Palantir stock continues to crush the broader market, but can the company sustain these gains over the next several months?

Outside of Nvidia, I’d argue that no other company has benefited from the tailwinds of the artificial intelligence (AI) revolution as much as data mining specialist Palantir Technologies (PLTR 2.59%).

Over the last three years, shares of Palantir have gained more than 1,300%. Just this year alone, Palantir stock has rocketed by 97%. To put that into perspective, the S&P 500 and Nasdaq Composite indexes haven’t even posted gains of 10% in 2025.

While it can be tempting to follow the momentum in hopes of more outsize gains, smart investors understand that hope is not a real strategy.

Let’s explore the catalysts behind Palantir’s generational run, and assess some recent trading activity to help discern whether Palantir stock could be headed even higher.

The unprecedented rise in Palantir

When AI first started to emerge as the next megatrend during late 2022 and early 2023, investors were consistently bombarded with news around big tech’s splashy investments in the space. Microsoft plowed $10 billion into OpenAI, the maker of ChatGPT. Both Amazon and Alphabet invested hefty sums into a competing platform, called Anthropic. Tesla was touting its advancements in self-driving cars and humanoid robots. You get the drift — the AI narrative largely hinged on the moves big tech was making.

But in the background, Palantir was building. In April 2023, the company launched its fourth major software suite — the Palantir Artificial Intelligence Platform (AIP).

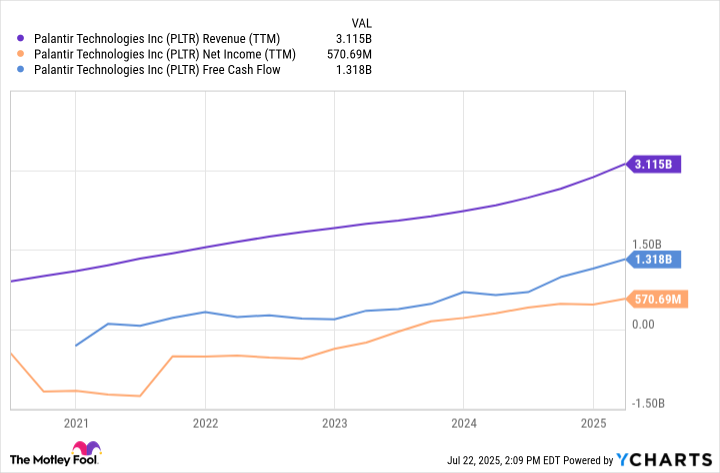

PLTR Revenue (TTM) data by YCharts

As the graph above illustrates, Palantir was a relatively slow-growth, cash-burning enterprise prior to the release of AIP. But since AIP’s launch a little more than two years ago, Palantir’s revenue has accelerated considerably. On top of that, the company has been able to command improving unit economics underscored by a sweeping transition to positive net income and generating billions in free cash flow.

At the end of 2022, Palantir had 367 total customers. As of the end of the first quarter this year, Palantir boasted 769 total customers. Perhaps even more impressive is that the company’s commercial customers (non-government) have risen by more than twofold over the last couple of years.

To me, AIP is serving as a gateway for Palantir to expand its reach beyond federal contracts with the U.S. military, which is what Palantir is best known for. AIP represents a transformational shift as a defense contractor to a more ubiquitous software platform capable of penetrating the private sector, despite relentless competition from larger companies such as Salesforce or SAP.

As a Palantir bull myself, I’ve been blown away by management’s ability to outmaneuver big tech and deliver on lofty growth targets time and again. But as an investor, I can’t help but wonder if the company’s share price trajectory is sustainable.

Image source: Getty Images.

Is Wall Street trying to tell investors something?

In addition to analyzing financial trends and operating metrics, investors can augment their due diligence process by listening to how Wall Street analysts talk about a company or even dig into the trading activity of notable investors. Thanks to a nifty tool called a form 13F, investors can access an itemized breakdown of all of the buys and sells from hedge funds during a given quarter.

