Tesla (TSLA) shares dropped 3% after reporting mixed third-quarter results — revenue rose 12% to $28.1 billion, but adjusted EPS of $0.50 missed the $0.55 estimate from LSEG.

IBM (IBM) tumbled 6% despite beating earnings expectations, as its software revenue matched forecasts instead of exceeding them.

More than 75% of S&P 500 companies reporting so far have beaten profit estimates, according to FactSet, but markets remain sensitive to guidance and margins.

In the previous session, the S&P 500 fell 0.5%, the Dow Jones lost 334 points (–0.7%), and the Nasdaq Composite declined 0.9%, reflecting rotation away from high-valuation tech names.

Live Events

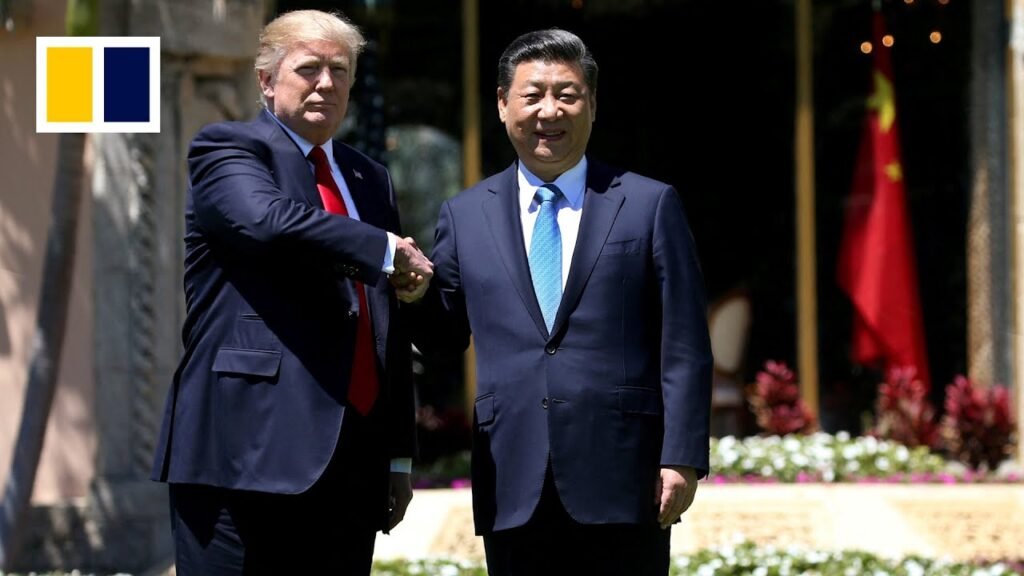

Traders also monitored policy developments. President Donald Trump confirmed that his meeting with Chinese President Xi Jinping is “scheduled,” slightly easing trade tensions. But Washington added new sanctions on Russian oil majors Rosneft and Lukoil, citing Moscow’s resistance to a Ukraine ceasefire. Market strategist Chris Grisanti of MAI Capital warned valuations are now the “second-highest in a century,” comparing the environment to the dot-com bubble. “The market is strong but stretched. Many stocks are being priced on 2030 or 2035 projections — just like in 1999,” he told CNBC.

Investors are eyeing Friday’s inflation report, which could steer the Federal Reserve’s late-October policy decision. Analysts expect a 0.25% rate cut, despite weak jobs data.

Fundstrat’s Mark Newton remains optimistic, predicting a sharp S&P 500 rally into month-end driven by AAPL and GOOGL breakouts.

US stock futures today:

Dow Jones Industrial Average futures fell 0.25%, S&P 500 slipped 0.03%, and Nasdaq 100 edged 0.01% lower. The Russell 2000 outperformed with a 0.37% gain.

According to reports, the Trump administration is weighing new export restrictions to China targeting products made with or containing U.S.-developed software. Officials are also in talks with quantum computing firms about taking ownership stakes in exchange for federal funding — a move that could reshape tech oversight.

The SPDR S&P 500 ETF Trust (SPY) rose 0.0045% to $667.83, while the Invesco QQQ Trust (QQQ) added 0.012% to $605.56 in premarket trading.

Market strategist Chris Grisanti of MAI Capital Management advised investors to rebalance portfolios, noting that U.S. equity valuations are at their second-highest level in a century.

“This feels like 1999 all over again,” Grisanti said, drawing parallels to the dot-com bubble. He warned that “companies are now being priced on 2030 and 2035 projections.”

Fundstrat’s Mark Newton sees a bullish setup for the S&P 500 through late October.

“I anticipate a sharp rally to finish the month,” Newton said. “Breakouts in AAPL and GOOGL could lift broader indices to new all-time highs.”

Fed rate cut odds rise above 96%

Bond yields held steady ahead of economic data. The 10-year Treasury yield hovered around 3.98%, while the 2-year note traded near 3.46%.

The CME FedWatch Tool now projects a 96.7% probability that the Federal Reserve will cut rates at its October meeting — reinforcing expectations for policy easing as growth moderates.

