The global electric vehicle (EV) market is entering a pivotal phase, with China’s premium six-seat segment emerging as a battleground for innovation and market dominance. Tesla’s upcoming Model Y L, a long-wheelbase, three-row variant of its bestselling Model Y, is poised to disrupt this segment in China—a market that accounts for over 50% of global EV sales. This article examines how the Model Y L’s competitive advantages, pricing strategy, and strategic positioning could catalyze Tesla’s global expansion while reshaping the EV industry’s trajectory.

Competitive Edge: Design, Range, and Practicality

Tesla’s Model Y L addresses a critical gap in its lineup by offering a family-friendly, six-seat configuration without compromising on performance. With a 4,976 mm length and 3,040 mm wheelbase, the Model Y L provides 180 mm more length and 150 mm more wheelbase than the standard Model Y, enabling a spacious interior with captain-style second-row seats and foldable third-row seating. This design mirrors the practicality of the Model X but at a significantly lower price point (estimated RMB 400,000, or ~$55,700).

The vehicle’s dual-motor AWD system (142 kW front, 198 kW rear) and 82 kWh battery pack deliver a CLTC range of 751 km, outperforming many competitors. For context, Nio’s Onvo L90 offers 605 km on the same cycle, while Li Auto’s i8 maxes out at 720 km. Tesla’s range advantage, combined with its over-the-air software updates and global Supercharger network, positions the Model Y L as a premium yet accessible option for families.

Pricing Strategy: Balancing Affordability and Premium Positioning

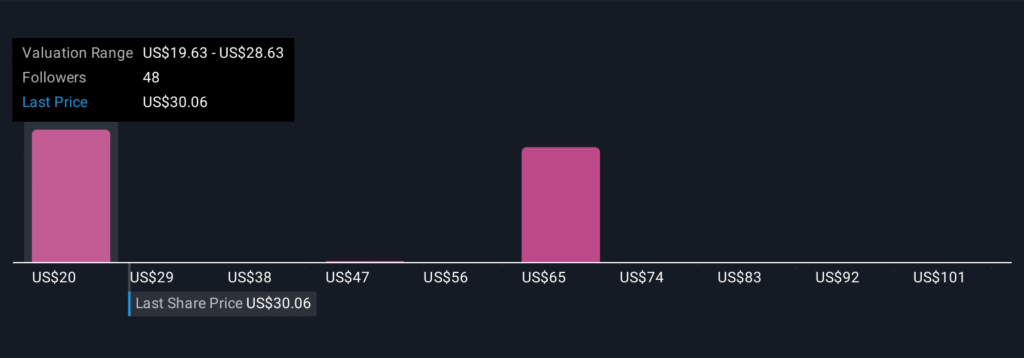

Tesla’s pricing for the Model Y L is strategically calibrated to outflank local rivals. At RMB 400,000, it sits below the Model X’s price range (~RMB 500,000) but above competitors like the Li i8 (RMB 321,800–400,000) and Nio’s Onvo L90 (BaaS model starting at RMB 179,800). This pricing reflects Tesla’s intent to capture affluent Chinese buyers seeking a blend of luxury, space, and brand prestige.

The Onvo L90’s BaaS model, which separates battery costs from the vehicle price, has been a disruptive force in the segment. However, Tesla’s brand equity and ecosystem (including its FSD software and global service network) provide a unique value proposition. Analysts note that Tesla’s ability to maintain premium pricing while undercutting the Model X’s cost could attract buyers who view the Model Y L as a “downsized” Model X with comparable features.

Global Implications: A Springboard for Expansion

The Model Y L’s potential global launch—evidenced by prototype sightings at Germany’s Nürburgring—signals Tesla’s intent to replicate its Chinese success in Europe and North America. The model’s family-friendly design aligns with growing demand for third-row SUVs in markets like the U.S. and Europe, where Tesla’s current offerings lack a six-seat option.

Moreover, the Model Y L’s success in China could accelerate Tesla’s production efficiency and economies of scale. The Shanghai Gigafactory, which already produces the Model Y at record volumes, is well-positioned to scale the Model Y L’s production. This could drive down costs further, enabling Tesla to undercut competitors in other regions while maintaining profit margins.

Investment Considerations: Risks and Opportunities

While the Model Y L presents a compelling growth story, investors must weigh several factors:

1. Competition: Chinese EV brands like Nio, Li Auto, and Aito (backed by Huawei) are rapidly innovating, offering advanced features (e.g., 192-line LiDAR, 5C charging) at aggressive prices. Tesla’s reliance on software differentiation may not suffice in a hardware-driven segment.

2. Regulatory and Geopolitical Risks: Tariffs and trade tensions could impact Tesla’s global pricing strategy, particularly in Europe and North America.

3. Battery Costs: The 82 kWh battery from LG Energy Solution is a key enabler of the Model Y L’s range, but lithium prices remain volatile.

Despite these risks, the Model Y L’s launch represents a strategic inflection point for Tesla. If it captures even 10% of China’s premium six-seat EV market, the model could generate $1.5 billion in annual revenue, bolstering Tesla’s margins and free cash flow. For the broader EV sector, the Model Y L’s success could spur competitors to accelerate innovation in family-oriented EVs, driving industry-wide growth.

Conclusion: A Catalyst for the EV Revolution

Tesla’s Model Y L is more than a product—it’s a calculated move to dominate a high-growth segment in China and beyond. By combining the Model Y’s affordability with the Model X’s luxury, Tesla is redefining the premium EV landscape. For investors, the Model Y L’s launch offers a unique opportunity to bet on Tesla’s ability to scale innovation while navigating a fiercely competitive market. As the EV industry matures, the Model Y L could serve as a blueprint for how global automakers adapt to the next phase of the electric revolution.