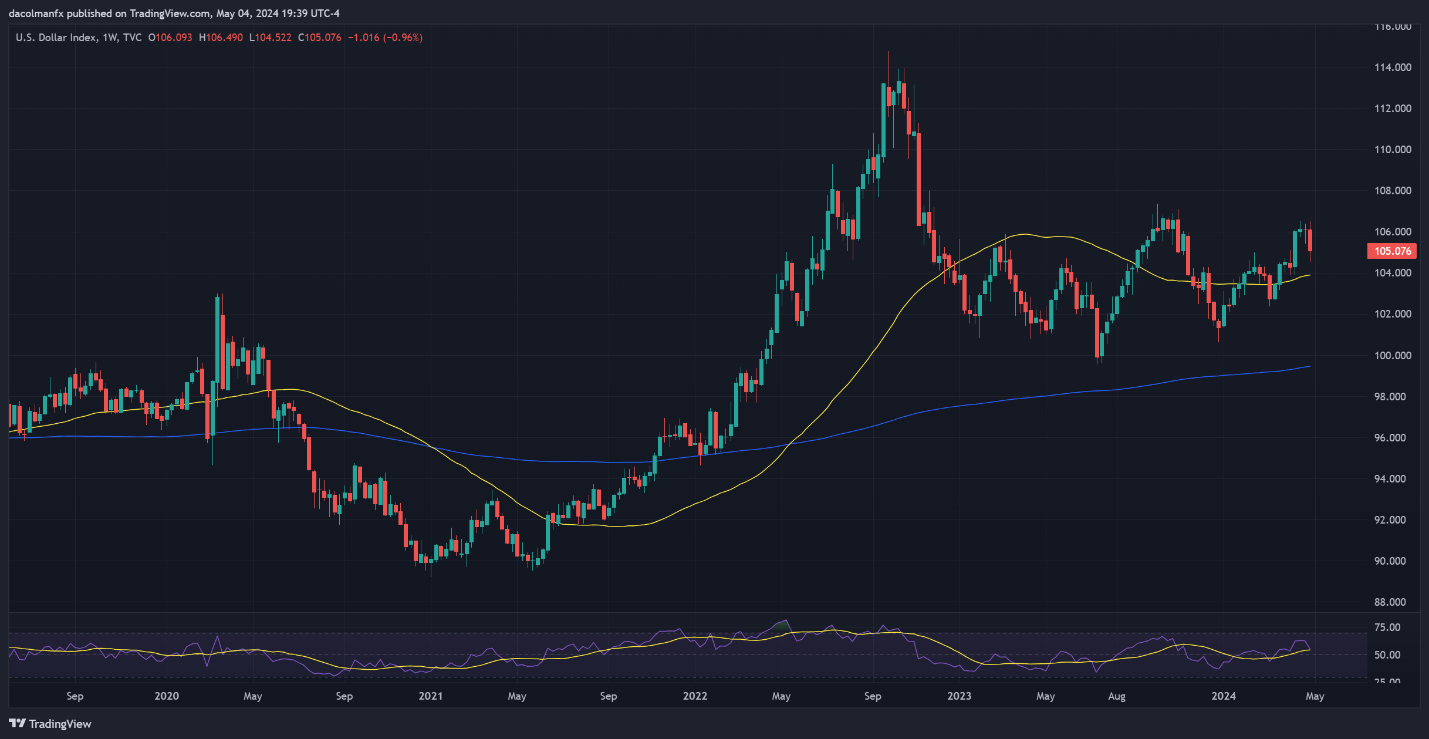

The U.S. dollar, as tracked by the DXY index, retreated sharply this past week, briefly reaching its lowest point since April 10th. This selloff stemmed primarily from falling U.S. Treasury yields following the Federal Reserve’s monetary policy announcement and weaker-than-anticipated U.S. employment numbers. Ultimately, the DXY dropped nearly 1%, settling just above the 105.00 mark.

US DOLLAR INDEX WEEKLY PERFORMANCE

US Dollar (DXY) Chart Created Using TradingView

Initially, the greenback’s decline was triggered by Fed Chair Powell’s dovish remark at the central bank’s last meeting, indicating that a rate cut is still likely to be the next policy move despite rising inflation risks. Subsequently, the US non-farm payrolls report, which revealed an unexpected cooling in job creation accompanied by softer wage pressures, further reinforced the currency’s downward reversal.

Want to know where the U.S. dollar may be headed over the coming months? Explore key insights in our second-quarter forecast. Request your free trading guide now!

