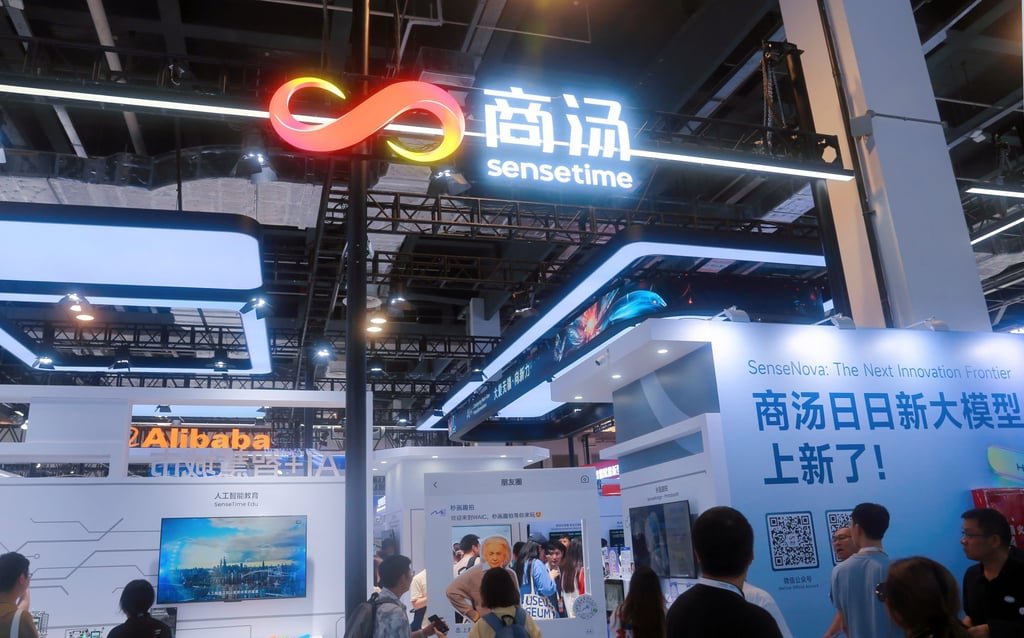

In 2025, China’s Premier Li Qiang unveiled a transformative AI strategy that transcends domestic ambitions, positioning the nation as a cornerstone in the global AI ecosystem. By advocating for an international AI governance framework and cross-border collaboration, Li’s vision not only addresses the fragmented state of global AI regulation but also creates a fertile ground for investment in AI-driven sectors. This article explores how China’s strategic pivot toward global cooperation—coupled with aggressive state-backed industrial policies—could catalyze a surge in R&D funding, infrastructure development, and cross-border partnerships, making Chinese AI infrastructure stocks a compelling early-stage opportunity.

The Global AI Renaissance: A New Era of Collaboration

Premier Li’s call for an international AI organization signals a shift from isolationist tech development to a collaborative model. By emphasizing the need to overcome barriers like restricted data flows, talent exchange, and access to advanced chips, China is positioning itself as a bridge between nations. This aligns with its broader 2030 AI leadership goals, which include integrating AI with manufacturing, healthcare, and emerging industries. The World Artificial Intelligence Conference (WAIC) in Shanghai, now a global showcase for AI innovation, underscores this pivot. With over 800 participating companies—including Tesla, Amazon, and Alibaba—China is not only demonstrating its technological prowess but also inviting foreign partners to co-develop solutions.

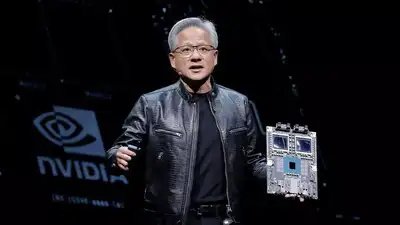

Semiconductors: The Bedrock of AI Self-Reliance

The U.S. export controls on advanced AI chips have accelerated China’s push for semiconductor self-sufficiency. State-backed initiatives like the National Integrated Circuit Investment Fund (now $47 billion) are fueling R&D in domestic alternatives. Key players include:

– Huawei’s HiSilicon: Developing NPUs for AI and 5G, reducing reliance on foreign GPUs.

– Semiconductor Manufacturing International Corporation (SMIC): Advancing 7nm chip production under U.S. sanctions.

– Yangtze Memory Technology (YMTC): Leading in 3D XPoint-like memory for AI and HPC.

Investors should note that SMIC and HiSilicon are not only surviving but thriving under sanctions, securing contracts for mature-node chips critical for AI and cloud infrastructure. Their partnerships with Alibaba and Tencent highlight their strategic role in China’s AI ecosystem.

Cloud Computing: Powering the AI Economy

China’s National Integrated Computing Network and the “Eastern Data, Western Computing” initiative are building a nationwide infrastructure to meet surging AI compute demands. By 2025, the country aims to reach 300 EFLOP/s of compute capacity, driven by state-owned and private cloud providers. Key beneficiaries include:

– Baidu’s Apollo: Pioneering autonomous driving and cloud AI solutions.

– Alibaba Cloud: Expanding its global AI services and data centers.

– Tencent Cloud: Leveraging AI in gaming, finance, and enterprise services.

The government’s National AI Industry Investment Fund ($8.2 billion) is further boosting cloud infrastructure, enabling startups to access subsidized compute resources. This democratization of AI training and deployment is creating a competitive edge for Chinese cloud providers.

Autonomous Systems: The Future of Intelligent Mobility

Premier Li’s emphasis on AI+ applications has spurred investment in robotics, autonomous vehicles, and smart cities. Shenzhen’s 4,000 PFLOP/s intelligent computing center and Hangzhou’s AI-powered smart city projects are emblematic of this shift. Key players include:

– NIO: Integrating AI into electric vehicles and autonomous driving.

– WeRide: Scaling robotaxi services in multiple cities.

– UBTech Robotics: Developing AI-driven humanoid robots for industrial and consumer use.

These companies are capitalizing on AI pilot zones and state subsidies, creating scalable solutions for logistics, healthcare, and urban management. The global demand for AI-driven automation is a tailwind that extends beyond China’s borders.

Strategic Risks and Opportunities

While geopolitical tensions and U.S. export controls pose risks, they also accelerate China’s self-reliance. The RISC-V open-source chip architecture and domestic AI platforms like OpenI are reducing dependency on Western technologies. For investors, the key is to focus on companies with strong government backing, robust R&D pipelines, and cross-border partnerships.

A Call to Action: Early Investment in AI Infrastructure

The convergence of Premier Li’s global cooperation initiatives, state-led funding, and sector-specific innovation creates a unique window for investors. Chinese AI infrastructure stocks are not just surviving—they are redefining the global tech landscape. By allocating capital to semiconductors (SMIC, HiSilicon), cloud computing (Alibaba Cloud, Baidu), and autonomous systems (WeRide, UBTECH), investors can position themselves at the forefront of a tech renaissance.

In conclusion, China’s AI strategy is a masterclass in leveraging adversity into opportunity. For those with the foresight to act early, the rewards could be transformative.