I was off last week and couldn’t believe the amount of news that landed on the headlines in just a week.

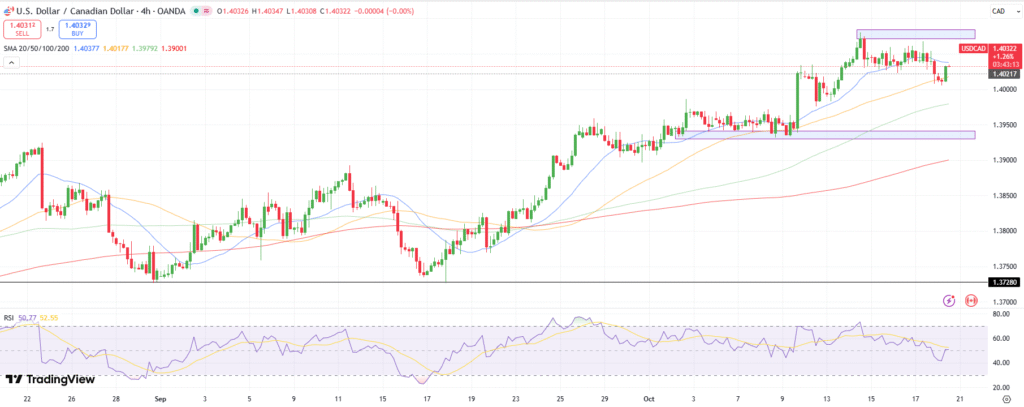

First, trade tensions between the US and China are fully back after China restricted rare earth metal exports to the US and the US threatened China with 100% tariffs — before Scott Bessent said later in the week that there could still be a trade truce for another three months. Bessent will meet Chinese leaders this week — hopefully to ease the latest flare-up.

Meanwhile, China kept its rates unchanged today and printed a set of stronger-than-expected production and GDP figures. Yet, growth expanded at the slowest pace in a year, while retail sales grew at the weakest pace in a year. Chinese equities kicked off the week with a small rebound from Friday on optimism over the upcoming trade talks, while the HSI is up 2.4%, led higher by a solid rebound in tech stocks this Monday, with Alibaba up 5% in Hong Kong at the time of writing.

Elsewhere in tech, TSMC is testing all-time highs in Taiwan after posting — last week — a fresh quarterly profit record and improved outlook on sustained AI demand. ASML in the Netherlands also printed strong earnings, further backing the AI rally and lofty valuations. Then, there was a fresh deal between OpenAI and Oracle, while Applied Materials was hit by new export restrictions toward China — a reminder that trade risks are never too far. But remember that Nvidia expects to make more than $54 bn in revenue last quarter, excluding China. So, Chinese risks — though present — are largely priced in. Plus, the prospects of lower Federal Reserve (Fed) rates continue to support valuations.

Speaking of which, Fed Chair Powell gave a fresh hint last week about an upcoming rate cut by the end of this month — and his words were the only solid indication of what the Fed might do in the absence of economic data as the US government remains shut. The probability of a 25 bp cut by month-end is now seen as nearly 100%. The good news is that the US Bureau of Labor Statistics will release September CPI data on Friday, giving investors something to rely on before the late-October Fed decision. The headline CPI is expected to have rebounded past the 3% mark, while the core CPI figure will likely remain steady above 3% – higher than the Fed’s 2% inflation target. But, because the Fed is now believed to have unofficially shifted its inflation comfort zone closer to 3%, and assuming the US jobs market continues to weaken, that 3% inflation shouldn’t derail expectations for a Fed cut this month, even less so as credit worries are somehow building under the rug.

Big US banks announced strong — even record — quarterly results last week on robust trading revenue and rising deal-making, but rising credit concerns weighed heavier. Zions and Western Alliance, two regional US banks, said they were victims of suspected fraud on loans tied to distressed property funds. The news landed after last month’s implosion of auto lender Tricolor and the bankruptcy of parts supplier First Brands. JPMorgan Chase CEO Jamie Dimon seized the opportunity to add fuel to the fire by comparing these failures to cockroaches, warning that “there are probably more.” But don’t panic just yet: the credit exposures of banks are thought to be sufficiently isolated to avoid sector- or system-wide risk. And three regional banks reported results on Friday — and no new cockroaches, phew. As such, Thursday’s sell-off in bank stocks eased on Friday, keeping the KBW index above its 100-day moving average, and US futures are positive at the time of writing following a strong open in Asia on trade-truce hopes between the US and China this week.

It was however amusing to see that — contrary to popular fear — Big Tech wasn’t behind last week’s volatility; banks and credit worries were! Still, the S&P 500 closed the week 1.7% higher, supported by tech stocks, as the Nasdaq 100 rallied almost 2.5%. In the absence of major data — and hopefully with easing credit fears — attention will remain on earnings: Netflix, Coca-Cola, GM, P&G and Intel are due to report in the US, while STMicroelectronics, UBS, Barclays and Dassault Systèmes will be ones to watch in Europe.

On the political front, the US government remains shut. In Japan, the ruling LDP’s nearly 13-year coalition with Kōmeitō ended last week, but the Ishin party is joining forces with the LDP to pave Takaichi’s way toward the top seat — a development that could keep the USDJPY above the 150 mark.

In Europe, French PM Sébastien Lecornu survived two no-confidence votes by shelving pension reform last week. But that move will necessarily force the French government to find savings elsewhere — all with a deteriorating credit rating, as S&P Global downgraded France to A+ from AA-. The EURUSD will likely remain under pressure.

And in the UK, Rachel Reeves was relieved to see gilt yields fall amid last week’s flight to safety — making her think that, if she improves the narrative around Britain, she might just improve the country’s fortunes. But wait before buying the story — and sterling — ahead of the Autumn Budget announcement.