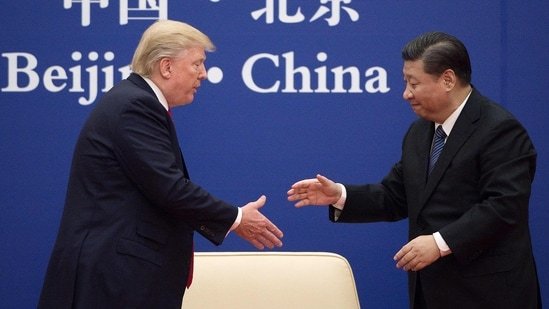

Trump said the 100% tariffs he had threatened on Chinese goods from Nov. 1 would not be a “sustainable” level for either economy. He confirmed plans to meet Chinese leader Xi Jinping later this month, adding, “We’ll see what happens.” His remarks helped calm investors and eased some of the market’s earlier volatility.

Meanwhile, US regional bank stocks turned positive after upbeat earnings updates from lenders including Truist Financial Corp. (TFC), Huntington Bancshares (HBAN), and Fifth Third Bancorp (FITB). These gains helped offset earlier market jitters triggered by two regional banks disclosing loan problems allegedly linked to fraud. JPMorgan CEO Jamie Dimon’s “cockroach” warning had also fueled fears about cracks in the creditworthiness of US borrowers.

Earlier in the week, investors had sold risky assets like AI and tech shares, moving money into safer options such as gold and Treasury bonds. The stock gyrations capped a turbulent week for markets, affected by US-China trade tensions and the ongoing US federal shutdown. The shutdown, now tied for the third longest in history, continues to suspend federal workers’ paychecks, with some lawmakers concerned it could extend into November and beyond Thanksgiving.

Big tech stocks like Nvidia and Oracle were hit hard, down 1.8% and 3.4%, while gold rose 1% and traded above $4,300 per ounce. Bank of America’s stock also fell more than 1%, adding to the banking sector’s losses, as per the report by CNBC. On Thursday, all three major US stock indexes closed in the red, mainly because bank stocks tumbled late in the day.

Live Events

Regional bank shares such as Zions and Western Alliance dropped after they reported bad loans, raising fears of loose lending and fraud issues. The SPDR S&P Regional Banking ETF (KRE) lost more than 6%, marking four straight weeks of decline. These worries deepened after the recent bankruptcies of two auto-related companies, which increased tension about loan defaults.The Cboe Volatility Index (VIX), known as Wall Street’s fear gauge, jumped above 27, its highest since April, showing rising market anxiety. Gold prices hit fresh records, showing that investors are seeking safe-haven assets, as per the report by Bloomberg. Liz Ann Sonders, Chief Investment Strategist at Charles Schwab, said the market has a lot of “speculative froth” with people buying risky stocks like quantum computing and unprofitable tech, according to the report by CNBC. She explained, “When you have that speculative froth and then you have sort of a bigger picture potential issue, those two can sometimes collide and cause an increase in volatility.” However, banking fears eased slightly after Fifth Third Bancorp posted better-than-expected earnings, rising 2%, and Zions also turned positive.

Still, other concerns remain — global trade tensions, high AI stock valuations, and the ongoing US government shutdown which has stopped key economic data releases. Despite Thursday’s drop, US stocks are still up for the week — S&P 500 up 1.2%, Dow up 1%, and Nasdaq up 1.6%.

Banking & credit worries deepen

Yahoo Finance reported that two US regional lenders admitted to loan problems linked to possible fraud, worsening investor panic. JPMorgan CEO Jamie Dimon’s “cockroach” warning added to the fear, as he hinted that there could be more hidden issues in the banking system. Investors rushed into bonds and gold as safer assets. The 10-year Treasury yield dropped below 4%, and gold hit another record above $4,300.

This sell-off capped a turbulent week affected by US-China trade tensions and the federal government shutdown entering its third week. China has imposed fresh export controls and sanctions after Trump threatened new tariffs, though the White House may ease tariffs on the auto sector soon. The shutdown could last into November, delaying federal workers’ pay and key data releases. Meanwhile, American Express and other companies are reporting earnings as part of the ongoing third-quarter results season.

Dollar and fed impact

The US dollar is heading for its worst week since July, falling for four straight days amid Federal Reserve rate-cut expectations and banking worries. The Bloomberg Dollar Spot Index dropped 0.5% this week, while two-year Treasury yields fell to a three-year low. Traders now expect 53 basis points of rate cuts by year-end, up from 46 basis points earlier.

Fed Governor Christopher Waller said officials could keep cutting rates to support the weak labor market, as per the report by Bloomberg. Governor Stephen Miran said a larger rate cut might be needed soon. Morgan Stanley economists predicted another 25-basis-point cut in October despite missing data due to the shutdown.

Bank stocks fall again

Bank stocks kept falling Friday morning after Thursday’s sharp regional bank sell-off. Bank of America and Citigroup each dropped around 2%, while Morgan Stanley and Wells Fargo slipped slightly. Zions and Western Alliance led Thursday’s declines after fraud-linked loan problems came to light.

Leonard Cohen, CEO of Ginjer AM, said, “Investors are logically worried… they haven’t identified where the risks lie.” The panic hit European and Asian banks too — Europe’s Stoxx 600 Banks Index dropped 3%, its biggest fall since August 1, with Deutsche Bank, Barclays, and Societe Generale down over 4%, as stated by Bloomberg. More US regional bank earnings are due soon from Truist, Huntington, Fifth Third, Regions Financial, and Comerica.

Other trending stocks

MP Materials (MP) shares fell 3% due to US-China trade tensions and China’s rare earth export restrictions. Wolfspeed (WOLF) stock dropped 4% after announcing a results call for October 29, 2025. EssilorLuxottica (EL.PA), maker of Ray-Ban, jumped 10% after strong smart glasses sales.

Gold shines amid chaos

Gold surged more than 7% this week, reaching above $4,300 per ounce, the highest ever. Silver also hit a record above $54, as investors turned to precious metals amid credit fears. The rally began in August and accelerated as banks disclosed fraud-related loan problems, as per the report by Bloomberg. Traders are betting on at least one large rate cut by the Federal Reserve before year-end.

The ongoing US government shutdown has delayed key data, but a resolution could release fresh economic numbers showing more weakness, which would support more rate cuts — and gold prices.

Drug price shock

President Trump said the price of Ozempic would soon drop to $150 per month, sending Novo Nordisk and Eli Lilly shares down over 4%. Novo’s stock fell 6% in Copenhagen and has lost 60% in 12 months. Trump said, “Those are going to be $150 out of pocket,” referring to Ozempic and similar drugs, as stated by Bloomberg. His remarks came during an event about cutting drug prices in exchange for easing pharma tariffs.

Deals have already been struck with Merck, Pfizer, and AstraZeneca, and similar talks are ongoing for weight-loss drugs. Mehmet Oz, head of Centers for Medicare and Medicaid Services, later said, “We haven’t negotiated those yet.”

FAQs

Q1. Why are US stocks falling today?

US stocks are falling because investors are worried about regional banks’ bad loans, possible credit problems, and growing fears of a US economic slowdown.

Q2. Why is gold price rising now?

Gold prices are rising as investors move money from risky stocks to safe assets amid bank troubles, trade tensions, and rate-cut expectations.