President Donald Trump appeared to admit that the import taxes he’s unilaterally imposed on Chinese products are having a detrimental effect on American consumers’ pocketbooks but did not express a willingness to change course in the trade war he has waged against Beijing since returning to the White House nine months ago.

The president made the startling admission during a Friday appearance on Fox Business Network’s Mornings with Maria program after anchor Maria Bartiromo pressed him on his recent threat to slap an additional 100 percent tariff on Chinese imports after the Chinese government announced plans for new export controls on rare earth metals used in a variety of technology-related products.

Bartitomo asked: “If you put a 100 percent tariff on top of what is in place, a 157 percent tariff on China, can that stand? What is that doing to the economy?”

In response, Trump admitted that a 157 percent tax on Chinese imports is “not sustainable” before conceding that such a tax rate is “where the number is” at this point.

“It is probably, could stand — but they forced me to do that,” he added.

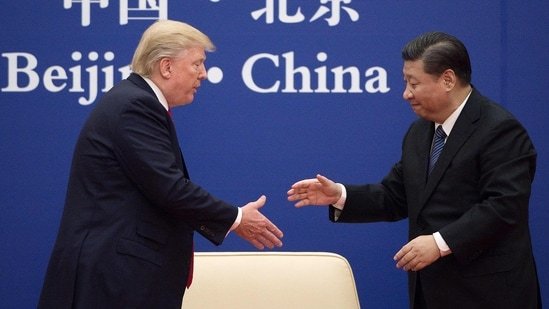

Trump then pivoted to offering fulsome praise for Chinese leader Xi Jinping, calling him an “amazing man” and a “great leader” whose life story could be “good for a movie” in his estimation.

“I think we’re going to be fine with China but we have to have a fair deal got to be fair, you covered it as well as anybody that ever covered the subject here very complex subject. China ripped us off from day one,” he said.

He then blamed one of his predecessors, Richard Nixon, for having “opened China” with his 1972 visit there, which preceded a relaxation of trade and travel restrictions imposed during the Korean War. Full diplomatic relations with Beijing were later established during the Jimmy Carter administration, which broke off recognition of Taiwan in favor of the People’s Republic of China.

“Richard Nixon allowed this to happen opened China — I said, ‘Is that good or bad? You tell me,” he said, adding later that the 37th president had “unleashed a very strong adversary” by working to ease Sino-American tensions.

The proposed 100 percent tax is scheduled to go into effect on November 1, but U.S. Trade Representative Jameson Greer told CNBC that could change depending “on what the Chinese do” with respect to their export controls on rare earth minerals.