- The AUD/USD forecast indicates caution at the start of the week.

- Economists believe RBA officials will cut rates by 25-bps.

- US headline inflation might accelerate from 2.7% to 2.8%.

The AUD/USD forecast indicates caution at the start of the week as market participants gear up for the RBA meeting and crucial US inflation numbers. At the same time, traders will watch trade developments as the deadline for a deal between the US and China looms.

–Are you interested to learn more about ECN brokers? Check our detailed guide-

The Reserve Bank of Australia will hold its policy meeting on Tuesday, and economists believe officials will cut rates by 25-bps. Inflation in Australia has eased significantly, and the labor market has slowed. Therefore, policymakers have every reason to lower borrowing costs. Moreover, traders expect another rate cut before the end of the year. A dovish tone during the meeting will likely weigh on the Australian dollar.

Meanwhile, the US will release its consumer inflation report. Economists expect the headline figure to accelerate from 2.7% to 2.8%. Meanwhile, the monthly figure might increase by 0.2%, compared to the previous reading of 0.3%. A hotter-than-expected reading will lower Fed rate cut expectations, boosting the dollar. The opposite is also true.

Elsewhere, China must sign a deal with the US before the August 12 deadline. Otherwise, trade tensions between the two countries could return.

AUD/USD key events today

Market participants are not expecting any key releases from Australia or the US. Therefore, they might remain cautious until the RBA policy meeting.

AUD/USD technical forecast: Rally stalls above the 0.6500 key level

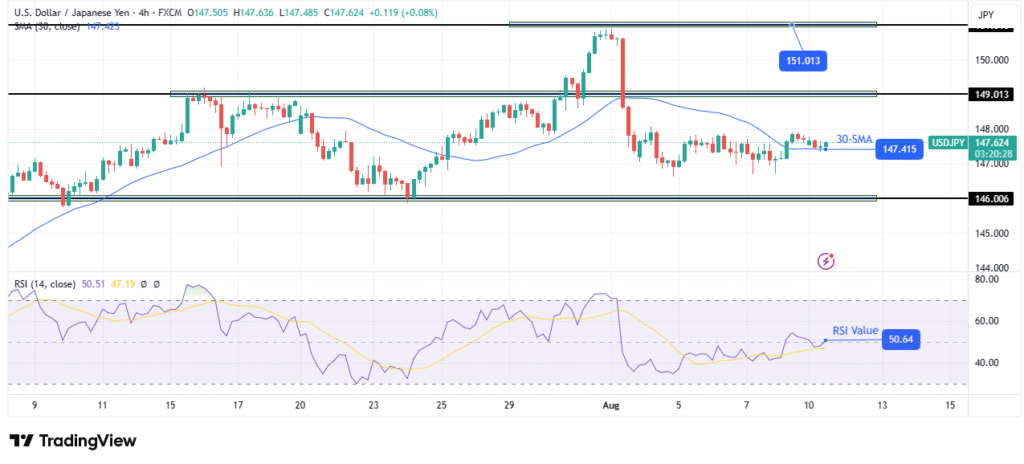

On the technical side, the AUD/USD price has paused its rally above the 0.6500 key resistance level. However, it still trades above the 30-SMA, a sign that bulls are still in the lead. At the same time, the RSI is above 50, supporting solid bullish momentum.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

Bulls recently took over after the price made a bullish engulfing candle near the 0.6425 support level. However, they have lost enthusiasm since the price broke above and retested the 0.6500 level. This is a sign that they are not ready to commit to another swing high.

Nevertheless, since the bias is bullish, the price might soon climb to retest the 0.6600 key resistance level. If this happens, it will solidify the bullish bias. However, if bears become stronger, the price will likely break below the 30-SMA and the 0.6500 support.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.