While the world has been celebrating some rare, good news from the Middle East this week, the strategic contest between the two major global powers took a worrying turn.

On Friday, China jolted the United States by announcing plans to seriously tighten export restrictions on rare earths, used in everything from fighter jets to computer chips and electric vehicles.

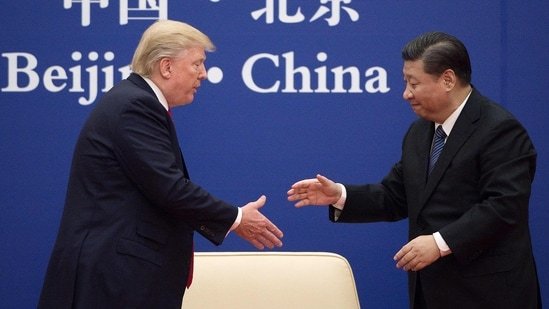

China dominates 70 per cent of rare earth mining and more than 90 per cent of processing. It has a stranglehold on the market, which Xi Jinping uses as a powerful bargaining tool.

Loading…

‘Give us your critical minerals’

“It was shocking,” said Donald Trump of Xi’s latest move in the ratcheting trade war between the two. He said it had come “out of the blue”. The US president immediately threatened to retaliate with an additional 100 per cent tariff on all Chinese goods, before softening his language and settling instead on a range of higher tariffs on foreign timber products including kitchen cabinets and furniture.

Trump may have expressed “shock”, but his administration is clearly not surprised at China’s willingness to flex its dominance on rare earths. The US has been aware of, and desperately trying to address, this vulnerability for some time. As Beijing exerts more pressure, Australia sees an opening.

Three weeks ago, Trade Minister Don Farrell met his US counterpart Jamieson Greer in Malaysia. The White House had just confirmed Trump would meet Anthony Albanese in the Oval Office on October 20. Farrell was seeking to prepare the ground.

“How can we help America become great again?” the trade minister asked Greer in a gesture of goodwill.

“Give us your critical minerals,” the US Trade Representative responded, acknowledging how seriously the administration now views this issue.

Three weeks ago, Trade Minister Don Farrell met his US counterpart Jamieson Greer in Malaysia. (Reuters: Kevin Mohatt)

A $1.2b critical minerals reserve

Australia has no plans to “give” away anything, but it is offering the US something it can’t get from China: a guaranteed and reliable supply of rare earths. No geopolitical vulnerabilities attached.

Australia has some of the best deposits of critical minerals, including rare earths, and some of the best technology for discovering them. Extracting and processing these deposits, however, is the more complicated and expensive part.

Before the last election the prime minister announced plans for a $1.2 billion critical minerals reserve to help develop the sector.

Details are still being worked through, but the idea is to give investors in selected “partner” countries access to Australia’s critical minerals, with taxpayer-funded floor prices to create a level of certainty.

The prime minister recently told Insiders, quite bluntly, the aim of the reserve was “to stop manipulation, particularly by state enterprises”. He specifically called out China and its manipulation of nickel prices as an example.

Europe, Japan and South Korea have already begun investing in Australian critical minerals to diversify their supply chains away from China. The Albanese government has been trying to attract American interest for years.

During the Biden years there was a “compact” signed and a “Critical Minerals Taskforce” established. Trump’s return to the White House meant starting again from scratch.

Donald Trump will meet Anthony Albanese in the Oval Office on October 20. (Instagram: @Albomp)

Albanese government increasingly justified

A deal is not expected to be signed next week when Albanese sits down in the Oval Office, but the Australian government is hoping the president will at least support the idea of the two countries working together, giving the green light for serious negotiation.

Fears have eased about this meeting descending into an argument over Australia’s military spending levels. AUKUS appears safe. There could still be awkward moments, but the heat appears to have come out of differences over defence.

On trade, Albanese will raise concern over the 10 per cent blanket tariffs the US has imposed on Australia but given it’s a lower rate than most other countries face, some exporters are finding their sales to both the US and China are up.

There won’t be any sort of demand to remove the tariffs as a price for access to critical minerals. Australia wants the US to invest regardless. Progress on this has now become one of the main tests for the meeting.

Given the increasing geo-strategic importance of rare earths, the Albanese government is feeling increasingly justified in its decision to create the $1.2 billion reserve.

Shadow Finance Minister James Paterson said “our dependence on authoritarian powers for critical imports is a serious problem”. (ABC News)

Where does the Liberal Party stand?

It’s unclear, by contrast, where the Liberal Party stands.

Before the election, then-shadow treasurer Angus Taylor dismissed tax credits for critical minerals as “billions for billionaires”.

Peter Dutton said he backed critical minerals, “but not with taxpayers’ money”. It was seen as a blanket rejection of any government support for the industry.

Andrew Hastie, however, took a very different view. In a speech back in February, the then-shadow defence minister didn’t contradict the party line, but highlighted the national security and economic benefits of Australia and the US working together on rare earths and critical minerals.

Now on the backbench and free to express his views, the West Australian Liberal strongly believes the Australian government should be involved in supporting and developing this industry. It can’t sit back and leave it to the free market. That approach has simply left China with a chokehold on the sector.

Hastie may not have won much conservative applause for his social media lament at the loss of car manufacturing in Australia, but championing government support for critical minerals is very different.

China dominates rare earth mining and processing, which Xi Jinping uses as a powerful bargaining tool. (Reuters: Kevin Lamarque)

If Trump backs Australia’s efforts next week through the critical mineral reserve, where does that leave the Liberal Party?

Opposition Leader Sussan Ley and Shadow Treasurer Ted O’Brien haven’t said much on this, but they have vowed to rein in spending as a priority. Is this an area they would cut?

In his Tom Hughes oration this week, one of the few Liberals actively trying to hold the show together and chart a way forward struck something of a middle course.

Shadow Finance Minister James Paterson argued there was no national security reason to make fridges or washing machines in Australia.

“But in an era of strategic competition”, he said, “our dependence on authoritarian powers for critical imports is a serious problem.”

“Where we do have to make interventions, we must be surgical in how we do so”.

Paterson cited defence industry as an area that would qualify for such surgical support. But he warned against going much further. “Otherwise, every vested interest will beat a path to Canberra’s door with their hand out and a business case about why their industry is strategically important.”

Perhaps, but the strategic importance of rare earths is clear to both Trump and Albanese.

As the prime minister heads to the White House with his $1.2b reserve up his sleeve, the Liberals are still working out where they stand on this sort of government intervention.

Loading

David Speers is national political lead and host of Insiders, which airs on ABC TV at 9am on Sunday or on iview.