The US stock market indices are at a record high, powered by investor optimism about trade discussions and solid corporate earnings reports. US stock futures edged higher on Friday, after the major averages closed mixed the previous session. On Thursday, the S&P 500 and Nasdaq Composite rose 0.07% and 0.18%, respectively, reaching new highs. Meanwhile, the Dow fell 0.7% but remained up for the week overall.

Tech Stocks

Markets have been bolstered by good corporate results and positive trade developments. Alphabet climbed 1% after exceeding Q2 estimates and increasing its capital investment guidance for 2025 by $10 billion, boosting investor confidence in its AI plan. Tesla (TSLA) fell more than 8% on Thursday after the electric vehicle maker disclosed quarterly results that fell short of Wall Street’s expectations. CEO Elon Musk warned of difficult quarters ahead.

Other mega-cap technology stocks rose, led by increases of about 2% for chipmakers Nvidia (NVDA), Broadcom (AVGO), and Amazon (AMZN). Microsoft (MSFT) and Meta Platforms (META) both rose, but Apple (AAPL) fell.

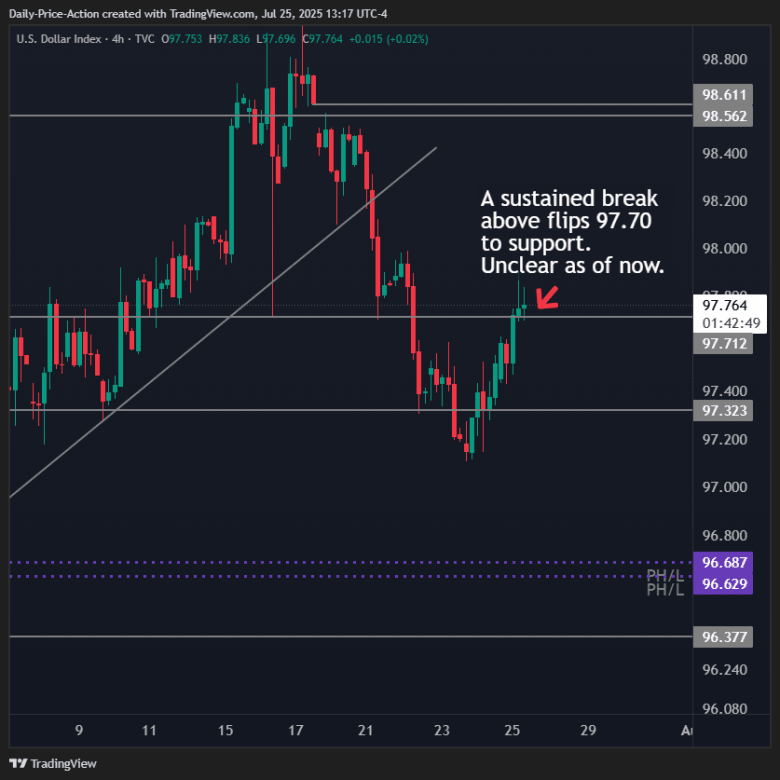

Trump, Powell and Rate Cuts

On the policy front, the Federal Reserve is largely expected to keep interest rates unchanged at next week’s meeting. Following a historic visit to the Fed’s headquarters, President Trump softened his tone toward Chair Jerome Powell, declaring that he had no plans to remove him.

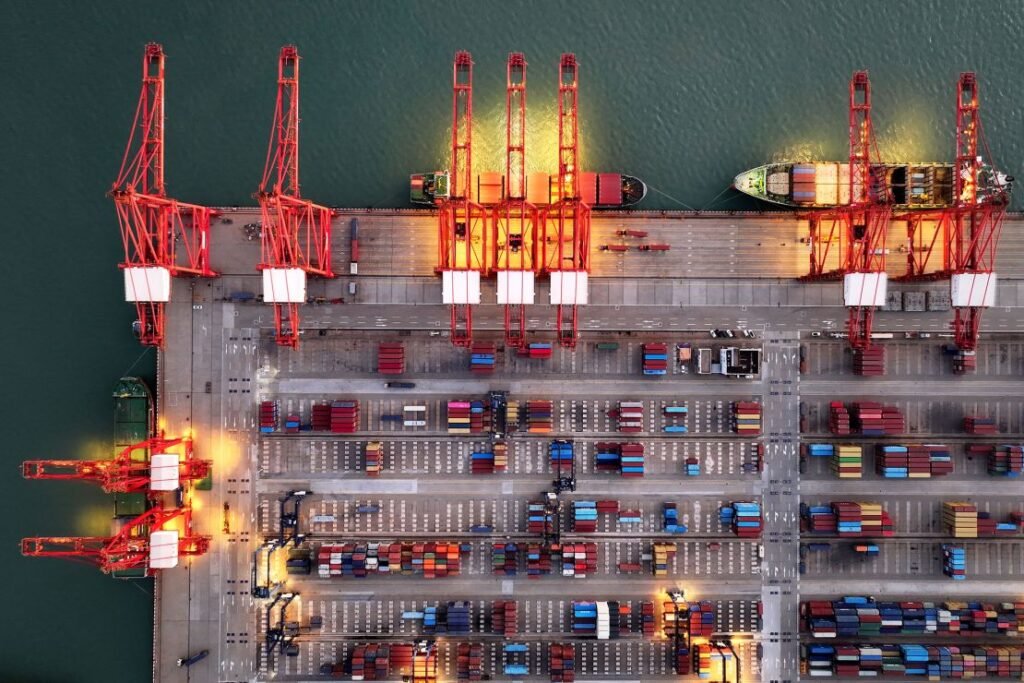

President Donald Trump has recently signed trade accords with Japan, Indonesia, and the Philippines, and government officials have reported progress in negotiations with the European Union and other key trading partners.

Investors are keeping close tabs on the trade talks ahead of an August 1 deadline for the U.S. to impose hefty tariffs on imports, which analysts have warned could spark inflation and bite into corporate profits.

Trump appeared to backtrack on some of his threats against Powell, saying he did not believe it was “necessary” to fire him. However, Trump refused to back down from his demand that the central bank lower its crucial federal funds rate at its FOMC meeting next week on July 29-30.