Artificial Intelligence has now entered retail trading with publicly available AI tools. Traders can use AI tools to save time, replace coding skills, or discover new trading ideas. This is an excellent development for independent day traders, as it suddenly opens the door to a whole new world of analysis and trading that previously required specialized programming, knowledge, or computing power, usually available only to institutional traders.

Let’s explore how AI can empower day trading.

What Is AI Day Trading?

There is no consensus definition for the term “AI day trading,” but most traders understand it to mean using AI-powered technology to help with any aspect of day trading. The term does not necessarily mean that AI must drive every aspect of trading from end to end. It can simply mean using AI to assist with part of the process.

AI can reduce the time required to carry out tasks, such as programming indicators or speeding up analysis, and provide insights into the market that may not be easily achievable with non-AI technology. For example, it can identify chart patterns in historical data or spot changes in market sentiment across social media channels. AI can also help build and execute fully automated trading strategies. As we shall see in this article, there’s no one-size-fits-all approach to using AI in day trading.

Using AI in Day Trading

AI itself is a broad technology, and traders are continually discovering new ways to utilize it to enhance their trading. I’ve used AI and various automated trading tools to automate tasks that I can already perform, but AI can do them even faster. I’ve also used AI to program ideas that I didn’t have the skills to program myself. AI can go further and backtest strategies (with entry, stop-loss, and take-profit rules) or even provide trading recommendations, which would be a more powerful way to utilize its capabilities.

Let’s look at some of the AI tools for day trading.

ChatGPT for Building Trading Systems

Yes, the same ChatGPT that helps you write a letter or find a new recipe can also help with building trading systems. Even if someone has not used ChatGPT before, it has one of the simplest interfaces of any online tool, making it easy to get started.

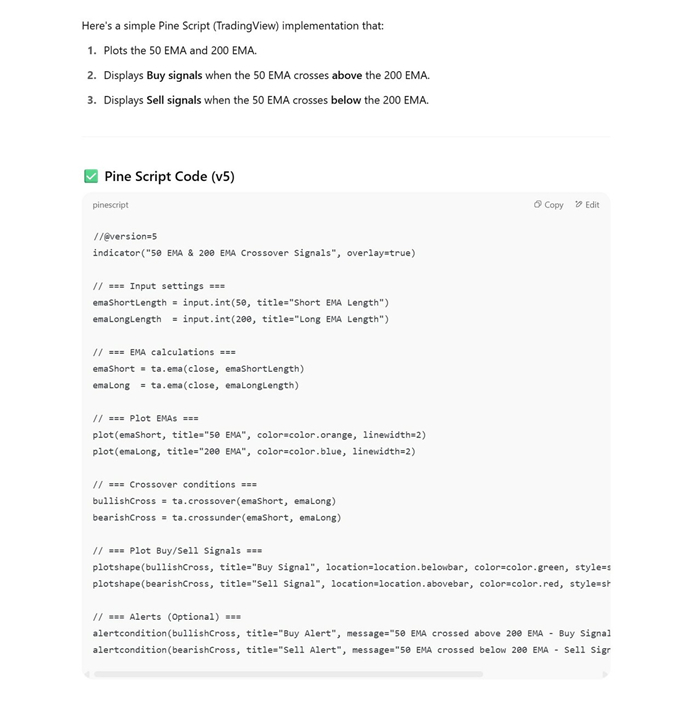

Let’s say I want to program alerts on my TradingView platform every time the 50-period Exponential Moving Average (EMA) crosses the 200-period EMA. Without AI, I would have to learn TradingView’s programming language, Pine Script. However, with ChatGPT, I can request it to write the code.

Here is what that process looks like, starting with my initial prompt:

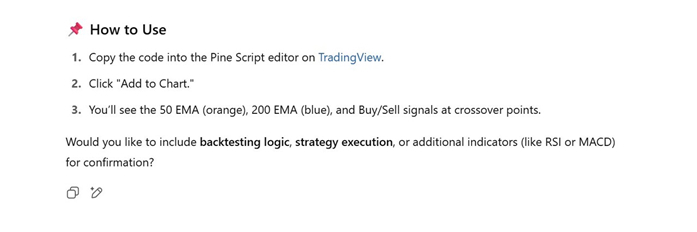

And here’s what Chat GPT gave me:

ChatGPT then takes it further by suggesting next steps in the trading process. This is a powerful use of AI, as it provides me with ideas that I may not have considered implementing. Here is what ChatGPT offered me next in this particular example:

ChatGPT can add stop-loss, take-profit, and re-entry rules, as well as filtering with additional indicators, such as RSI, MACD, and volume. The above prompts are for TradingView, but they also work equally well if I request the MetaTrader programming language, MQL. For example, ChatGPT can even create MetaTrader 5 Expert Advisor (EA) versions of code.

So far, I have not required any programming knowledge to get this code from ChatGPT. Or if I had the programming knowledge, using ChatGPT instead would have saved me hours of work in writing code or testing a strategy manually.

My tip for using a tool like ChatGPT is that, although it can understand human language, it is not human; it is a sophisticated computer program. Speak to it as you would speak to a computer and be specific in your requests.

Real-time Sentiment Analysis from News and Social Media

In recent years, the news cycle has increasingly become faster and spread across an expanding number of media outlets, particularly with the emergence of social media. This makes it much more difficult to monitor news and sentiment manually. AI can help by analyzing news headlines and social media posts (e.g., X and Reddit) to rapidly gauge bullish and bearish sentiment and quickly spot changes in sentiment. Think of AI as a listening ear to the ground. It enables traders to spot potential price changes much more quickly, like an advanced warning system.

