- The AUD/USD price recovers as Israel may head for a ceasefire with Hammas.

- China’s upbeat retail sales data boosts Aussie.

- US dollar stays weaker amid improved risk and dovish FOMC.

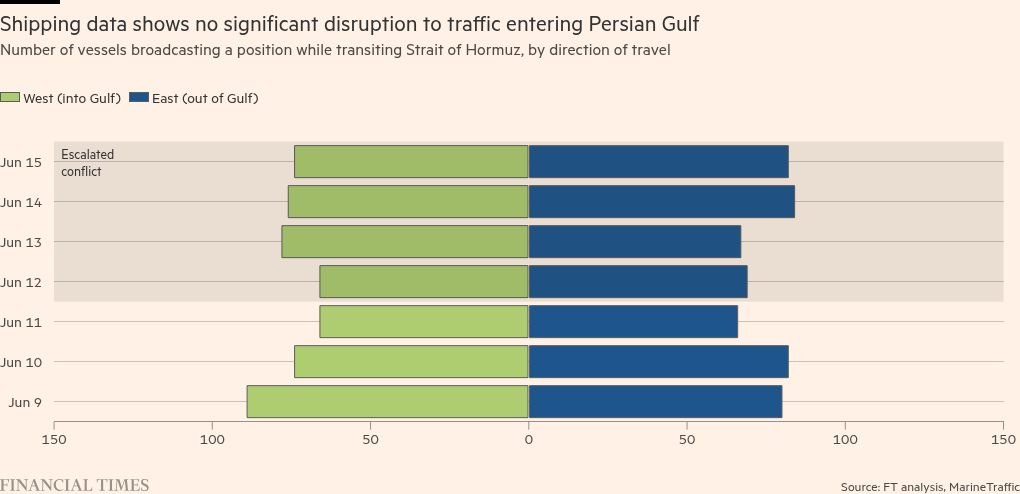

The AUD/USD price recovers ground as the geopolitical tension cools down after Israel proposed a revised deal to negotiate with Hammas for the hostages. The situation may lead to a temporary ceasefire. However, the boiling situation of Israel and Iran may cap the gains for the Australian dollar.

-If you are interested in forex day trading then have a read of our guide to getting started-

Although the US President urged to broker peace between the countries, Iran said that it will not negotiate while under attack. If the situation cools down, the Aussie may see a continued upside.

China’s retail sales data exceeded expectations of 5% to hit 6.4% which boosted the Aussie. However, the industrial production missed expectations slightly at came 5.8%. The Chinese National Bureau of Statistics noted that the first half may remain stable for the domestic economy. However, the second quarter growth may struggle amid trade concerns.

The US dollar loses intraday gains as risk sentiment improves on the day. Last week, the US CPI and PPI data were negative enough to trigger a sell-off. Meanwhile, upbeat UoM Consumer Sentiment could not lend support to the currency.

The major event this week is FOMC meeting that may provide future policy guidance to the market participants. With inflation data cooling and softening labor market, the central bank may ease sooner.

Key Events Ahead

There is no major event due today. Hence, risk sentiment will be the key driver.

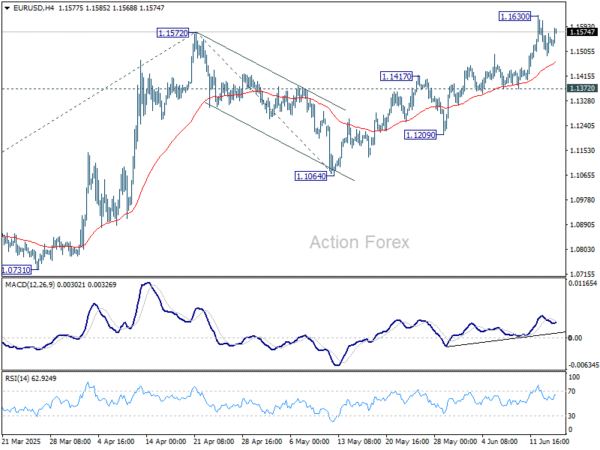

AUD/USD Price Technical Analysis: Bullish Pennant Pattern

The AUD/USD 4-hour chart shows the price is wobbling around the 20-period SMA. The last two candles show a buying pressure, enabling the price to close above the 20-SMA. The chart also shows a bullish continuation pattern called “pennant.” Hence a probability of a breakout exists too.

-Are you looking for the best AI Trading Brokers? Check our detailed guide-

The upside may meet resistance at 0.6550 ahead of 0.6575 and 0.6600. On the flip side, breaking the lower boundary of the pennant may trigger a sell-off towards 0.6450 support ahead of 0.6410.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.