Bearish view

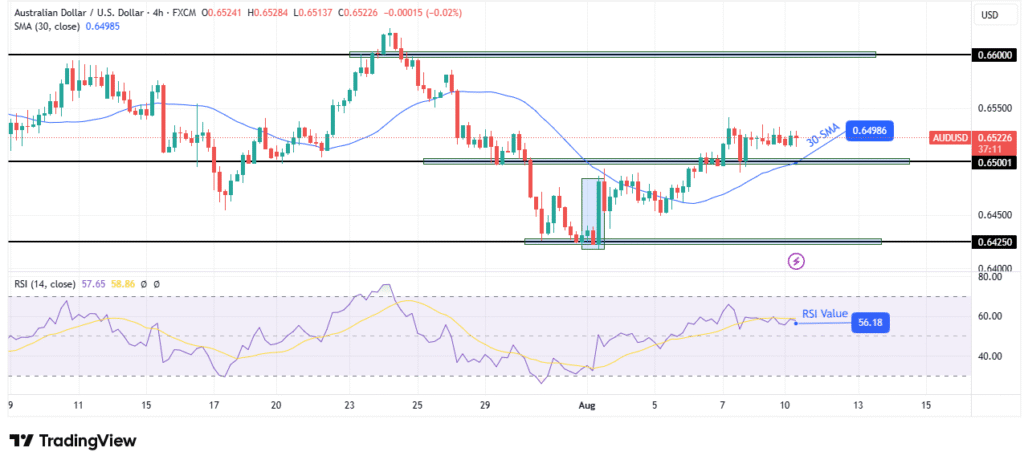

- Sell the AUD/USD pair and set a take-profit at 0.6425.

- Add a stop-loss at 0.6650.

- Timeline: 1-2 days.

Bullish view

- Buy the AUD/USD pair and set a take-profit at 0.6650.

- Add a stop-loss at 0.6425.

The AUD/USD exchange rate rose and retested a crucial resistance level as traders waited for the upcoming Reserve Bank of Australia (RBA) interest rate decision and US consumer inflation numbers. It rose to the key level at 0.6525, a few points above this month’s low of 0.6425.

RBA Decision and US Inflation Data

The AUD/USD pair will be one of the top tokens to watch this week as the RBA concludes its two-day meeting on Tuesday. Economists polled by Reuters believe that the bank will cut interest rates by 0.25% to 3.60% now that inflation is moving in the right direction.

The most recent numbers showed that Australia’s trimmed mean inflation dropped from 3.3% in the first quarter to 2.9% in the second one. Additional data revealed that the broad CPI decreased from 2.4% in Q1 to 2.1%, which is close to the central bank’s target of 2.0%.

Australia’s economy is doing relatively well, helped by higher commodity prices and Chinese demand. The most recent data showed that the GDP grew by 1.3% in the first quarter, a trend that may continue this year.

The bank will also point to Donald Trump’s trade war and its impact to the economy. Australia exported goods worth $40 billion to the United States in 2022, accounting for approximately 5% of its total exports for the year.

The other key AUD/USD news will come from the United States, which will publish the latest consumer inflation data on Tuesday. Economists expect the report to show that the headline CPI rose from 2.7% in June to 2.8% in July, continuing the slow uptrend that started in May.

These numbers come at a time when analysts expect the Federal Reserve to cut interest rates in the upcoming September meeting.

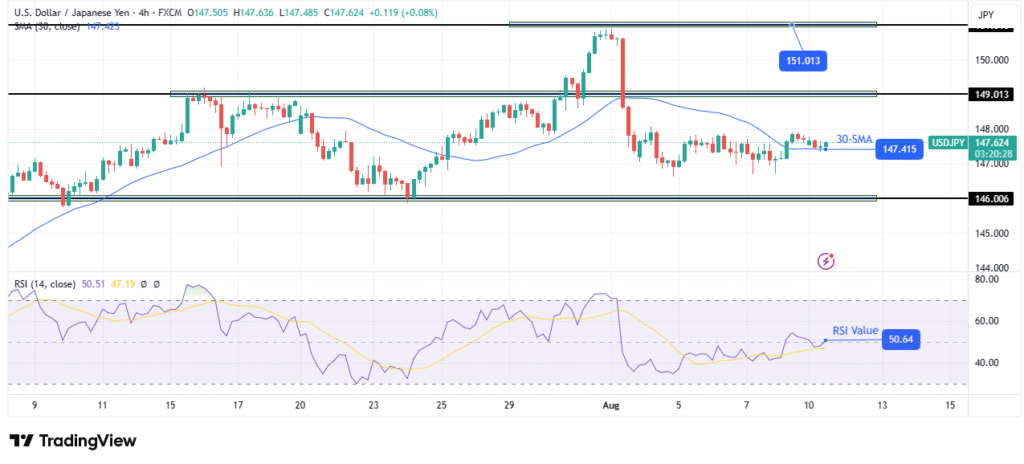

AUD/USD technical analysis

The AUD/USD exchange rate has been in a slow uptrend in the past few days, moving from a low of 0.6425 on August 1 to the current 0.6522. It has retested the lower side of the ascending channel shown in red.

The pair has formed a small bearish flag pattern, while the Relative Strength Index (RSI) and the MACD have formed a bearish divergence.

Therefore, a combination of the bearish flag pattern and the divergence points to more downside. If this happens, it might drop and retest the support at 0.6425.

Ready to trade our free Forex signals? Here are the best forex platforms in Australia to choose from.

Crispus Nyaga is a financial analyst, coach, and trader with more than 8 years in the industry. He has worked for leading companies like ATFX, easyMarkets, and OctaFx. Further, he has published widely in platforms like SeekingAlpha, Investing Cube, Capital.com, and Invezz. In his free time, he likes watching golf and spending time with his wife and child.