USD/JPY is trading around the 150 mark as markets digest political developments in Japan, shifting Fed expectations and narrower US–Japan yield differentials. The pair sits at a technical and policy crossroads — a small nudge from risk sentiment, a BoJ comment or a US data surprise could determine the next clear direction.

This article breaks down what has happened to USD/JPY recently, why it matters, the principal drivers today, the likely scenarios for the coming days and the key levels traders should watch.

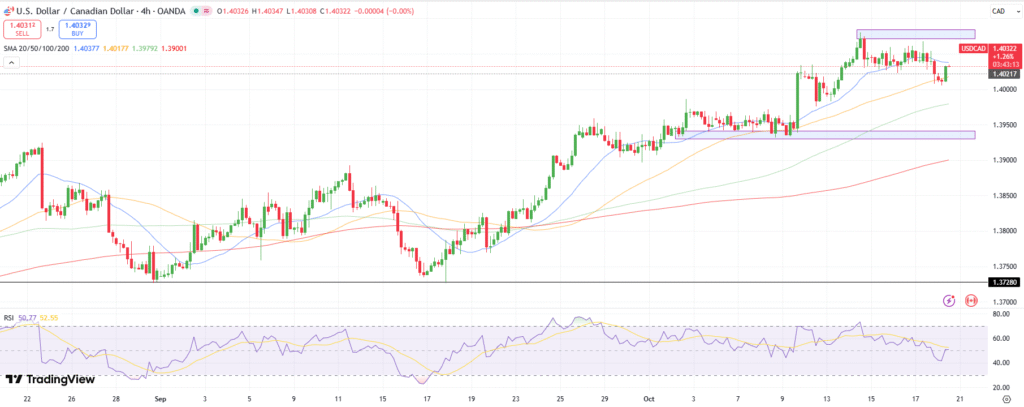

Where the market stands right now

At time of writing, USD/JPY is trading near 150.8–151.0. a touch above the psychological 150 level but well inside the broader trading range that has characterised the pair in recent weeks. This reading is consistent with live price services and market summaries.

The pair has shown recent intraday volatility, falling below 150 on some sessions (e.g. a low around 149.7 on 17 October) before recovering as risk sentiment ebbed and flowed.

| Driver | Why it matters | Current signal |

|---|---|---|

| Japan politics | Fiscal-expansion talk weakens the yen by boosting risk appetite. | Dovish tone from leadership bets slightly weighs on JPY. |

| Bank of Japan | Policy delay softens yen; tightening talk lifts it. | BoJ remains cautious; hikes not imminent. |

| US monetary policy | Lower US yields erode dollar carry advantage. | Markets expect Fed cuts later this year. |

| Risk sentiment | Yen gains when investors seek safety. | Mixed tone: mild risk appetite, lingering volatility. |

| Yield spread | Narrow gap reduces appeal of dollar holdings. | Spreads have narrowed, trimming USD support. |

How these factors have played out recently

-

Political news in Tokyo.

Market chatter about likely changes to Japan’s political leadership — including the rise of figures seen as supportive of fiscal stimulus — has been a focal point.That political backdrop pushed investors to price in greater fiscal largesse and, in turn, a weaker yen in early October. More recently, however, political uncertainty has also encouraged safe-haven flows at times, creating intra-week whipsaws.

-

BoJ prudence.

Bank of Japan Governor Kazuo Ueda has been careful not to telegraph firm moves ahead of meetings, preferring to wait for data.That caution means the yen’s path largely depends on whether the BoJ begins to normalise policy and how aggressively markets expect any tightening.

-

US dynamics.

Ongoing expectations around Fed rate cuts and periodic easing in US risk perceptions (for example, when regional banking stresses recede) have weakened dollar momentum.When US yields fall, USD/JPY often drifts lower. Conversely, a resilient US data run or hawkish Fed surprise can lift the dollar.

-

Technical and trading flows.

