Today’s Gold Analysis Overview:

- The overall Gold Trend: Neutral, with an upward opportunity still present.

- Today’s Gold Support Levels: $3310 – $3275 – $3190 per ounce.

- Today’s Gold Resistance Levels: $3360 – $3400 – $3430 per ounce.

Today’s gold trading signals update:

- Sell Gold from the resistance level of $3375 with a target of $3290 and a stop-loss at $3400.

- Buy Gold from the support level of $3290 with a target of $3400 and a stop-loss at $3240.

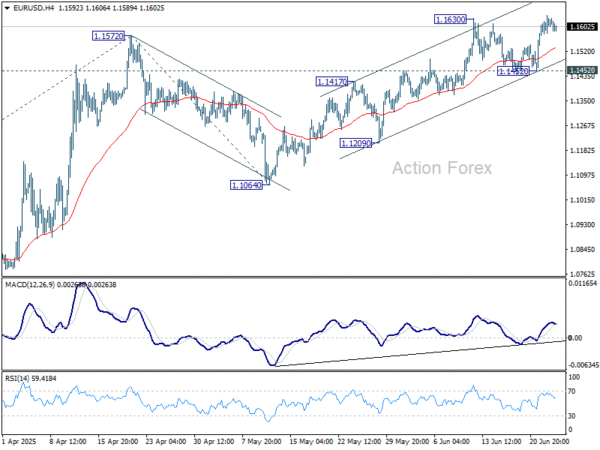

Technical Analysis of Gold Price (XAU/USD) Today:

For two consecutive trading sessions, the gold price index has been attempting to halt the pace of recent selling losses, which pushed spot gold prices to the $3295 per ounce level. This movement is primarily due to investors abandoning the yellow metal as a safe haven amid the cessation of Iranian/Israeli military operations. According to performance across gold trading platforms, attempts to rebound and halt losses have not surpassed the $3336 per ounce resistance level. As for performance, since the beginning of the month, the gold price index has risen by 1.16%. Year-to-date, it has increased by $697.90 per ounce, or 26.54%.

Trading Tips:

We still advise buying gold bullion on every price dip, but without taking excessive risks.

According to recent performance on the daily timeframe chart, spot gold prices are still in the early stages of breaking the bullish trend. As mentioned before, gold’s stability around and above the $3300 per ounce resistance will remain an important area to confirm the strength of bullish control. Regarding the movement of technical indicators, the 14-day RSI (Relative Strength Index) is on the verge of a 50 reading, which would give bears the green light for a strong downward move. At the same time, the MACD (Moving Average Convergence Divergence) lines are in a downward correction phase. The psychological resistance of $3400 per ounce remains most important for bulls currently. Conversely, on the same timeframe, for a break of the bullish outlook, bears need to push gold prices towards the $3275 and $3248 support levels, respectively.

Gold Market Pressured by Dollar and Bond Yields:

According to forex market trading, the US dollar rose in mid-week trading, as investors continued to monitor the ceasefire between Israel and Iran and any hints about developments in the tariff situation. Overall, the US dollar had a poor start to the first half of the year, falling by about 10%. As for trading, the US Dollar Index (DXY), a measure of the US dollar’s strength against a basket of other major currencies including the Japanese Yen and the British Pound, rose by 0.32% to 98.17. Overall, the index is expected to record a monthly decrease of 2% and a first-half loss of about 9.5%.

Broadly, Wall Street markets are paying close attention to developments in the Israeli Iranian conflict. US President Donald Trump announced a ceasefire between the two Middle Eastern countries this week, but both sides have violated the truce. So far, the ceasefire remains in place.

Meanwhile, Federal Reserve Chair Jerome Powell will continue his second day of testimony before Congress. He will appear before the House Financial Services Committee, informing lawmakers that the US central bank will keep interest rates steady to determine the effects of tariffs on inflation, if any. Powell stated in prepared testimony: “Policy changes are still evolving, and their effects on the economy remain uncertain.” He added, “The effects of tariffs, among other things, will depend on their final level.”

On the trade front, there has been very little news regarding tariffs and agreements. In this regard, Kevin Hassett, the direct head of the National Economic Council, states that trade deals will be concluded after Republicans pass the “big and beautiful” bill. The July 9 deadline set by the US President is fast approaching, and the administration has only reached a trade agreement with the United Kingdom.

In other financial markets, US Treasury yields generally rose, with the yield on the ten-year bond increasing by 2.5 basis points to 4.318%.

Ready to trade our Gold price forecast? We’ve made a list of the best Gold trading platforms worth trading with.