Recommended by Diego Colman

Get Your Free USD Forecast

Looking ahead, the prospect of Fed easing irrespective of conditions, coupled with increasing signs of economic fragility reflected in recent data, should prevent bond yields from heading higher, removing from the equation a bullish catalyst that has benefited the U.S. dollar this year. This could lead to further weakness in the short term, at least during the first part of the month.

The upcoming week offers a relatively quiet U.S. economic calendar, allowing recent FX moves time to consolidate. However, the near-term outlook will need to be reassessed in mid-May, when the next set of CPI figures will be released. This report will provide fresh insights into the current inflation landscape, thereby guiding the Fed’s policy path and the direction of the broader market.

Wondering about EUR/USD’s medium-term prospects? Gain clarity with our Q2 forecast. Download it now!

Recommended by Diego Colman

Get Your Free EUR Forecast

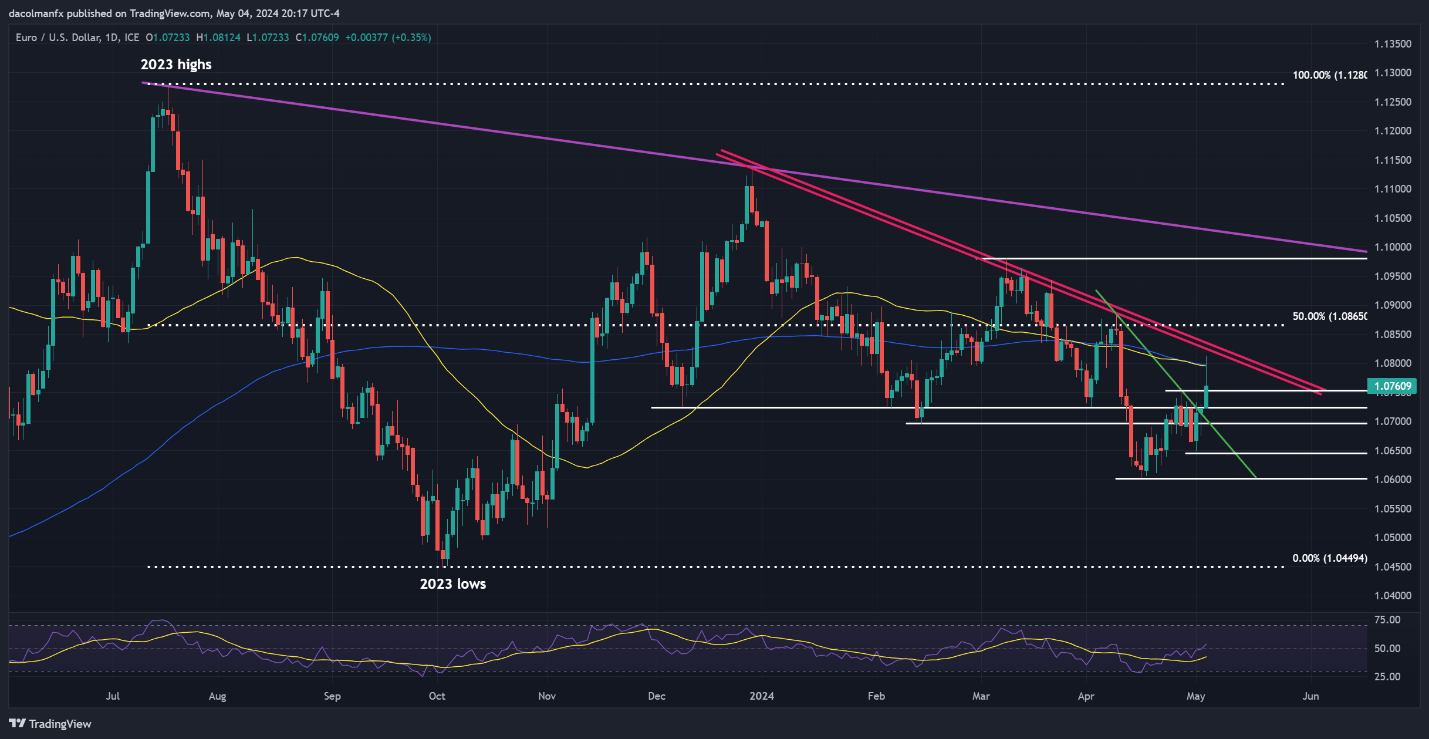

EUR/USD FORECAST – TECHNICAL ANALYSIS

EUR/USD rallied this past week, breaking above several resistance zones and coming within a hair’s breadth of breaching the 50-day and 200-day SMA. Bears need to keep prices below these technical indicators to contain upside momentum; failure to do so could spark a move toward trendline resistance at 1.0830. On further strength, attention will be on a key Fibonacci barrier near 1.0865.

