FNG Exclusive… FNG has learned via regulatory filings that ParFX, the wholesale electronic spot FX institutional trading venue owned by Compagnie Financière Tradition, saw a 13% decline in Revenues and a near halving in profitability in 2024, the company’s second consecutive annual decline on both the top and bottom line.

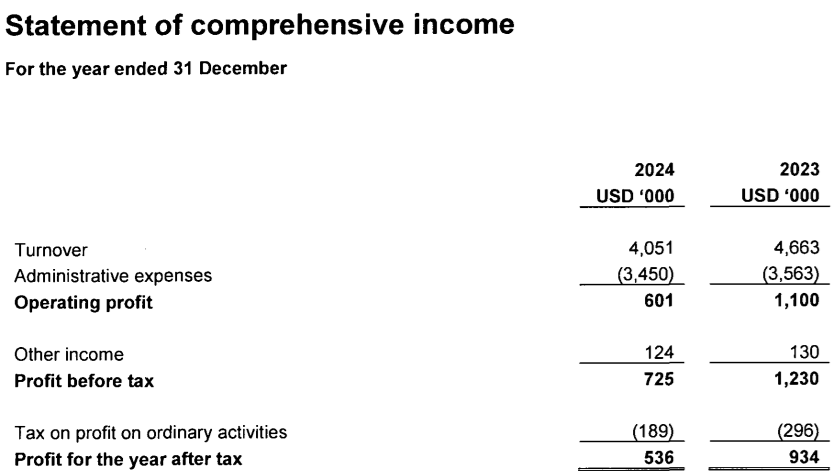

Following a 14% drop in 2023, Revenues at ParFX came in at USD $4.1 million in 2024, down by 13% from $4.7 million in 2023 (and $5.6 million in 2022), which the company said was mainly due to a decrease in customer base. This also includes the provision of electronic data to third parties (data sales) of $124K (2023: $130K). Net Profit of $536K was off by 43% versus $934K in 2023 (and $1.7 million in 2022).

The principal activity of ParFX is the provision of a wholesale electronic trading platform for spot FX products, supporting multiple currency pairs on a 24-hour basis. ParFX is run from both London and New York by COO Roger Rutherford, Director of Operations Alex Lewis, and Head of Business Development Rob Parr.

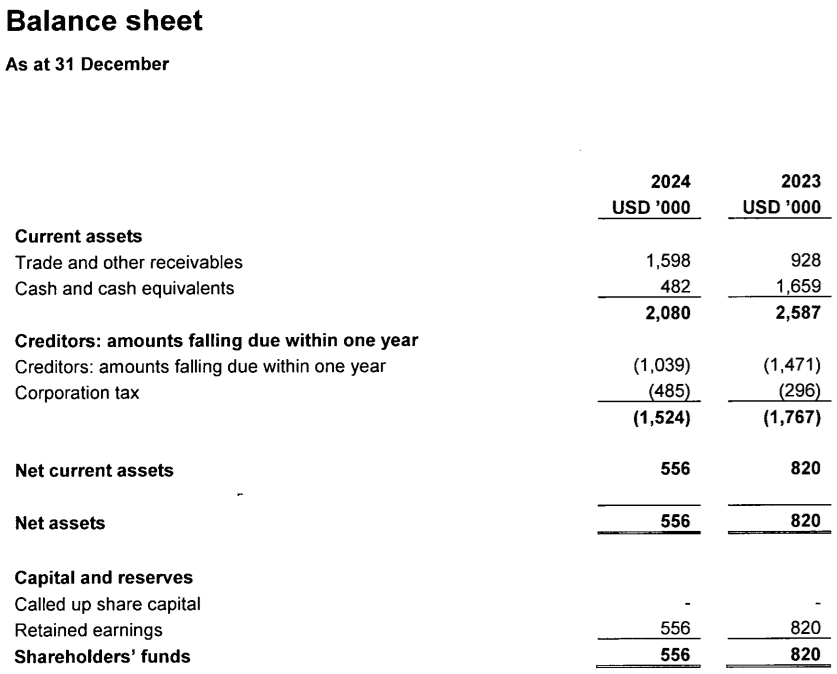

ParFX’s 2024 income statement and balance sheet follow below.