During the first quarter, famed billionaire investor Stanley Druckenmiller sold out of his fund’s Palantir position. In addition, Cathie Wood has been trimming exposure to Palantir in Ark’s portfolio as well.

On the flip side, billionaire investors Ken Griffin and Israel Englander both added to their funds’ respective Palantir positions during the first quarter. Given these dynamics, it might be hard to discern how Wall Street really feels about Palantir.

I think there are some nuances to point out given the details above. First, both Druckenmiller and Wood have been in and out of Palantir stock in the past — this is not the first time each investor reduced their exposure to the data analytics darling.

On top of that, I think Griffin’s and Englander’s activity should be taken with a grain of salt. Both investors run highly sophisticated, multistrategy hedge funds. From time to time, some of this activity may include being a market maker.

Although it may appear bullish that Palantir stock is held in Griffin’s Citadel and Englander’s Millennium Management portfolios, I wouldn’t quite buy that narrative. Neither fund is necessarily known for holding positions for the long term.

Moreover, as a multistrategy fund with a number of different teams and objectives, I think that it’s highly likely that Citadel and Millennium have a layered and complex hedge strategy when it comes to owning a volatile growth stock such as Palantir.

Where will Palantir stock be at the end of 2025?

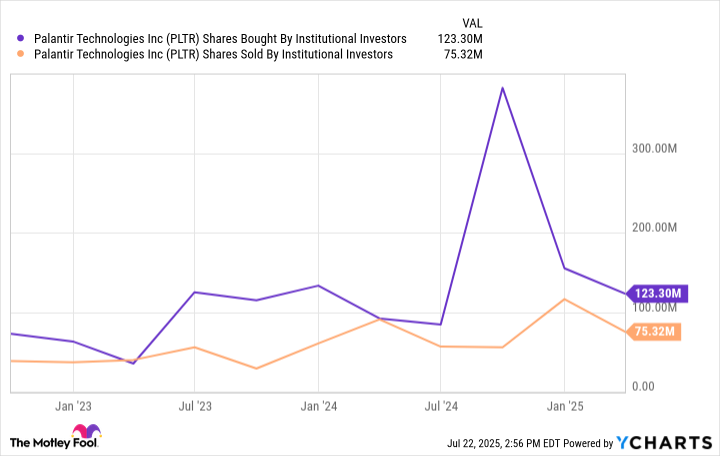

The chart below illustrates institutional buying and selling of Palantir stock over the last few years.

PLTR Shares Bought By Institutional Investors data by YCharts

Given that buying (the purple line) remains elevated over selling (the orange line), this could suggest that Palantir remains a favorite among institutional portfolios. However, as I expressed above, not all hedge funds and money managers have the same strategy. In other words, some of this elevated buying could be part of a broader, more complex trading strategy and less so an endorsement of long-term accumulation.

Over the last few months, Palantir stock has become increasingly more expensive. In fact, the company is trading well beyond levels seen during peak days of the dot-com or COVID-19 bubbles.

While it’s impossible to know for certain where Palantir stock will be trading by the end of the year, smart investors know that nothing goes up in a straight line forever.

A good indicator for how investors feel about Palantir’s prospects should come after the company reports second-quarter earnings in a couple of weeks. As a reminder, shares fell off a cliff for a brief moment following the company’s first-quarter blowout report. Expectations are rising with each passing report, and I would not be surprised to see Palantir stock sell off again — even if its Q2 results are stellar.

Given the convergence between institutional buying and selling, combined with Palantir’s increasingly expensive valuation, I can’t help but be cautious at this point. I do think a valuation correction could be in store sooner or later and would not be surprised if shares are trading for a considerably lower price by the end of the year.

Adam Spatacco has positions in Alphabet, Amazon, Microsoft, Nvidia, Palantir Technologies, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, Nvidia, Palantir Technologies, Salesforce, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.