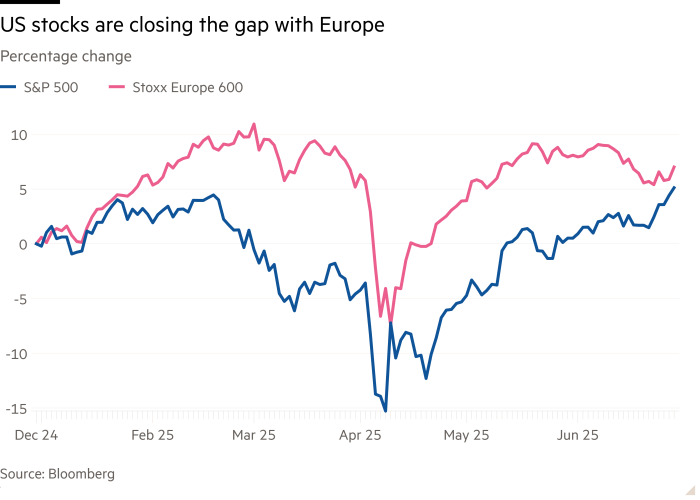

The S&P 500 (^GSPC) rode a bumpy path to end the first half of 2025 at a record high.

After falling more than 19% in April from its previous all-time high, the benchmark index ripped to new records just two months later as the market’s worst fears about the impact of President Trump’s tariffs evaporated.

Still, it hasn’t been a clean run higher for the benchmark index. Fears over AI competition from China, tariffs’ impact on the growth outlook for American corporates, and increasing tensions in the Middle East have all tested the market’s chug to new records.

Overall, stocks have largely shrugged off such concerns, with investors continuing to buy the dips and bid them higher.

“The market still does tend to have a bullish sentiment to it,” Charles Schwab head of trading and derivatives strategist Joe Mazzola said in an interview. “So I think you’re seeing investors looking for those opportunities on pullbacks to buy in.”

There was perhaps no better evidence of market resilience than Trump’s “Liberation Day” tariff announcement on April 2. The S&P 500 fell more than 10% in three days, with the rout ranking just below the top 10 worst sell-offs since World War II. But in roughly a month, the benchmark index was back above levels seen before the announcement as markets cheered Trump’s various tariff delays.

A large part of inflows back into stocks came from retail investors, including a record $3 billion in net purchases on April 3, per VandaTrack Research’s data that dates back to 2014.

“[There’s a] certain feeling of invincibility that’s crept into the mindset of a lot of traders, a lot of active investors,” Interactive Brokers chief strategist Steve Sosnick said in an interview on June 16. “And it’s understandable, because why wouldn’t you? I mean every dip … can be considered a buying opportunity.”

And now with the market back at record highs, many on Wall Street have argued for stocks to keep moving higher by the end of the year. Fundstrat global head of technical strategy Mark Newton pointed out to Yahoo Finance that many money managers are benchmarked to large indexes like the S&P 500. With those indexes rebounding back to record highs, there is building pressure to outperform the market and “play catch-up,” per Newton.

“They all want to earn bonuses at the end of the year,” Newton said. “They want to make sure they’re keeping track with the S&P.”

At the end of the day, the key for investors is always how any headwind will impact the economy and the outlook for corporate profits, Newton said. While those estimates fell alongside stock prices earlier this year, the growth outlook for both metrics has increased alongside the recent rally in stocks.