All eyes are on Friday’s inflation report, which could shape expectations for the Federal Reserve’s late October meeting.

According to CFRA’s Sam Stovall, markets expect another quarter-point rate cut despite weak jobs data. “The Fed won’t hesitate to cut even without clear labor support,” he wrote.

Stocks in focus: Tesla, IBM, American Airlines lead action

Tesla (NASDAQ: TSLA) dropped 3.04% after posting better-than-expected Q3 revenue but missed earnings estimates. Despite the dip, Tesla remains strong on long-term price trends, according to Benzinga’s Edge Stock Rankings.

IBM (NYSE: IBM) fell 7.14% in premarket trading despite beating expectations for Q3 results. The company raised its full-year 2025 revenue growth forecast to “more than 5%” from “at least 5%.”

American Airlines (NASDAQ: AAL) rose 1.41% as analysts expect a quarterly loss of 28 cents per share on $13.63 billion in revenue.

Medpace Holdings (NASDAQ: MEDP) surged 18.52% after reporting $659.9 million in Q3 revenue and $3.86 EPS, both well above estimates.

Ford Motor Co. (NYSE: F) traded flat ahead of earnings, with consensus estimates calling for $43.08 billion in revenue and $0.36 EPS.

Southwest Airlines rose 2% after posting a surprise profit and beating revenue estimates with $6.95 billion.

Moderna fell 6% as its Phase 3 CMV vaccine trial missed its primary efficacy target.

Key data to watch Thursday

Investors are eyeing several key updates that could sway market sentiment. The initial jobless claims report has been delayed amid the looming government shutdown, while existing home sales for September will be released at 10:00 a.m. ET.

On the policy front, Federal Reserve Vice Chair for Supervision Michelle Bowman is scheduled to testify before the Senate Banking Committee at 10:00 a.m., followed by Fed Governor Michael Barr speaking at 10:25 a.m. ET. These events are expected to provide fresh insights into the Fed’s policy direction and the broader economic outlook.

Commodities, gold, and crypto update

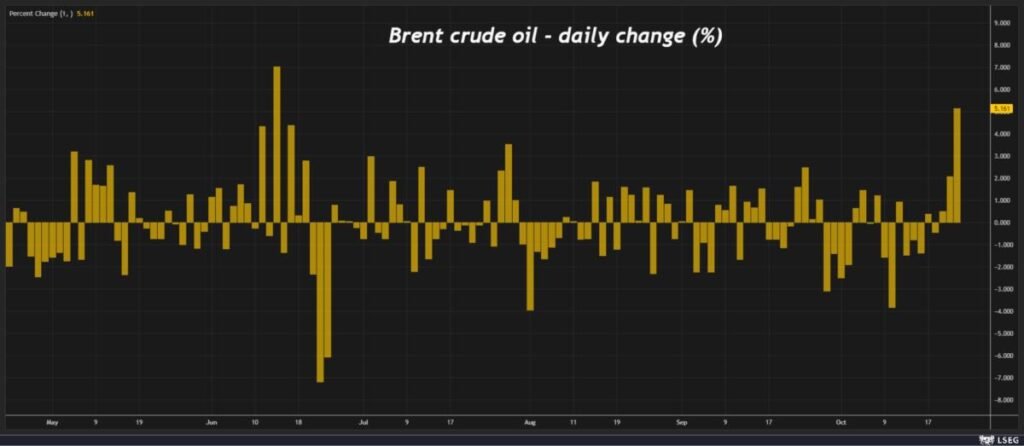

Commodities traded with heightened volatility in early Thursday trading. Crude oil futures jumped 5.22% to around $61.54 per barrel, rebounding on supply concerns.

Gold prices climbed 0.38% to $4,114.22 per ounce, staying below their recent record high of $4,381.6. The U.S. Dollar Index rose 0.16% to 99.0560, signaling continued demand for safe-haven assets. In digital currencies, Bitcoin (BTC) gained 1.16% to trade near $109,323.15, extending its recent bullish momentum.

Global markets mixed

Overseas markets reflected a mixed tone. Asian indices closed mostly higher, led by gains in India’s NIFTY 50, Hong Kong’s Hang Seng, Australia’s ASX 200, and China’s CSI 300. However, Japan’s Nikkei 225 and South Korea’s Kospi ended lower amid caution ahead of U.S. earnings and trade developments. In Europe, major indices opened on a mixed note, with traders closely tracking geopolitical headlines and global bond movements for cues.

Wednesday recap: Markets close lower

All major U.S. indexes closed in the red on Wednesday, weighed down by industrials, communication services, and consumer discretionary stocks.

| Index | Performance | Close |

| Nasdaq Composite | -0.93% | 22,740.40 |

| S&P 500 | -0.53% | 6,699.40 |

| Dow Jones | -0.71% | 46,590.41 |

| Russell 2000 | -1.45% | 2,451.55 |

![[News] China Reportedly Damaged DUV Machine in Reverse-Engineering, Called ASML for Help](https://koala-by.com/wp-content/uploads/2025/10/ASML-tools-624x624.jpg)