Why Domino’s may deliver market-beating returns to the investment giant.

As many stock market observers know, Warren Buffett‘s Berkshire Hathaway has been a net seller of stocks. The most notable sale has been Apple. That position made up over 40% of the portfolio at one time, but the share has since fallen to around 22%.

What investors need to understand is that the selling does not mean Buffett’s team isn’t buying stocks at all. One notable recent purchase has been Domino’s Pizza (DPZ -0.03%). The stock’s past gains and its value proposition have likely inspired this investment, and such optimism warrants a closer look at the business and the stock to see if it is a suitable choice for average investors.

Image source: Getty Images.

Berkshire Hathaway and Domino’s

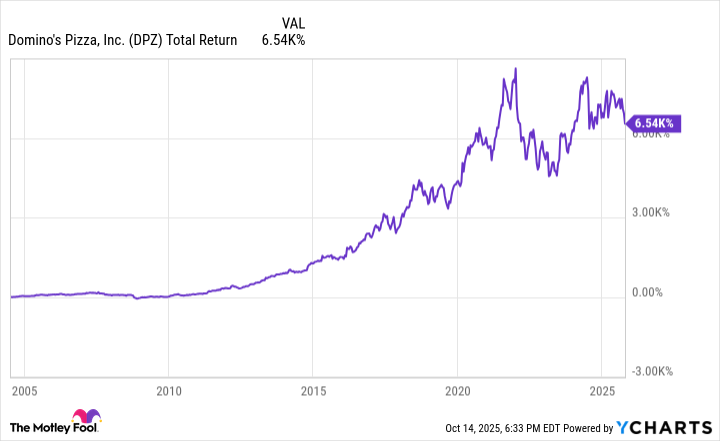

Domino’s has returned more than 6,500% in stock gains and dividend payments since it went public in 2004. Most investors, including Berkshire Hathaway, have missed out on most of those gains, but Berkshire’s bets could indicate that significant upside remains.

DPZ Total Return Level data by YCharts

Buffett’s company began buying Domino’s shares in the third quarter of 2024 and has increased its position size in every quarter since that time. Today, it holds just over 2.6 million shares, or about 7.75% of the outstanding shares.

Another possible factor in Berkshire’s investment in Domino’s is that it is the world’s largest pizza chain, boasting 21,750 locations globally as of the end of fiscal Q3. Despite that success, investors may question why an investor would want to get into a business like pizza, which at least in theory, has low barriers to entry.

However, no other pizza business has grown to the same size, and one can find the kinds of competitive advantages that attract investors like Buffett when looking at Domino’s more closely.

One key part of Domino’s is its franchise model. This enables the chain to open a large number of locations with a relatively small amount of capital, leveraging high brand recognition to drive business.

Moreover, it offers a digital-first approach, which makes ordering easier and capitalizes on route planning for faster deliveries. Additionally, an efficient supply chain helps standardize food quality and costs, increasing consistency across locations.

Furthermore, despite a global footprint, Domino’s adapts its menu to suit local tastes, and new offerings such as parmesan-stuffed crust or added customization options keep its customers coming back to Domino’s.

The financial case for Domino’s

Buffett’s team was likely also drawn by its financial metrics. Indeed, with its global footprint, the maturity of the business appears to make it more of a value stock.

In the first nine months of fiscal 2025 (ended Sept. 8), revenue of $3.4 billion rose by 4%. Nonetheless, during that time, its free cash flow of $496 million surged 32% higher over the same timeframe. Gains on assets and lower capital expenditures bolstered that cash position.

Additionally, that free cash flow easily covered the company’s $119 million in dividend costs in the first nine months of the fiscal year. At $6.96 per share, its 1.6% dividend yield is well above the 1.2% average for the S&P 500. Buffett’s team also probably liked its 13-year history of payout hikes, a trend that makes further annual payout hikes likely to continue.

Investors should also take note of the pizza chain’s valuation. Its P/E ratio of 25 is below the company’s five-year average earnings multiple of 30. Also, since its P/E ratio has not fallen significantly below 25 since the early 2010s, one can assume that Domino’s stock sells at a reasonable price.

Should you follow Berkshire Hathaway into Domino’s stock?

Given the state of the company, investors can likely make a prudent move by following Berkshire Hathaway into Domino’s stock.

Indeed, a 6,500% total return over the stock’s history may cause some prospective buyers to shy away, particularly because of the competitive nature of the pizza industry.

However, Domino’s brand recognition and its focus on franchising, operational efficiency, and a robust supply chain give the company a competitive advantage. Moreover, investors can buy the stock at a relatively reasonable price and collect an above-average dividend yield.

In the end, even if Domino’s does not generate excitement, the stock is likely to cook up rising dividends and market-beating returns over time.