Key Highlights

- EUR/USD started a recovery wave above the 1.1620 resistance.

- It cleared a major bearish trend line with resistance at 1.1660 on the 4-hour chart.

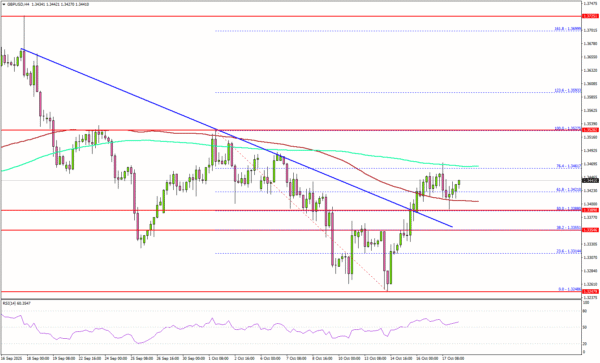

- GBP/USD started a recovery wave above 1.3400 but faces hurdles.

- Gold rallied to a fresh all-time high above $4,350 before correcting some gains.

EUR/USD Technical Analysis

The Euro started a recovery wave from 1.1540 against the US Dollar. EUR/USD formed a base and cleared the 1.1600 barrier.

Looking at the 4-hour chart, the pair traded above the 38.2% Fib retracement level of the downward move from the 1.1918 swing high to the 1.1542 low. Besides, it cleared a major bearish trend line with resistance at 1.1660.

However, the bears remained active near the 1.1730 level and the 50% Fib retracement level of the downward move from the 1.1918 swing high to the 1.1542 low.

On the downside, the pair might find support at 1.1630. The main support might be 1.1600. A close below 1.1600 could start a major pullback toward 1.1550. Any more losses might open the doors for a test of 1.1500.

On the upside, the pair faces resistance near the 1.1720 level and the 200 simple moving average (green, 4-hour). The next hurdle could be near 1.1775. A close above 1.1775 resistance might push the pair to 1.1850.

Looking at GBP/USD, the pair started a recovery wave, but the bears might remain active near the 1.3450 and 1.3460 levels.

Upcoming Key Economic Events:

- ECB’s Schnabel speech.

- ECB’s Nagel speech.