- AUD/USD price remains positive amid improved risk tone.

- China’s upbeat data and trade optimism lend support to the Aussie.

- Australian PM’s visit to the US could further support Australian economy.

The AUD/USD picked momentum on Monday, extending upside for the second consecutive session as the US-China trade sentiment improves while Chinese economy further boosted the risk appetite. The pair is trading at 0.6501 at the time of writing.

–Are you interested in learning more about crypto robots? Check our detailed guide-

Market optimism improved as the US President Trump signaled that imposing 100% tariff on Chinese goods would not be sustainable. He also confirmed a plan meeting President Xi Jinping, easing trade war concerns. Trump stated, “We can lower what China has to pay in tariffs, but China has to do things for us too.” The remarks triggered a rebound in risk-sensitive assets, including Aussie.

Adding more to the optimism, China’s Q3 GDP rose to 4.8% y/y, matching expectations but revealed a slower momentum from second quarter’s 5.2%. The economy expanded 1.1% on quarterly basis, beating expectations of 0.8%. Industrial production also showed an upside surprise, gaining 6.5% y/y, while retail sales rose 3%. Though the fixed-asset investment showed weakness, the data shows resilience in China’s economy, lending support to the Aussie.

The People’s Bank of China (PBOC) left the rates unchanged at 3%. The steady policy shows confidence in domestic recovery without a fresh stimulus. Markets took this as a sign of stability.

On the domestic front, Prime Minister Anthony Albanese’s visit to the US add another layer to the market optimism. Talks with President Trump are expected to focus on mutual cooperation regarding critical minerals, trade and regional security under AUKUS pact. The discussions could open opportunities to enhance mutual trades and bilateral resource investment, especially in rare earth minerals.

However, the upside for Aussie could be capped as investors grow bets on rate cut by the Reserve Bank of Australia. The recent unemployment report showed a rise to 4.5% (four year high), increasing odds of easing expectations.

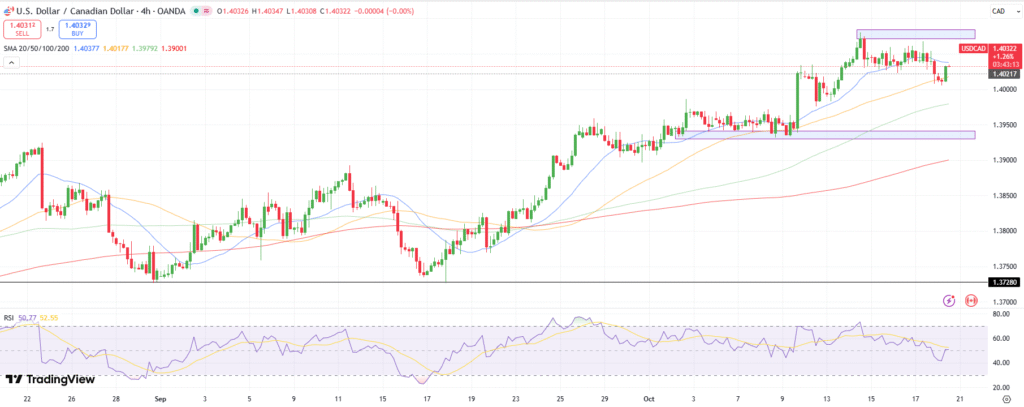

AUD/USD Price Technical Analysis: Neutral Bias Around 20-MA

The 4-hour chart for Aussie shows a mildly bullish sentiment, staying supported by the 20-period MA. However, the upside remains capped by the 50-period MA at 0.6520. The RSI is near 50.0, showing a neutral bias.

–Are you interested in learning more about buying Dogecoin? Check our detailed guide-

Provided the price stays above the 20-period MA, the price could test the 0.6550 resistance ahead of 0.6600. On breaking below the 20-period MA, the price could slip to the demand zone at 0.6450.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.