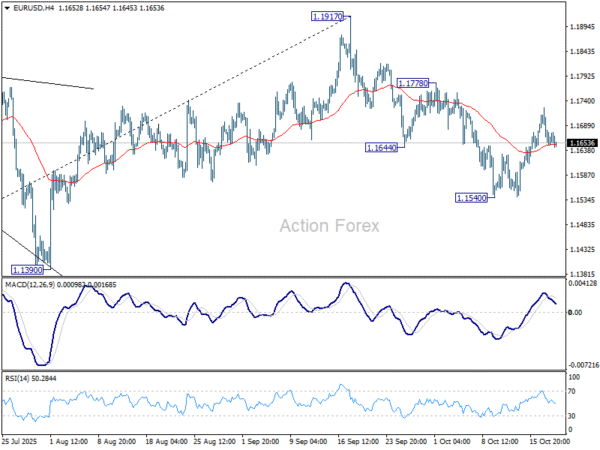

Daily Pivots: (S1) 1.1627; (P) 1.1677; (R1) 1.1705; More…

Outlook is EUR/USD is unchanged and intraday bias stays neutral. Further decline is in favor as long as 1.1778 resistance holds. Break of 1.1540 will resume the decline from 1.1917 and target 1.1390 support, or even further to 38.2% retracement of 1.0176 to 1.1917 at 1.1252. On the upside, through, break of 1.1778 will target retest of 1.1917 high instead.

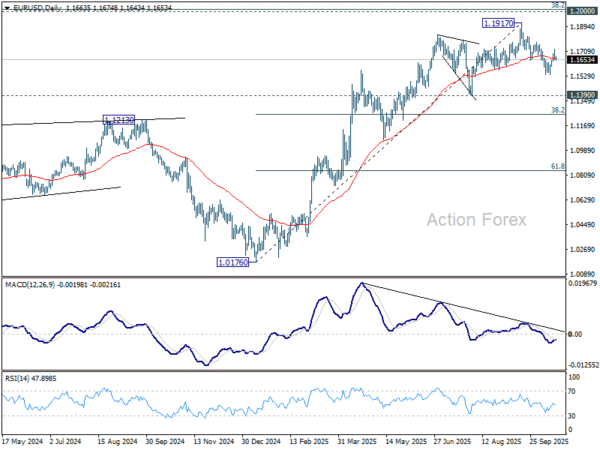

In the bigger picture, considering bearish divergence condition in D MACD, a medium term top is likely in place at 1.1917, just ahead of 1.2 key psychological level. As long as 55 W EMA (now at 1.1290) holds, the up trend from 0.9534 (2022 low) is still expected to continue. Decisive break of 1.2000 will carry larger bullish implications. However, sustained trading below 55 W EMA will argue that rise from 0.9534 has completed as a three wave corrective bounce, and keep outlook bearish.