Some traders are using traditional prompts in AI search engines, such as ChatGPT, by asking about the social media sentiment surrounding specific stocks or inquiring which asset classes exhibit strong bullish and bearish sentiments.

Other traders are training AI models on past price reactions to sentiment shifts and even building systems that predict price spikes based on news tone and frequency.

AI Chart Pattern Recognition

Several online AI tools are available to identify classic chart patterns, such as head and shoulders, double tops/bottoms, triangles, wedges, cup and handle, and others. These tools can help save time and find patterns that the human eye may miss.

The pattern recognition tools can even provide a confidence level for the pattern, i.e., how accurately the AI system believes it is in identifying the pattern, breakout prices, and target levels. Other statistics may include simulated backtests of the pattern on specific timeframes and asset classes, displaying win-loss ratios and profitability.

AI-driven Trading Bots

As expected, several companies have begun building and selling AI-driven trading bots that provide trading signals for copying. These may utilize a combination of AI trading concepts, including pattern recognition, continuously adjusting indicator settings to identify the most effective ones under recent market conditions, and real-time sentiment analysis. The goal is to integrate the most effective aspects of AI analysis and package them for off-the-shelf use by traders.

Are AI Tools Suitable for Beginner Traders?

Beginner traders must understand the concepts that the AI is using to produce its results. That means beginners should not skip learning the basics behind trading the markets. This is important because AI’s weak spot currently is understanding the wider contexts of a scenario, and this is where humans have a much better understanding. For example, an experienced trader will know that Moving Average crossovers do not work in ranging markets and are better suited for trends. If a trader is using an AI-powered moving average crossover system, they should be aware of when to override the AI strategy, especially when the market appears to be in a range. Another scenario is if unexpected geopolitical events alter the market’s characteristics outside of the AI’s training data, resulting in different performance. Experienced traders would know to recognize this and adapt accordingly.

Are AI & Algorithmic Day Trading the Same Thing?

Algorithmic day trading means using predefined rules to initiate trade entries and exits. AI could have helped develop some of those rules, but algorithmic trading does not necessarily require an element of AI.

AI day trading may also not necessarily be algorithmic trading. For example, I could build and test a strategy using AI and then implement it in a discretionary way. Let’s say I was using an AI-driven pattern recognition tool. In real time, it could show me patterns such as head and shoulders or triangles. But I may then decide whether to take those trades on a case-by-case basis, which would not fit the definition of algorithmic trading.

Does AI Day Trading Really Work?

AI is broad and continually evolving, and the answer about whether AI day trading is effective will change over time as the field continues to develop. I believe there will be many AI tools and strategies that do not work well, but a few that do work profitably. This is similar to non-AI day trading strategies, where numerous unprofitable ideas exist, and only a handful of strategies are profitable. AI day trading has a lot of potential, especially in helping to build and test ideas that would require more time and programming skills than most people have. It’s certainly benefited me in this way. However, AI systems are only as good as the rationale behind them and the quality of the training data. The best way to test AI systems is in real-time to see if their walk-forward performance matches their historical performance.

AI Day Trading Pros & Cons

AI Trading Pros

- AI tools such as ChatGPT allow non-programmers to code systems on platforms such as TradingView and MetaTrader effortlessly.

- Even for programmers with good knowledge, AI can speed up the time to write code for trading systems, saving many hours of manual coding.

- AI systems can continuously test the effectiveness of the strategy or patterns it finds, adjust accordingly, and tell the users a “confidence level” in its analysis.

- AI analysis can monitor hundreds of stocks or other asset classes for patterns or changes in sentiment, which humans cannot do manually at that scale.

- AI can help build much more sophisticated systems compared to traditional programming.

- AI can resemble some of the adaptability of humans but without the emotional biases, e.g., falling prey to emotions such as FOMO or panic selling.

- AI can take much more data into account instantly, across a variety of sources, e.g., technical patterns across timeframes and social media, than humans could do effectively in real-time.

- AI can be adapted for many different trading styles and risk tolerances.

- AI systems can monitor markets around the clock for news or key chart patterns in real time.

AI Trading Cons

- AI systems are only as good as the data they use for training. I may select data in a specific market environment, such as a trending or high-volatility market, and use AI to build a system with that data. However, if those market conditions change, the system’s real-time performance will become unreliable.

- Social media data that AI uses for training to spot sentiment is messy and prone to inaccuracies.

- It’s far easier to curve fit and over-optimize with the sophistication that AI provides, resulting in excellent historical results but poor results in real-time.

- AI is not human – it’s a sophisticated pattern-matching algorithm. It just interacts with us in a human-like way. It lacks context, for example, geopolitical events or macroeconomic conditions that can change the technical picture. For example, I saw how an AI tool spotted a perfect triangle, but the next day, unexpected inflation data changed the entire picture.

My Take

AI is here to stay and can be a valuable part of any trader’s arsenal. Every trader today uses a platform, so ask yourself, is there anything you might want to code into the platform to make your life easier, such as alerts for different indicator settings? Tools such as ChatGPT can hand the code to you on a plate. AI can take it a step further by helping you build fully automated systems and backtest them. It can also monitor sentiment across the media landscape and quickly digest economic announcements, for example, providing summarized reports. AI is rapidly evolving. I urge you to experiment with it and keep an eye out for new tools or services that could help enhance your trading.