Bearish view

- Sell the AUD/USD pair and set a take-profit at 0.6400.

- Add a stop-loss at 0.6600.

- Timeline: 1-2 days.

Bullish view

- Buy the AUD/USD pair and set a take-profit at 0.6600.

- Add a stop-loss at 0.6400.

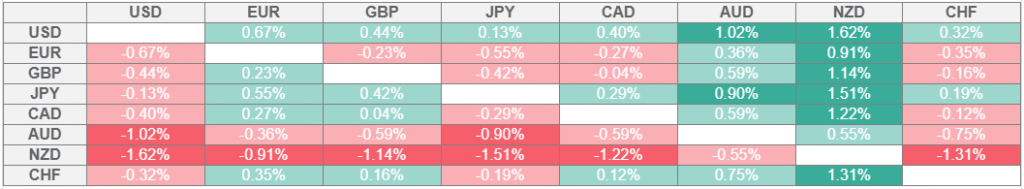

The AUD/USD pair remained flat on Tuesday, marking a fairly quiet week with no major economic events from Australia. It was trading at 0.6500 on Tuesday, a range it has maintained for the past few months.

Jackson Hole Symposium

The AUD/USD exchange rate moved sideways on Tuesday as market participants reacted to last week’s Reserve Bank of Australia (RBA) interest rate decision. In a statement, the bank announced a 0.25% reduction in interest rates, offering relief to households.

Economists expect the bank to cut interest rates at least two more times this year to supercharge the economy. Without the cuts, the bank expects the economy to deteriorate because of the trade war.

The AUD/USD pair will next react to the upcoming US building permits and housing starts data. Data compiled by Reuters is expected to show that the building permits dropped slightly to 1.39 million, while housing starts fell to 1.30 million.

The most important catalyst for the pair will come from the United States where the Federal Reserve will publish minutes of the last monetary policy meeting on Wednesday. These minutes will provide more color on the last meeting and what to expect later this year.

Jerome Powell, the head of the Federal Reserve, will also deliver a closely-watched statement at the annual Jackson Hole Symposium. Fed officials use this meeting to share their outlook on the economy and prepare the market on what to come.

Powell, who is under pressure from Trump, is likely to maintain his hawkish stance due to the recent strong consumer and producer inflation data. The data showed that the headline CPI rose to 2.7%, while the producer price index (PPI) moved to 3.6%.

AUD/USD Technical Analysis

The daily timeframe chart shows that the AUD/USD pair has moved upwards in the past few months. It has formed an ascending channel and is now slightly above the lower side.

The pair is hovering at the 50-day and 25-day moving averages. At the same time, the oscillators point to a bearish divergence pattern, with the Awesome Oscillator, Relative Strength Index (RSI), and the MACD moving downwards.

Therefore, the pair will likely continue falling as sellers target the psychological point at 0.6400. A move above the resistance point at 0.6560 will invalidate the bearish outlook.

Ready to trade our free trading signals? We’ve made a list of the top forex brokers in Australia for you to check out.

Crispus Nyaga is a financial analyst, coach, and trader with more than 8 years in the industry. He has worked for leading companies like ATFX, easyMarkets, and OctaFx. Further, he has published widely in platforms like SeekingAlpha, Investing Cube, Capital.com, and Invezz. In his free time, he likes watching golf and spending time with his wife and child.