Bullish view

- Buy the AUD/USD pair and set a take-profit at 0.6600.

- Add a stop-loss at 0.6400.

- Timeline: 1-2 days.

Bearish view

- Sell the AUD/USD pair and set a take-profit at 0.6300.

- Add a stop-loss at 0.6600.

The AUD/USD exchange rate has drifted upwards in the past few weeks as the US dollar index has pulled back. It was trading at 0.6493 on Monday, a few pips below the year-to-date high of 0.6540.

The pair reacted mildly to last Friday’s nonfarm payrolls (NFP) data. According to the Bureau of Labor Statistics (BLS), the economy created 139,000 jobs in May, lower than the previous month’s 147,000. The unemployment rate remained unchanged at 4.2%.

BLS’s report was much better than the one released by ADP on Wednesday, which showed that the economy created just 37k in March. It signaled that companies were still hiring despite Donald Trump’s tariffs on imported goods.

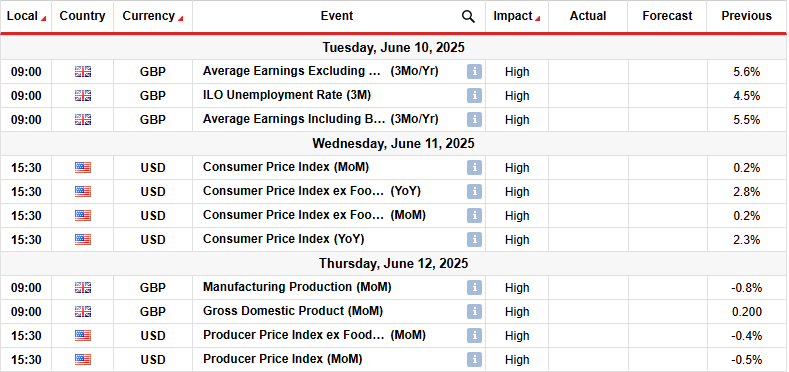

The next key AUD/USD news will come out on Tuesday when Australia publishes the latest consumer and business confidence data. Economists expect the data to show that consumer confidence rose from 92.1 in May to 94.4 in June after the Reserve Bank of Australia (RBA) slashed interest rates by 0.25%.

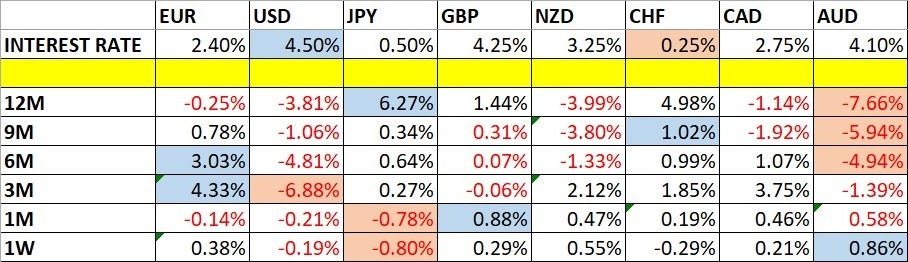

The AUD/USD will then react to the US inflation data on Wednesday. Economists expect the inflation data to show that prices rose slightly in May as companies started hiking prices because of tariffs. Precisely, they expect the headline CPI rose from 2.3% in April to 2.5% in May.

A lower-than-expected inflation report will increase the odds of the Fed cutting rates in its September meeting. On the other hand, a higher figure than expected will push the bank to maintain higher interest rates for longer.

The AUD/USD pair will also react to the upcoming talks between the US and China in London. A deal between the two countries will be bullish for the Australian dollar because of the vast trade volume between the two countries.

AUD/USD technical analysis

The daily chart shows that the AUD/USD pair bottomed at 0.5914 in April and then bounced back to 0.6540. Most recently, the pair has formed an ascending channel, which is shown in black.

The pair has remained above the 50-day and 100-day Exponential Moving Averages (EMA). It has also moved between the 50% and 38.2% Fibonacci Retracement level.

Most oscillators, like the MACD and the Relative Strength Index (RSI) have all pointed upwards. Therefore, the pair will likely continue rising as bulls target the psychological point at 0.6600.

Ready to trade our daily Forex signals? Here’s a list of some of the best Forex platforms in Australia to check out

Crispus Nyaga is a financial analyst, coach, and trader with more than 8 years in the industry. He has worked for leading companies like ATFX, easyMarkets, and OctaFx. Further, he has published widely in platforms like SeekingAlpha, Investing Cube, Capital.com, and Invezz. In his free time, he likes watching golf and spending time with his wife and child.