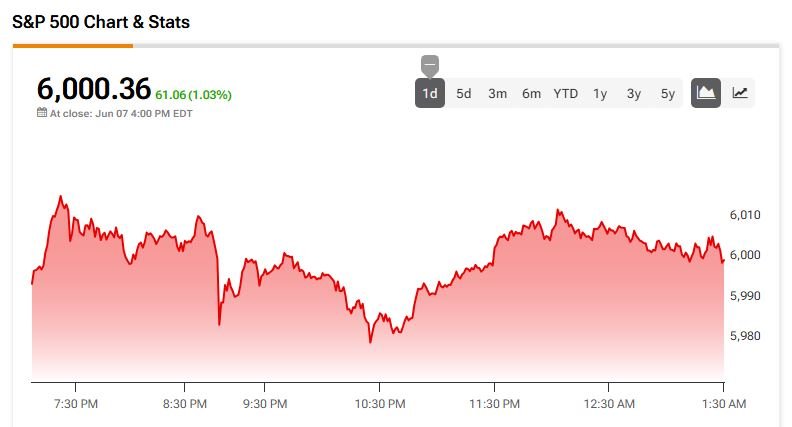

Last week ended on a positive note. Improved headlines on the trade front between the US and China and a set of better-than-expected US jobs data helped lift the S&P 500 by 1.5% over the week. The Nasdaq 100 rallied 2% despite a sharp selloff in Tesla shares amid a heated dispute between Donald Trump and Elon Musk. As a result, the Nasdaq closed the week just below its all-time high reached in February, while the S&P 500 hit and closed at the key 6,000 psychological level – the first time since February we’ve seen the major US index trading at this level. We are now approaching overbought conditions.

On the bond front, Friday’s rally was driven largely by a narrative that the US economy remains surprisingly resilient despite trade chaos and geopolitical uncertainty. The US economy added 139K new nonfarm jobs in May, while wage growth unexpectedly accelerated – giving further ammunition to Federal Reserve (Fed) hawks arguing against a July rate cut. As it stands, September looks like the earliest point at which the Fed might consider cutting rates… and even that depends on inflation. On Wednesday, the US will publish its latest CPI data, and forecasts point to growing price pressures – both in headline and core metrics – which could further cool expectations for rate cuts. The US 2-year yield jumped past the 4% mark on Friday. At these levels, the Fed is unlikely to act as a catalyst for equity bulls. However, a strong auction of 30-year US bonds on Thursday could help ease concerns at the long end of the yield curve – as the 30-year yield opens the week just below the 5% psychological level.

More positive trade news could also help sentiment.

Speaking of inflation and trade: Chinese exports grew much slower than expected in May – weighed down by still-elevated triple-digit import tariffs – while imports fell significantly more than forecast. Consumer prices declined for the fourth consecutive month, and the drop in producer prices deepened. Chinese equities opened the week on a mildly positive note, supported by hopes that weak macro data will prompt further stimulus from the People’s Bank of China (PBoC) and the government, and that the second round of US-China trade talks – today in London – could lead to further progress. Last week, a phone call between Trump and Xi yielded news that China would relax export controls on rare earth metals to the US, suggesting the US may also ease restrictions on certain technology exports. Still, some observers warn that the second round of talks may not bring the same level of progress as the first. Any lack of progress could prompt bulls to take profits and move to the sidelines.

In earnings, Oracle and Adobe will be in focus on Wednesday and Thursday, respectively. Oracle’s results will provide an update on cloud infrastructure momentum, while Adobe’s will offer insight into whether consumers are willing to pay for AI tools. Last quarter, Oracle’s infrastructure business grew 50% on demand from major clients including Nvidia and OpenAI. However, the multibillion-dollar Stargate data center expansion has raised concerns about margins and whether the company is spending more on AI than investors are comfortable with.

Elsewhere, European growth data surprised to the upside on Friday, with Ireland and Germany particularly standing out. The upside surprise was largely due to net trade, as exporters rushed to ship goods ahead of expected US tariffs – a possibly temporary boost – but investment also rose in Q1, in line with more government spending, particularly on security. The Stoxx 600 closed the week 0.9% higher. The EURUSD remained bid below the 1.14 level, although the pair has yet to break through 1.15 resistance. The European Central Bank (ECB) delivered another 25bp rate cut but signaled that this may be the end of the rate-cutting cycle. Still, continued inflows into euro-denominated assets should help support the euro against the dollar.

In Japan, GDP figures released earlier today showed stronger-than-expected growth and hotter-than-expected inflation – reinforcing expectations of a more hawkish Bank of Japan (BoJ) stance. The USDJPY is currently testing its 50-day moving average to the downside. A break below this level could trigger further decline, with key support seen in the 142.50–142.75 zone.

In energy, US crude rose more than 5% last week on optimism over US-China trade progress, a weekly decline in US inventories, and strong US jobs data. Crude is consolidating just below the $65/barrel mark this morning. Any positive surprise on the trade front could lift prices above the $65.35 level – the key 38.2% retracement of this year’s decline, and a potential signal of a shift from a bearish to a medium-term bullish trend.