The pair has been sensitive to technical levels — the 150 handle has acted as both support and resistance in recent sessions — while some leveraged carry positions have been reduced as volatility rose.This combination has produced choppy trades rather than a steady trend.

| Horizon | Level (approx.) | Role |

|---|---|---|

| Immediate resistance | 151.7–152.5 | Recent intraday highs; a close above here would suggest further upside. |

| Near resistance | 150.5–151.0 | The psychological 150 zone and immediate cap on rallies. |

| Near support | 149.0–149.7 | Recent intraday lows where buyers have appeared. |

| Medium-term support | 146.3–148.6 | Lower support cluster; a break below here could indicate a more decisive yen rally. |

Scenarios and probabilities (short to medium term)

1. Scenario A — Range continuation (Base case, ~50%)

-

USD/JPY stays between 149–152 as markets wait for clearer signals from the BoJ, US economic data and Japan’s political process.

-

Rationale: mixed policy signals and modest risk appetite keep traders cautious; technical levels contain moves.

2. Scenario B — Yen strengthens (bearish USD/JPY, ~30%)

-

Risk-off shock or accelerating expectations of earlier BoJ tightening push USD/JPY below 148. with potential tests of 146.3 if selling intensifies.

-

Rationale: safe-haven flows and unwind of carry trades deepen the move.

3. Scenario C — Yen weakens (bullish USD/JPY, ~20%)

-

Confirmation of pro-stimulus Japanese government policy combined with dovish BoJ messaging and an improved US growth outlook sends USD/JPY back above 152–153.

-

Rationale: fiscal expansion expectations, plus any US-China thaw that boosts risk appetite, could favour the dollar/weak yen trade.

Market implications — who is affected and how

-

Japanese importers and consumers.

A weaker yen raises import costs (energy, commodities), putting upward pressure on domestic inflation and household bills. -

Exporters.

A softer yen normally helps exporters’ competitiveness and reported profits, which can be supportive for equities. -

FX traders and hedge managers.

Greater intraday volatility means both risk and opportunity; active hedging of currency exposures becomes more important near policy or political events. -

Monetary authorities.

Large, rapid FX moves can prompt official comments or, in extreme cases, intervention — authorities have publicly signalled they would consider intervention if moves were disorderly.

Watchlist — events and data that could move USD/JPY next

-

Bank of Japan meeting and commentary (next BoJ meeting dates and any change in forward guidance).

-

Key US macro prints (inflation, payrolls and ISM data) that alter Fed rate expectations.

-

Japanese political calendar — steps in coalition formation, budget announcements or clear policy signals on fiscal plans.

-

Risk events — surprises in global growth data, banking sector stress or shifts in US–China relations.

Practical guidance for traders and risk managers

-

Define the time horizon.

Short-term traders should focus on intraday technicals around 149–151; medium-term investors must watch policy signals and bond yields. -

Use layered hedges.

Consider staggered option hedges or limit orders around the technical bands rather than a single large hedge. -

Monitor carry exposure.

If you are long carry positions funded in yen, be mindful that narrowing yield differentials increase vulnerability.

Conclusion

USD/JPY today sits at a sensitive juncture. The pair is near the 150 mark where politics in Tokyo, the Bank of Japan’s next moves and US yield dynamics intersect. In the short run, expect range-bound trading punctuated by abrupt moves when policy cues or risk sentiment change.

Over the medium term, the direction will be determined by whether Japan pursues monetary normalisation or greater fiscal loosening, and by how quickly US–Japan yield spreads evolve. Keep an eye on the BoJ, Tokyo’s political calendar and incoming US macro releases — each could tip the balance.

Frequently Asked Questions

1. What does USD/JPY represent?

It shows how many Japanese yen are needed to buy one US dollar. A higher rate means a weaker yen and stronger dollar.

2. Why is the 150 level important for USD/JPY?

The 150 mark is a major psychological and technical barrier; moves beyond it often prompt market attention or government concern.

3. What drives USD/JPY in daily trading?

Interest-rate differentials, central bank policies (BoJ and Fed), political developments, and global risk sentiment are the main drivers.

4. How does the Bank of Japan influence USD/JPY?

The BoJ affects the yen through monetary policy and yield curve control; dovish signals weaken the yen, while hawkish hints strengthen it.

5. Could Japan intervene if the yen weakens further?

Yes. Authorities have stated they may act if currency moves are deemed excessive or disorderly, especially beyond key thresholds.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.