Asian stocks were mostly higher Monday while oil dipped ahead of talks between Donald Trump, Ukrainian President Volodymyr Zelensky, and European leaders in Washington.

US President Trump met Russian President Vladimir Putin in Alaska on Friday, but the summit failed to yield any breakthrough on a ceasefire in Ukraine.

Zelensky, who will be joined in Washington by European leaders, however called a US offer of security guarantees to Ukraine “historic”.

“Trump and Putin walked away without a ceasefire, without even the illusion of one,” said Stephen Innes at SPI Asset Management.

“What they did offer was theatre: enough ‘progress’ for Trump to declare victory and quietly holster his double-barreled threat — tariffs on Beijing for buying Russian barrels and sanctions on Moscow’s crude,” Innes said.

Before the Alaska talks, US stocks wavered on Friday after mixed economic data, with retail sales up but an industrial production index and a consumer survey both down.

Oil prices, which have been volatile for several days — Russia is a major crude producer — fell back on Monday, adding to a drop on Friday.

Japan’s Nikkei was up, posting a new record high and adding to gains on Friday after better-than-expected economic growth data.

The Hang Seng, Shanghai, and Sydney were also higher while Taipei fell back.

This week investor eyes will be on any clues on US interest rates at the Federal Reserve’s annual retreat at Jackson Hole.

– Key figures at around 0130 GMT –

Tokyo – Nikkei 225: UP 0.7 percent at 43,678.12

Hong Kong – Hang Seng Index: UP 0.1 percent at 25,293.34

Shanghai – Composite: UP 0.2 percent at 3,704.76

New York – Dow: UP 0.1 percent at 44,946.12 (close)

London – FTSE 100: DOWN 0.4 percent at 9,138.90 (close)

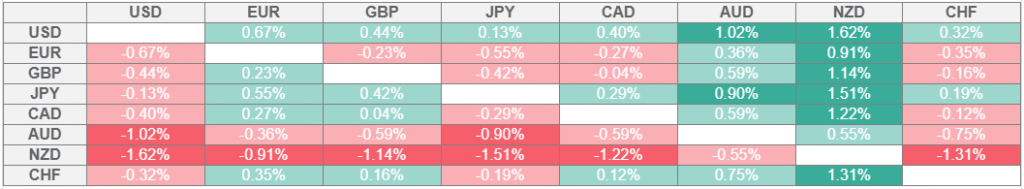

Euro/dollar: DOWN at $1.1699 from $1.1704 on Friday

Pound/dollar: DOWN $1.3556 at from $1.3557

Dollar/yen: UP at 147.47 yen from 146.85 yen

Euro/pound: DOWN at 86.30 pence from 86.34 pence

West Texas Intermediate: DOWN 0.2 percent at $62.69 per barrel

Brent North Sea Crude: DOWN 0.3 percent at $65.65 per barrel

burs-stu/fox