In the event of a bearish reversal, minor support areas can be identified at 1.0750, 1.0725 and 1.0695 thereafter. Below these levels, all eyes will be on the week’s swing low around 1.0645, followed by April’s through around the psychological 1.0600 mark.

EUR/USD PRICE ACTION CHART

EUR/USD Chart Created Using TradingView

For a complete overview of the British pound’s technical and fundamental outlook, make sure to download our complimentary Q2 trading forecast now!

Recommended by Diego Colman

Get Your Free GBP Forecast

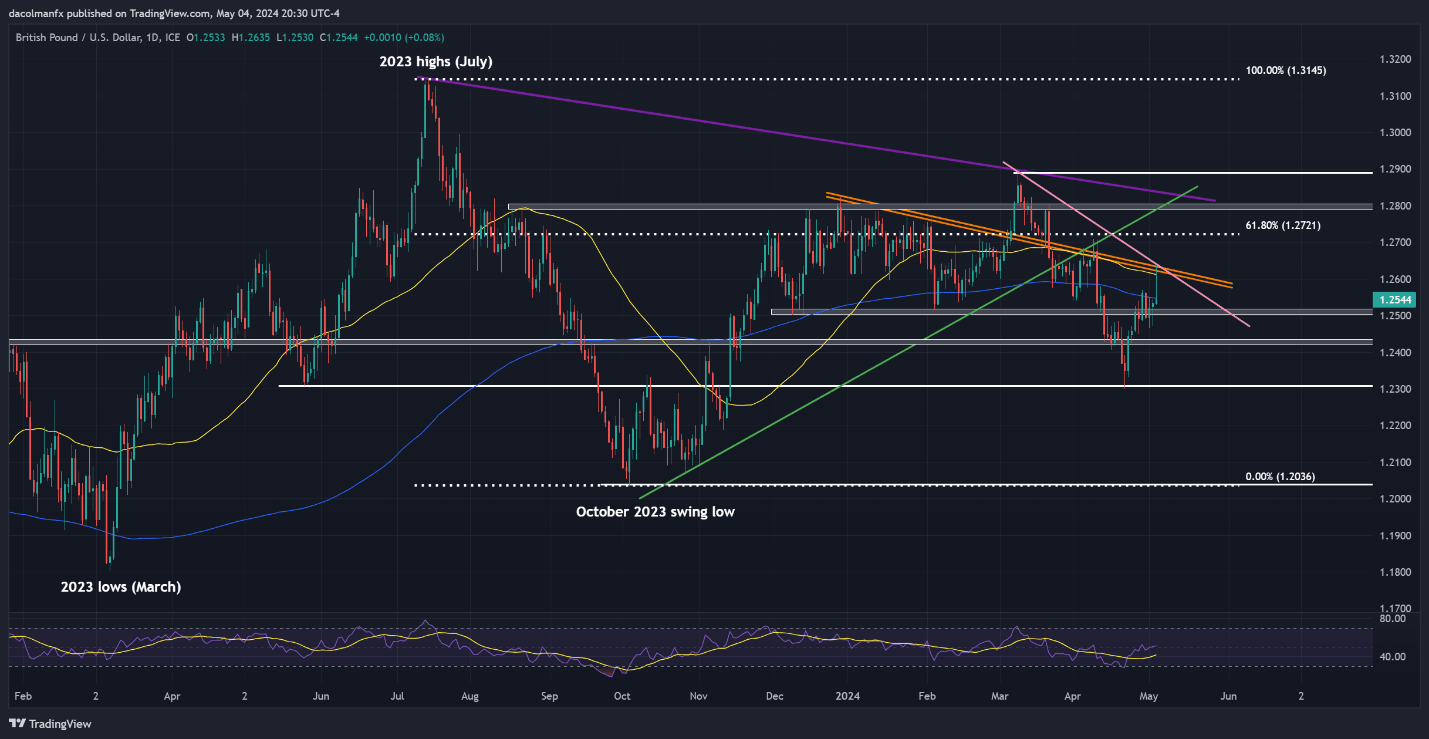

GBP/USD FORECAST – TECHNICAL ANALYSIS

GBP/USD also climbed this past week, but the advance lacked impulse, with prices failing to close above the 200-day simple moving average. Traders should keep a close eye on this indicator in the coming days, bearing in mind that a decisive breakout could pave the way for a retest of confluence resistance near 1.0620.

On the flip side, if sellers return and propel cable lower, support stretches from 1.2515 to 1.2500. Bulls need to keep prices above this range to mitigate the risk of escalating selling pressure, which could potentially steer the pair towards 1.2430. Subsequent declines from this point forward could bring into consideration the 1.2300 handle.