Macro uncertainties, geopolitical tensions, and news on the tariff front have kept the stock market volatile. Despite ongoing uncertainties, analysts remain optimistic about several growth stocks and their potential to generate attractive returns over the long term. Using TipRanks’ Stock Comparison Tool, we placed BigBear.ai Holdings (BBAI), CoreWeave (CRWV), and AppLovin (APP) against each other to find the best growth stock, according to Wall Street analysts.

Confident Investing Starts Here:

BigBear.ai Holdings (NYSE:BBAI) Stock

BigBear.ai Holdings stock has risen more than 31% so far in 2025 and 292% over the past year, as investors are optimistic about the prospects of the data analytics company. BBAI offers artificial intelligence (AI)-powered decision intelligence solutions, mainly focused on national security, defense, and critical infrastructure.

The company ended Q1 2025 with a backlog of $385 million, reflecting 30% year-over-year growth. However, there have been concerns about BigBear.ai’s low revenue growth rate and high levels of debt. Looking ahead, the company is pursuing further growth through international expansion and strategic partnerships, while continuing to secure attractive government business.

What Is the Price Target for BBAI Stock?

Last month, Northland Securities analyst Michael Latimore reaffirmed a Hold rating on BBAI stock but lowered his price target to $3.50 from $4 after the company missed Q1 estimates due to further delays in government contracts. On the positive side, the 4-star analyst noted the solid growth in BigBear.ai’s backlog and management’s statement that their strategy is “beginning to resonate.”

On TipRanks, BigBear.ai Holdings stock is assigned a Moderate Buy consensus rating, backed by two Buys and two Holds. The average BBAI stock price target of $4.83 indicates a possible downside of 17.3% from current levels.

CoreWeave (NASDAQ:CRWV) Stock

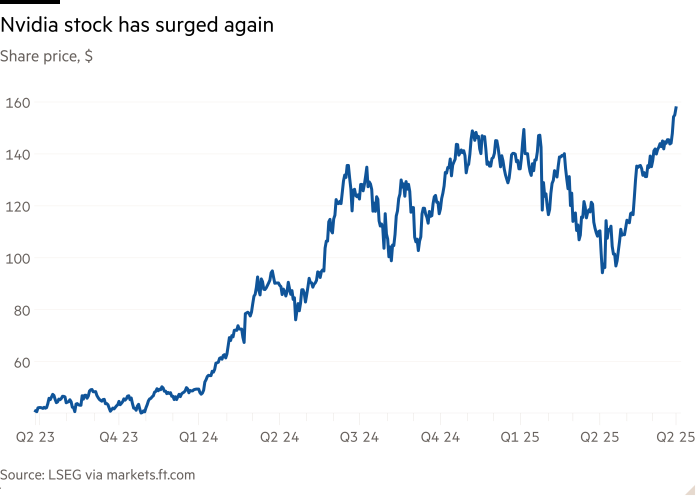

CoreWeave, a cloud provider specializing in AI infrastructure, is seeing robust adoption for its products. The company, which provides customers access to Nvidia’s (NVDA) GPUs (graphics processing units), went public in March. CRWV stock has risen about 300% to $159.99, compared to its IPO (initial public offering) price of $40.

Remarkably, CoreWeave delivered a 420% jump in its Q1 2025 revenue to $981.6 million. Moreover, the company ended the first quarter of 2025 with a robust backlog of $25.9 billion. Meanwhile, CoreWeave has entered into lucrative deals, including an expanded agreement of up to $4 billion with ChatGPT-maker OpenAI and a collaboration to power the recently announced cloud deal between Alphabet’s Google (GOOGL) and OpenAI.

CoreWeave has been in the news due to reports that it is in talks to acquire Core Scientific (CORZ).

Is CRWV a Good Stock to Buy?

Recently, Bank of America analyst Bradley Sills downgraded CoreWeave stock to Hold from Buy, citing valuation concerns following the strong rally after the company’s Q1 results. Also, the 4-star analyst expects $21 billion of negative free cash flow through 2027, due to elevated capital expenditure ($46.1 billion through 2027). However, Sills raised the price target for CRWV stock to $185 from $76, noting several positives, including the OpenAI deal and strong revenue momentum.

Overall, Wall Street has a Moderate Buy consensus rating on CoreWeave stock based on six Buys, 11 Holds, and one Sell recommendation. At $78.53, the average CRWV stock price target indicates a substantial downside risk of about 51%.

AppLovin (NASDAQ:APP) Stock

Adtech company AppLovin has witnessed a 301% jump in its stock price over the past year. The company provides end-to-end software and AI solutions for businesses to reach, monetize, and grow their global audiences.

Notably, AppLovin’s strong growth rates have impressed investors. In Q1 2025, AppLovin’s revenue grew 40% and earnings per share (EPS) surged by 149%. Investors have also welcomed the company’s decision to sell its mobile gaming business to Tripledot Studios. The move is expected to enable AppLovin to focus more on its AI-powered ad business.

However, APP stock has declined more than 12% over the past month due to the disappointment related to its non-inclusion in the S&P 500 Index (SPX) and accusations by short-seller Casper Research. Nonetheless, most analysts remain bullish on AppLovin due to its strong fundamentals and demand for the AXON ad platform.

Is APP a Good Stock to Buy

Recently, Piper Sandler analyst James Callahan increased the price target for AppLovin stock to $470 from $455 and reaffirmed a Buy rating. While Piper Sandler’s checks suggest some weakness in AppLovin’s supply-side trends, it remains a buyer of APP stock, with the tech company growing well above its digital ad peers and expanding into new verticals.

With 16 Buys and three Holds, AppLovin stock scores a Strong Buy consensus rating. The average APP stock price target of $504.18 indicates 51% upside potential from current levels.

Conclusion

Wall Street is sidelined on BigBear.ai stock, cautiously optimistic on CoreWeave, and highly bullish on AppLovin stock. Analysts see higher upside potential in APP stock than in the other two growth stocks. Wall Street’s bullish stance on AppLovin stock is backed by solid fundamentals and strong momentum in its AI-powered ad business. According to TipRanks’ Smart Score System, APP stock scores a “Perfect 10,” indicating that it has the ability to outperform the broader market over the long run.