Bullish view

- Buy the AUD/USD pair and set a take-profit at 0.6600.

- Add a stop-loss at 0.6350.

- Timeline: 1-2 days.

Bearish view

- Sell the AUD/USD pair and set a take-profit at 0.6350.

- Add a stop-loss at 0.6600.

The AUD/USD exchange rate remained at 2.8% as investors focused on th latest macroeconomic data from the United States. It was trading at 0.6465, a range it has been in the past few weeks.

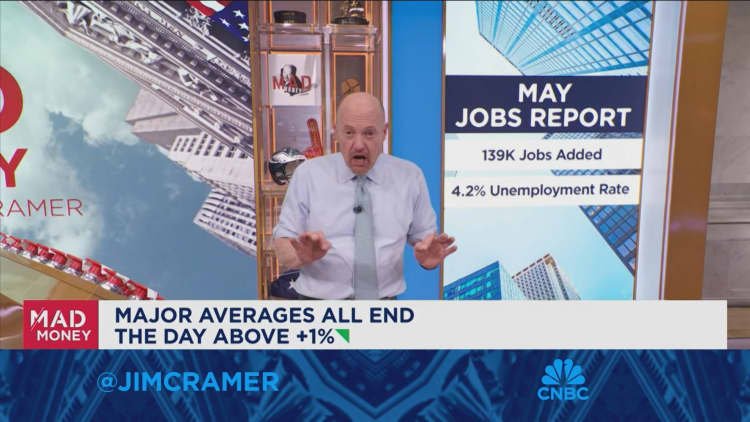

The pair reacted to a report that showed that the US labor market remained strong in February. According to the labor market, the US private sector jumped to 7.39 million from the previous month. The vacancy increase was also higher than the median estimate of 7.10 million.

The AUD/USD pair will next react to the upcoming data from ADP. Analysts expect the data to show that the economy added 115,000 last month after adding 62k a month earlier. If analysts are correct, it means that the economy was doing well even as tariffs continued.

The other key data to watch will be the S&P Global and ISM services PMI data. Economists expect the data to show that the composite PMI rose from 50.6 in April to 52.1.

They also expect the data to show that the services PMI figure rose from 51.6 to 5. Like in other countries, the services sector has done better than the manufacturing sector.

The AUD/USD pair also reacted to key macro data from Australia. A report showed that the country’s services sector remained in the expansion zone in May.

The second estimate of Australia’s GDP data showed that the economy continued growing in Q1, helped by robust business and consumer expenditure. These numbers mean that the Reserve Bank of Australia (RBA) will continue cutting rates in the next meeting.

AUD/USD technical analysis

The daily chart shows that the AUD to USD exchange rate was trading at 0.6465 on Wednesday morning. It has remained in this range in the past few weeks as traders assess the impact of the Fed and RBA decisions.

The pair has remained slightly above the 50-day moving average. Also, the Relative Strength Index (RSI) has remained above the neutral point of 50 since May this year.

The AUD/USD exchange rate has formed an inverse head and shoulders pattern, a popular bullish reversal sign. Therefore, the pair will likely have a bullish breakout as bulls target the psychological point at 0.6600. This view will be confirmed if it moves above the year-to-date high of 0.6540.

Ready to trade our free Forex signals? Here are the best forex platforms in Australia to choose from.

Crispus Nyaga is a financial analyst, coach, and trader with more than 8 years in the industry. He has worked for leading companies like ATFX, easyMarkets, and OctaFx. Further, he has published widely in platforms like SeekingAlpha, Investing Cube, Capital.com, and Invezz. In his free time, he likes watching golf and spending time with his wife and child.